The FY20 Budget: Post-LDC graduation challenges

Zaidi Sattar | June 22, 2019 00:00:00

The budget is not just a one-off income and expenditure programme of the Government. It is a national strategy document giving signals of policy directions. Therefore, the FY20 Budget must be in sync with the medium-term national goals and long-term aspirations, ambitious as they might be. After all the optimism expressed by national and international analysts regarding Bangladesh’s human and material progress, one cannot fault the FY20 Budget to take an overall optimistic stance for the future. But reaching some of those goals requires formulation of robust policies and strategies. That seems to be the missing link in this budget.

MACROECONOMIC PRUDENCE: It may sound ambitious as we strive to graduate out of Lease Developed Country (LDC) status in 2024, become an Upper Middle-Income Country (UMIC) by 2031 while eliminating extreme poverty, and become a High Income-Country (HIC) in the early 2040s. For these goals to materialise, job-oriented growth acceleration is a must. That said, relative to the size of the economy budget outlays and revenue projections mirror past ambitious budget targets some of which remained unfulfilled. But the fiscal deficit, an anchor of macroeconomic stability, which has been the fulcrum of fiscal planning, remained unchanged as a percentage of estimated Gross Domestic Product (GDP) – at 5.0 per cent. In the past 28 years since 1991, the hallmark of prudent macroeconomic management was the recognisably sustainable deficit of under 5.0 per cent of GDP, financed by (a) concessional foreign loans and grants (1.5-2.0 per cent of GDP), and (b) the rest financed through domestic resources – government borrowing from bank and non-bank sources. Thus revenue mobilisation outcome and the constant fiscal deficit pretty much defined the perimeters of public expenditure. So it is for this budget.

Like most years, the expenditure target of 18 per cent of GDP (Tk 5231.9 billion) will have to be scaled down to around 16 per cent of GDP in the final tally if revenue mobilisation effort ultimately falls short and stands no higher than 11 per cent of GDP – still highly optimistic considering the significant recent shortfalls in meeting revenue targets. The major concern expressed by all and sundry is the lack of tangible reforms in the tax system. What we see are ad-hoc measures except for the new Value Added Tax (VAT) Law which goes into effect with multiple rates (below the uniform 15 per cent) giving signals that VAT will morph into a sort of multi-layered Excise tax. The early analyst predictions are that it is unlikely to yield the extra revenue targeted. While import VAT remains at 15 per cent across the board, the emergence of multiple VAT rates on domestic production cuts at the root of the trade neutrality principle of VAT. Some clarity on how this anomaly will be addressed will be worthwhile information for all concerned. In 2024 when the country graduates out of LDC status the lack of MFN (most-favoured-nation) treatment in VAT and Supplementary duties (SD) could become a potential irritant with trading partners.

GROWTH OUTLOOK AND INCONGRUENCE: The GDP growth outlook of 8.2 per cent in the budget exceeds end-year targeted growth of 8.0 per cent, ahead of the provisional growth rate for FY19 estimated at 8.1 per cent. These rates, if attained, will produce an average GDP growth rate of 7.7 per cent for the 7th Plan period – exceeding the Plan target of 7.3 per cent compared to the actual average growth of 6.3 per cent for the 6th Plan. In terms of GDP growth performance, the 7th Plan will go down as the most successful Plan having achieved if not exceeded growth targets in all years. The typical historical record of average decadal GDP growth rising by one percentage point every decade is now replaced by one percentage point growth acceleration every five years. Now some analysts have raised the question of credibility of the latest GDP growth rates arguing that other macro indicators like exports, imports, revenue, bank credit growth, do not provide supporting evidence of such high growth performance. For FY2019, while the World Bank and IMF (International Monetary Fund) came up with their own estimate of 7.3 per cent, the ADB (Asian Development Bank) has endorsed the official growth rate of 8.1 per cent. WB-IMF estimate probably comes from using the Incremental Capital Output Ratio (ICOR) and relating that to Gross Capital Formation or Investment-GDP ratio. Average ICOR of 4.3 for 2010-2018 and 2018 GDI (gross domestic investment) of 31.2 per cent yields GDP growth of 7.3 per cent (Investment rate/ICOR). To attain sustained annual growth of 8.0 per cent+ will need an investment rate of 35 per cent of GDP or higher. So one finds an inexplicable incongruity between the official statistics of growth rate and investment rate that needs clarification.

Be that as it may, historically, GDP growth of 7.0 per cent or more is considered excellent performance for any economy. Nobel Laureate economists have opined that in these times of globalisation high growth (7-8 per cent or higher) is eminently feasible for developing countries that can leverage the enabling effect of the global economy. That means economies aiming for high growth must be deeply integrated with the world economy to leverage external demand rather than relying only on domestic demand, as the latter is constrained by the limited size of the domestic economy relative to the vast world economy.

