Sadiq Ahmed in the first of a two-part article on the Sixth Five Year Plan

Capital accumulation, along with increase in average labour productivity, is the mainstay of long-run economic growth. Bangladesh is lagging behind in capital accumulation since investment as a percentage of gross domestic product (GDP) remains stagnant over the past few years (Table 1). To achieve the target of the Sixth Five Year Plan’s (SFYP) set at 8.0 per cent real GDP growth by fiscal year (FY)15, a boost in the investment rate is essential (from 24 per cent of GDP in FY10 to 32 per cent by FY15). Increasing investment to the desired level appears to be a formidable challenge and requires major effort to improve the investment climate, especially to attract more foreign direct investment (FDI). Reviews suggest that there is considerable scope for improving the investment climate, by strengthening the availability of power and transport services, by simplifying land acquisition and registration, and by reducing the corporate tax rate.

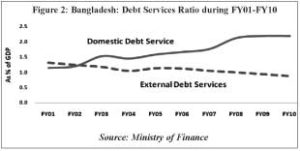

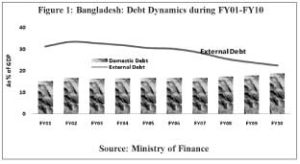

Consistent with standard accounting practice, national saving is derived as the difference between total investment less foreign current account deficit (foreign savings)](Consistent with standard accounting practice, public saving is defined as public investment minus fiscal deficit.)A new challenge that was unanticipated by the Sixth Plan is the emergence of a resource constraint. In recent years Bangladesh has been fortunate in rapidly expanding national saving. This made it possible to finance a growing domestic investment even in an environment of low FDI (foreign direct investment) and dwindling official assistance. The financing environment for investment has been changing rapidly over the past two years (Table 1). Compared to an estimated saving rate of 28.1 per cent in FY10, the saving rate declined dramatically in the first two years of the Plan, falling to 25.7 per cent in FY11 and further sliding to 25.2 per cent in FY12. This is a major negative development that requires urgent attention. The financing constraint appeared primarily in the public sector. In the private sector, buoyant demand, accommodating monetary policy, low real interest rates and acceleration of housing prices that built up windfall untaxed wealth pushed the growth of private consumption. Nevertheless, total private saving rate still substantially exceeded private investment. In the public sector, the projected increases in public saving during the first two years of the Plan did not materialise as growing energy and food subsidies increased public consumption. As well, the financing of public investments from foreign sources, both official and through public-private partnership (PPP) channels, did not materialise to the extent projected in the FY11 and FY12 budgets.A range of policies could be taken to offset this pattern, including higher public saving, through cutback in subsidies and increase in tax revenues, and through greater mobilisation of private financial savings by offering more attractive real rate of return. Importantly, the Government needs to focus serious attention to mobilising FDI, reactivating the PPP infrastructure financing initiative, greater mobilisation of official assistance and faster use of available foreign aid pipeline.Strategy for external resource mobilisation in the Sixth Plan: Traditionally, Bangladesh has managed its external borrowing prudently by securing low current account deficits and relying on mostly concessional sources of official assistance. This has served Bangladesh well. External debt to GDP ratio has been declining (Figure 1) and external debt servicing burden has been very low and also declining. The management of domestic debt has been similarly conservative over the longer term (Figure 1) but the cost of domestic borrowing has been growing in recent years (Figure 2).

The external financing strategy under the Sixth Plan essentially sought to maintain the current strategy of prudent external borrowing on best possible terms. It was expected that donor supports for various major infrastructure projects (like the Padma Bridge, deep sea port in Chittagong, power plants, expressways etc.) should increase as the pace of project initiation and implementation gains momentum under the Plan. Bangladesh also planned to implement numerous projects for mitigating the adverse impacts of climate change during the Plan period and much of them were to be financed in the form of grants and soft loans from the international community under multilateral initiatives.The external financing of the Plan also sought to rely on greater inflows of FDI and a broadening of the sources of financing, creating greater scope for private investors to secure external financing on better terms through reduced country/sovereign risk. Bangladesh received favourable ratings from the international rating agencies like Moody’s and Standard and Poor’s (S&P). The positive ratings are reflections of Bangladesh’s good track record in macroeconomic management, prudent debt management and its positive external outlook. The favourable rating thus opened up a new channel for potential borrowing from the international capital market at reasonable terms by issuing sovereign debt instruments. Although the Sixth Plan did not anticipate the need to issue sovereign debt for budgetary or balance of payments financing, it recognised that such an issue would establish a benchmark.Projections based on this broad strategy entailed continued reduction of government and government guaranteed external debt in relation to GDP and reduction of external debt service payments in relation to exports of goods and services (Figure 3). Sustaining this strategy was expected to help broaden access to international capital markets by domestic private borrowers and also help reduce financing cost for domestic borrowers.

