The recent visit of the prime minister of Bangladesh to Japan and China if carefully nurtured opens up huge development opportunities for Bangladesh that can materially affect the long-term welfare of its population. This requires the government to develop a sound look east economic cooperation policy that contains the following four pillars: (a) trade expansion, (b) expansion of foreign private investment in Bangladesh, (c) regional connectivity and other infrastructure connections; and (d) modernising the infrastructure of Bangladesh through high visibility infrastructure projects.

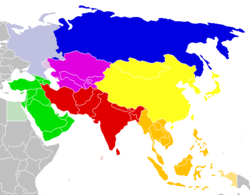

The focus of the look east policy would largely be on China, Japan and Korea but I believe that Myanmar should be included because of its geographical location. The remainder of this note develops the rationale for this policy.

The global economy has been transforming substantially with the rapid growth in income and exports in China and Korea, especially China, over the past few decades. In 2012 China, Korea and Japan (CKJ) together accounted for 21 percent of total global gross national income (GNI) in nominal dollar terms based on the World Bank’s Atlas method.

This compares with 23 percent for USA and 18 percent for the European Union (EU). If the purchasing power parity (PPP) method is used, which is a more accurate measure of internally comparable income definition, then the CKJ share grows to 21 percent while the US and EU shares fall to 19 percent and 14 percent respectively implying that the CKJ group of countries constitute the largest economic area in the world.

Indeed, more recent data (September 2014) shows that China’s GNI in PPP term now exceeds that in USA, making China the world’s largest economy in PPP terms.

Commensurate with its growing global presence in income terms, trade flows have also been increasing. In 2012, CKJ countries exported some $3,522 billion of goods and services as compared with $2,212 billion by USA and $7,339 billion by the EU.

In terms of imports, the values are $3,820 billion by CKJ, $3,306 billion by USA and $8,458 billion by the EU. While the EU is the clear leader in world trade, accounting for 33.3 percent of global imports, at 15 percent the CKJ area imports exceed that of USA (13 percent) by a handsome margin.

Apart from growing income, the CKJ has two other features that stand out from the perspective of a developing economy like Bangladesh. First, the CKJ countries have traditionally achieved large current account surpluses owing to their strong export orientation.

Over time the foreign reserve levels have swelled. With reserves estimated at $3.9 trillion, China sits at the top of the global list of owners of foreign reserves, followed by Japan at number 2 ($1.3 trillion).

With $368 billion, Korea is placed at number 8. These levels of reserves, especially in China and Japan, are unprecedented and speak volumes about the financial strength of these economies.

Second, all CKJ countries are exceptionally well endowed with technical knowledge, design and engineering capabilities in the area of infrastructure development. These capabilities are comparable to those found in USA and the EU.

Combined with surplus foreign resources, these capabilities make the CKJ countries an attractive source of supply of infrastructure projects to developing economies. The infrastructure marvels achieved are obvious to a visitor to these countries. Japan, arguably, also has superb urban planning skills that can be well appreciated when visiting Tokyo.

There is a lot that Bangladesh can learn from this and get expert advice and technical assistance from Japan to re-engineer the Dhaka city layout and transport network, thereby considerably improving the productivity of Dhaka city while also making it more liveable.

The rationale for Bangladesh policy to look east is clear. Bangladesh is eager to diversify and increase its export markets. It has already successfully penetrated the US and EU markets for its exports but the vast CKJ market remains virtually unexploited.

Along with rapidly growing income in the CKJ area, especially China, that is growing much faster than either in the EU or the USA, the export market opportunities for Bangladesh are immense.

The resource rich CKJ countries are looking for investment opportunities in developing Asia to diversify their investment portfolio. The RMG experience has firmly established Bangladesh’s claim to be an attractive destination of these new investments. Armed with abundant supply of labour, the labour cost advantage is a strong plus that could be gainfully employed to attract these investments.

The geographic advantage of Bangladesh in terms of its location as the gateway between Western Asia and Eastern Asia makes it a potentially attractive hub for the transit of trade and commerce between the CKJ countries in the east to the Southern and central Asian countries in the West.

India alone is a huge market. Additionally, the open access of Bangladesh to sea on the Southern borders makes it a natural choice for sea trade and transport regional hub. The related development of infrastructure—rail, roads, sea ports—can be attractive opportunities for infrastructure investment by the CKJ countries.

This gateway used to be the southwestern part of the ancient Silk Route that linked China to the Middle East and Europe. It is amazing that ancient people recognised the value of geography and trading more than we seem do in the 21st century!

Transit related infrastructure needs apart, the overall infrastructure investment requirements of Bangladesh are immense. The availability of surplus financing in the CKJ countries along with their globally competent infrastructure building capacities makes them a hugely attractive supply source for infrastructure development in Bangladesh.

Along with the supply of urban land, the infrastructure supply has become a binding constraint to accelerate the growth beyond the 6 percent rate for Bangladesh. The look east policy provides a natural and attractive solution to easing the infrastructure constraint.

The suggested focus of the look east policy is well-grounded into the development needs of Bangladesh. Implementation is another matter. It will not be automatic or simply based on diplomatic gestures.

The high-level political support and signals from the prime minister are no doubt important but implementation for results will require a sound approach, long-term effort and constant monitoring. The development of the look east policy will require a solid implementation framework. Some of the important policy elements of that framework include the following:

(i) A well-thought out land procurement and land development policy for foreign private investment. In that regard, it is especially important to quickly and satisfactorily resolve the current impasse surrounding the land transfer to the Korean EPZ in Chittagong.

(ii) An export promotion strategy for the CKJ areas based on a careful review of markets, products, cost structure, import flows and domestic capabilities. (iii) Exchange of business delegations to explore potential trade and investment opportunities.

(iv) Adoption of turn-key type procurement policies for infrastructure financing to avoid procurement related corruption problems and delays.

The government may face capacity constraint to develop the details of such a policy. But there is substantial experience and capacity in local research institutions to help the government develop this policy.

There might be some sensitive political issues raised by India and USA in view of the China angle. But by adopting a sensible economic approach these concerns can be neutralised.

After all despite all the noise, India and USA are among China’s largest trading partners. So, there is no reason why Bangladesh should not decide its own economic cooperation policies in a way that best serves its economic needs and interests based on a sound engagement strategy and implementation capacity.