TRADE POLICY DIRECTION IS CRITICAL: The Budget appears to have bypassed the need for mainstreaming trade policy as a critical development strategy for high growth and job creation. High growth is attainable but not without a trade policy that is robustly export-oriented. Willy-nilly, a big chunk of the budget has to do with setting directions of trade policy, i.e. the domestic policy content of how exports will be stimulated and imports will be managed through the imposition of tariffs and para-tariffs. Though the tri-annual Import Policy Order and Export Policy Order framed by the Ministry of Commerce make up the regulatory regime for import-export transactions, the fact that quantitative restrictions on imports no longer exist for protection purposes, these Orders no longer constitute trade policy per se. The schedule of tariffs (and para-tariffs) on imports set, adjusted, or confirmed under this annual budget, does constitute the principal mechanism whereby the Government has set the direction of trade policy, not just for the ensuing fiscal year but also for coming years. Export diversification, a national imperative, has remained stunted in my view due to lack of trade policy direction favouring non-RMG exports. A change of course in trade policy coming out of the budget statement was reasonable to expect.

That did not happen. Sadly, the initial assessment of the budget’s stance on trade policy suggests we are left with much of the same. Existing policy is tilted too much in favour of import-substitute production through high tariff protection such that cash subsidies of the kind offered to selected exports are no compensation. In FY2018 there were over 3000 exporters of some 1300 (HS 6-digit) non-RMG products of which only 300 products had export volumes of over $1.0 million. With some exception like leather and footwear, and home textiles, these exporters are mostly small without the benefit of the duty-free bonded system essential for all exporters. Hundreds of them enter the export market every year but leave without pursuing the export option for lack of incentives. For them the domestic market is far more lucrative compared to the meagre profit margins from exports. Unless the protection regime is rationalised, we cannot expect our export basket to be diversified. Given the pre-budget soundbites we were expecting some definitive directions in trade policy geared towards small and non-RMG exports. Instead, the big winners were the RMG exporters. Not that RMG exporters deserve no support. They do and so do all other exporters, big and small, RMG as well as non-RMG, at a time when the global context for export expansion from developing countries is facing strong headwinds stemming from the protectionist sentiments in Europe and North America.

That did not happen. Sadly, the initial assessment of the budget’s stance on trade policy suggests we are left with much of the same. Existing policy is tilted too much in favour of import-substitute production through high tariff protection such that cash subsidies of the kind offered to selected exports are no compensation. In FY2018 there were over 3000 exporters of some 1300 (HS 6-digit) non-RMG products of which only 300 products had export volumes of over $1.0 million. With some exception like leather and footwear, and home textiles, these exporters are mostly small without the benefit of the duty-free bonded system essential for all exporters. Hundreds of them enter the export market every year but leave without pursuing the export option for lack of incentives. For them the domestic market is far more lucrative compared to the meagre profit margins from exports. Unless the protection regime is rationalised, we cannot expect our export basket to be diversified. Given the pre-budget soundbites we were expecting some definitive directions in trade policy geared towards small and non-RMG exports. Instead, the big winners were the RMG exporters. Not that RMG exporters deserve no support. They do and so do all other exporters, big and small, RMG as well as non-RMG, at a time when the global context for export expansion from developing countries is facing strong headwinds stemming from the protectionist sentiments in Europe and North America.

The 1.0 per cent cash subsidy offered to RMG exports is neither here nor there, nor is it fair to non-RMG exporters who are crying for help. This runs counter to the strategy of export diversification. A far better alternative would have been to let the Taka depreciate by 2-3 percentage points as a strategic policy, something that can be done in a managed float exchange rate regime of ours. The benefit could then go to all rather than just a few selected groups. The same applies to the proposal of giving 2.0 per cent cash incentive on official remittance. This kind of selective depreciation (multiple exchange rates) cannot be the answer to the challenges faced by exporters or remitters. Moreover, it creates the scope for malfeasance of all sorts.

CASE FOR COMPENSATED DEPRECIATION: However, a policy of exchange rate depreciation faces two stumbling blocks: (a) a one-time inflationary impact, and (b) cost escalation of inputs for import substituting industries. Both of these could be countered through a strategic policy of compensated depreciation, which could still be considered. This involves an exchange rate depreciation that is counterbalanced by downward tariff adjustments. Such a measure could be (a) an incentive to exporters, (b) maintain protection level for import substitute producers, (c) have neutral effect on the price level, and (d) be revenue neutral.

Here is how it works. In principle, a 3.0 per cent depreciation of the exchange rate (say, from Tk.84 per dollar to Tk.86.5) is equivalent to a 3.0 per cent subsidy on exports, a 3.0 per cent increase in effective protection on import substitutes (because it raises tariffs on output and inputs equally). It also raises the value of imports by 3.0 per cent to yield 3.0 per cent extra revenue to NBR (National Board of Revenue). But this would also affect prices of imports and import substitute products upward by 3.0 per cent, which leads to the fear of currency depreciation fuelling inflation. That is where the compensation principle kicks in. If tariffs are then reduced by 3.0 per cent (only reduce CD=25 per cent, to 24 per cent), the price effect of the currency depreciation would be neutralised. The net result is a 3.0 per cent uniform (i.e. non-discriminatory) incentive to all exports (including remittance) but without increasing the prices of imports. Effective protection and revenues will remain unchanged. Finally, by letting the exchange rate depreciate Bangladesh Bank would not have to use about $1.5 billion of official reserves to hold the exchange rate, keeping reserves that much higher, adding to Net Foreign Assets (NFA) to prop up reserve money in banks and easing the liquidity situation. To be fair, any depreciation does raise the Taka cost of servicing foreign debt. But Bangladesh’s debt servicing capacity (at 3.4 per cent of foreign exchange earnings) leaves room for bearing the extra cost which will raise public expenditures marginally with only a ripple effect on the fiscal deficit.