The external financing strategy under the Sixth Plan essentially sought to maintain the current strategy of prudent external borrowing on best possible terms. It was expected that donor supports for various major infrastructure projects (like the Padma Bridge, deep sea port in Chittagong, power plants, expressways etc.) should increase as the pace of project initiation and implementation gains momentum under the Plan. Bangladesh also planned to implement numerous projects for mitigating the adverse impacts of climate change during the Plan period and much of them were to be financed in the form of grants and soft loans from the international community under multilateral initiatives.The external financing of the Plan also sought to rely on greater inflows of FDI and a broadening of the sources of financing, creating greater scope for private investors to secure external financing on better terms through reduced country/sovereign risk. Bangladesh received favourable ratings from the international rating agencies like Moody’s and Standard and Poor’s (S&P). The positive ratings are reflections of Bangladesh’s good track record in macroeconomic management, prudent debt management and its positive external outlook. The favourable rating thus opened up a new channel for potential borrowing from the international capital market at reasonable terms by issuing sovereign debt instruments. Although the Sixth Plan did not anticipate the need to issue sovereign debt for budgetary or balance of payments financing, it recognised that such an issue would establish a benchmark.Projections based on this broad strategy entailed continued reduction of government and government guaranteed external debt in relation to GDP and reduction of external debt service payments in relation to exports of goods and services (Figure 3). Sustaining this strategy was expected to help broaden access to international capital markets by domestic private borrowers and also help reduce financing cost for domestic borrowers.

The domestic debt management strategy was made commensurate with the above external resource mobilisation strategy. Maintaining the past momentum, the reliance on external financing was projected to go down while reliance on domestic financing will continue to increase. Since domestic financing is relatively costly and excessive borrowing by the public sector could crowd out the financing of the private sector, the domestic financing of the Plan was made consistent with the borrowing needs of the rapidly growing private sector. By limiting the overall fiscal deficit (including grants) within the targets set under the Plan (4.0-4.5 per cent of GDP) and by securing a sizable part of that from the external sources, the Plan expected to alleviate this concern. The domestic financing of the Plan took into account the sustainability of the public debt burden. Domestic debt accounts for about one third of the total public debt, but interest payments on account of domestic debt accounts for about two third of the total debt servicing payments. Although high costs of domestic debt servicing was not expected to pose any debt sustainability issue over the medium term, still it limits the size of budgetary discretionary spending and the fiscal space for undertaking priority programs in the public sector. Therefore, the Sixth Plan assumed that debt management reforms will be undertaken to make public borrowing cheaper and also to help domestic debt market development. Based on the above external and internal borrowing strategy, the Sixth Plan’s resource requirements for financing investment and growth was made fully consistent with a prudent national debt strategy and sound macroeconomic management.

Implementation record of the Sixth Plan’s external resource strategy: Balance of Payments developments: Despite satisfactory trend in export growth in recent years, trade deficit has been widening due to persistently high imports of fuel, food and capital goods (Table 2). The trade gap widened from US$ 4.7 billion in FY09 to $7.3 billion in FY11 and to $8.5 billion in FY12. Along with the gap on the services and other income accounts, the total financing gap on the trade and services account widened from $$7.7 billion in FY09 to $13.3 billion in FY12.

Implementation record of the Sixth Plan’s external resource strategy: Balance of Payments developments: Despite satisfactory trend in export growth in recent years, trade deficit has been widening due to persistently high imports of fuel, food and capital goods (Table 2). The trade gap widened from US$ 4.7 billion in FY09 to $7.3 billion in FY11 and to $8.5 billion in FY12. Along with the gap on the services and other income accounts, the total financing gap on the trade and services account widened from $$7.7 billion in FY09 to $13.3 billion in FY12.

(There are unresolved issues regarding the FY12 import data. The import figure based on payments recorded in BB is $1.4 billion lower than the import figure from NBR sources. The IMF has used an estimate that lies between these two figures, which is also used in this Table. Once a full reconciliation is done, the true import figure might change.)Fortunately for Bangladesh, these financing gaps in the trade and services account are financed by the large inflow of remittance income. Remittance inflows are still large enough to finance such gaps and allow a surplus in the current account. Monthly flows now exceed a billion dollars. For FY12, total remittance is expected to reach $12.9 billion, which is an all-time high for Bangladesh.Nevertheless, the widening gaps in trade and services account of the balance of payments are becoming a source of concern. While these gaps are still lower than total inflow of remittances, the current account surplus is narrowing sharply. This is a huge swing in the macroeconomic environment, with the current account surplus narrowing from 3.4 per cent of GDP in FY10 to less than 1 per cent in FY11 and further narrowing to 0.3 per cent of GDP in FY12. Although this remains a positive development and more generally a current account deficit rather than a surplus is a normal result for a low income developing country like Bangladesh, the main problem is the lack of adequate foreign funding in the capital account. To achieve the GDP growth targets of the Sixth Plan, Bangladesh needs to mobilise substantial higher inflows of official aid and foreign direct investment as an important element of financing required investments during the Sixth Plan.

Net Capital Account: Unlike other developing countries, Bangladesh in recent years has been experiencing mostly a negative capital account balance owing to inadequate FDI and declining net official aid (Figure 4). It was expected that the implementation of the Sixth Plan’s external resource mobilization strategy from both official and private sources will over-turn the past experience with net capital account and even allow the room for financing a deficit in the current account that might become necessary to finance the growing investment needs of the Sixth Plan. As noted above, while the surplus in the current account has narrowed from the level in FY10, there was still a surplus in the current account. This is partly owing to the slower-than-projected implementation of large infrastructure projects including the Padma Bridge. Importantly, the net positive capital flows projected in the Sixth Plan did not materialise. In addition to declining net official aid there have also been substantial private capital outflows in FY11 and FY12 due to a variety of factors including outward remittances. In FY12 the capital account outturn was slightly better, approaching a zero balance, thereby allowing a small surplus in the balance of payments in FY12.