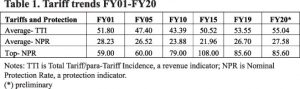

TARIFFS AND PROTECTION STATUS QUO: The budget does propose some changes in CD (custom duty) and SD (supplementary duty). As noted by WTO (World Trade Organisation) in its recent Trade Policy Review (TPR), these are the primary instruments of Bangladesh’s trade policy. At this juncture of our economy, it was opportune time to give clear direction on trade policy to bring more dynamism into exports. I wish the budget paid more attention to the need for rationalising the level and structure of tariff protection to change trade policy direction in favour of exports. Preliminary assessment indicates that protection has actually increased and there is no strategic move to reduce the reliance on trade taxes (Table 1). Preliminary estimates indicate both average trade taxes and nominal protection rising modestly. In fact a new dimension has been added to the protection structure with the introduction of discriminatory treatment of VAT on imports versus domestic production. More clarity is needed to understand to what degree the new VAT regime violates the principle of trade neutrality ordained by the VAT Law. We already have a nagging issue with SD which PRI research has shown to be augmenting protection, and confirmed recently by the WTO in its TPR of Bangladesh. PRI research has shown how high protection could be a major stumbling block for export diversification. This is one aspect of trade policy and its consequences that is least understood. Sadly, the budget has left this pivotal aspect of Bangladesh development strategy unaddressed.

The overall vision in the FY2020 Budget appears consistent with the goals laid down in the 7th Plan, viz, GDP growth, inflation, investment. But the budget seems to lack a trade policy orientation of the growth process. Coming as it does at a time when developments in the global economy are posing challenges for future export performance and preferential market access will be gone by 2024 as the economy graduates out of LDC status, we were expecting this Budget to make strong statements on mainstreaming trade policy. There is no way that Bangladesh can continue on a path of high growth without a stronger trade orientation of the economy. Relying on the domestic economy for high growth is not a viable option and there is no historical evidence that any economy has done that. Indeed, there is no prospect of a “Bangladesh surprise” on this count.

This Budget marks the concluding year of the 7th Plan. The 7th Five Year Plan (2016-2020), which was fully endorsed by the Ministries of Finance and Planning, was approved at the highest echelon of Government. The 7th Plan articulated a strategy for higher manufacturing growth coupled with export expansion and diversification predicated upon an export-oriented trade policy. For all its alignment with the 7th Plan’s inclusive approach to growth acceleration, the FY2020 Budget should have taken the bold step of changing trade policy orientation towards rationalising protection in order to boost exports. It would have been good if the budget speech contained brief statements indicating our protection stance and underlying rationale for prolonged protection of industry without any reference to a timeline.

THE HAPLESS CONSUMER: Finally, the hapless consumer is not really on the radar screen of budget discourse. The budget assumes an inflation rate of 5.5 per cent for the coming year, about the same as it is in the current year. That means average consumer prices would be rising by 5.5 per cent and their real income would be that much lower. Bringing that number down would have given relief to consumers. The Finance Minister in his budget speech informs us that Bangladesh’s middle class is now 40 million in size. PRI research has shown that our middle class in particular have been bearing the main brunt of the high tariff protection by way of higher tariff-induced domestic prices. During the 5-year period, FY2013-17, the total protection cost to consumers works out to a substantial amount of US$70.6 billion (through prices paid above international prices). For fiscal year 2017, the protection cost to consumers’ works out to US14.2 billion, or 5.7 per cent of FY17 GDP, and 31 per cent of manufacturing value added. 80 per cent of this protection cost accrues to import substitute producers of consumer goods while the remaining 20 per cent accrues to retail outlets. That is a huge transfer of resources from consumers to producers. Reversing this trend would be a huge policy challenge that will hopefully be undertaken in earnest by the Government in the coming days. That would win the hearts of a large swath of consumers who are voters.

To be fair, the Budget does contain numerous measures designed to improve revenue mobilization, incentivise private investment, provide social protection to vast numbers of the poor, and create jobs. The final outcome will depend on the effectiveness of implementation. Let us recognise that budget making under severe resource constraints is an art of the impossible. The challenge for the Government is to strike a realistic balance between business and national interests, between producer and consumer interests, and so many other competing claims on scarce national resources. Given the challenges the economy faces, we deserve bold and radical policies and strategies to squarely address those challenges which usually come with opportunities, now and in the days to come. Why wait another year to seize opportunities?

Dr. Zaidi Sattar is Chairman, Policy Research Institute of Bangladesh (PRI). zaidisattar@gmail.com