The volatility in Bangladesh’s capital markets shows few signs of abating as does the extensive discussion in the media about the causes,

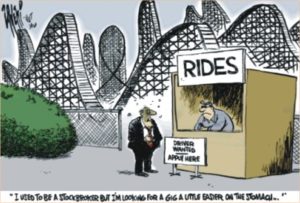

consequences and cures for the current price correction. Today’s article does not attempt to tell our readers when the sell-off will end, we will leave that for other market forecasters. But rather we wanted to explore stockmarket “M&M’s”, not related to America’s favourite candy, but rather the two issues of “Manipulation” and “Moral Hazard”. The former seems to be receiving all the attention from both the media, and, perhaps more significantly, regulators. However, we would argue the latter is perhaps the bigger risk to the healthy development of our capital markets. There seems to be a widely held view both among the protesters (perhaps they see themselves as market vigilantes?) on the streets around the DSE in Motijheel as well as some officials that the exceptional rise in the market in 2010 and the subsequent correction in the past month have taken place as a result of “market manipulators” or “syndicates” who lured unsuspecting retail investors into buying the market and subsequently pulled all their money out causing a collapse.

The growing backlash among the massive wave of new retail investors (BO accounts have increased by almost three million in the last four years) also makes capital market reforms an increasingly important social and political issue. This has resulted in the increasing politicisation of the discussion on the stockmarket. There is an excessive focus on witch hunts and finding scapegoats, thereby diverting the focus away from an impartial analysis of what happened, why it happened and what needs to be done to avoid it happening in the future.

Our summary assessment of the main drivers of the four year bull run in the stockmarket in order of importance are as follows: 1) excess liquidity growth with broad money (M2) expanding by more than 20 percent last fiscal year and once again this year; 2) a structural increase in retail investors holders from 0.5 million around three years ago, to 3.21 million by end of 2010; 3) lack of supply/IPOs with only six IPOs and two direct listings in 2010 and limited issuance in 2009; 4) excessive investment by commercial banks in the capital markets. Direct investment with financial institutions exposure increasing more than eight-fold since 2006 to about Tk 45 billion in 2009, further increasing in 2010; and 5) frequent regulatory interventions in support of stock price index increasing moral hazard.

We fully support the current initiative of the government to investigate the recent stockmarket turmoil and identify operators, if any, responsible for unlawful market activities. We would argue that the term “market manipulation” needs to be more clearly and comprehensively defined legally as well as in the regulatory framework. There is nothing illegal about buying stocks and then selling at a profit. We have to understand that all investors (small, large and institutional) are in the stockmarket to make profit and there is absolutely nothing wrong with that. There needs to be a clear distinction between investing for profit and making profit through spreading rumours to push up prices and then sell or engaging in insider trading. The authorities need to ensure the latter ones do not happen and prosecute those that engage in such activities.

“Moral Hazard” is an important concept widely used in economics literature. It is the idea that individuals or institutions can alter their behaviour if they know they are insured against some unfavourable outcomes. By reinforcing a sense that the government either can or indeed should support or even guarantee the level of prices in the stockmarket, the regulators are at risk of what economists call moral hazard, or sending out signals that encourage inappropriate decision making or risk taking. Specifically investors will be inclined to run larger exposures to the stockmarket than otherwise on the view that the authorities will always come in and support the market in any major decline. This is true not only for unsophisticated retail investors but also larger institutional investors such as banks and funds. In the US there has been talk of the “Greenspan Put Option” by which the Federal Reserve was perceived to be willing to cut interest rates to support the stockmarket. In Bangladesh we have seen much more direct interventions and policies to support stock price levels.

Excessive ad-hoc regulatory interventions in response to market developments also distort price movements and reduce the incentives for investors to buy stocks on the basis of fundamentals since unfavourable price trends might be unduly affected by official interventions.

One might also argue that repeated market support interventions, which are ultimately likely to fail, also risks fuelling greater social unrest to the extent that investors believe that the government has broken some form of implicit “contract” to protect against excessive market declines. In the recent market turmoil we have seen repeated occasions where retail investors have expressed surprise that the stock prices with good fundamentals can actually decline.

Space constraints limit the extent to which we can discuss in detail potential capital-markets reforms which we believe should be considered by the authorities. But some recommendations include: strengthening the capacity of the SEC in market surveillance; improved regulation and enforcement; transparent balance sheets/lessons from Sarbanes Oxley; taxation of capital gains: more fundamental research; and the need for training of professional market participants through a range of programmes under the newly established Capital Market Institution

There are other issues: the need for improved regulation in respect of accounting rules; transparency issues; governance structure and reporting requirements; criteria for determining insider trading; rules for dealing with market sensitive information/announcements; and sanctions (criminal and financial) for violations of the rules and regulations. These reform issues would need to be looked at by competent professionals with extensive international experience with possible technical support from the IFC and/or ADB.

There is a also a clear need to stimulate increased equity issuance in Bangladesh including fairer IPO pricing with the re-adoption of the book-building method; regulations and tax incentives for increased free float; the listing of state-owned enterprises; and the development of a mechanism whereby companies can raise the capital they need and meet free float requirements.

We also recommend the government and regulators think carefully about commercial banks’ exposure to the capital market (Are the limits at 10 percent of liabilities or 25 percent of capital too high?), ensure more regular co-ordination between Bangladesh Bank and SEC on stockmarket policies, and assess the impact of the market correction on the real economy.

But our conclusion would be that there is no quick solution for the current market correction. Any market sell-off of 30 percent after a 400 percent gain can only be termed a “correction” and not a “crash”. That is not to say that we do not have sympathy for investors who got into the market rally late and are facing losses. But the reality is no government or regulator in history has sustainably managed asset prices corrections when a bubble has burst. However, it will find its own natural equilibrium when the prices have been corrected and price/earnings ratios have declined to levels that are fundamentally attractive to both domestic and, as importantly international investors. The latter might be a key swing variable as foreigners only hold 1 percent of the market and more favourable valuations versus other regional markets might well persuade them to invest.

We understand why the government feels obligated to intervene to support the market. We have seen from the recent global financial crisis that getting the balance right in market regulation and intervention has proved challenging for the Federal Reserve and other central banks and governments in the developed economies. The main criteria for public sector intervention should be based on the systemic nature of the crisis. Until now there is no indication that the stockmarket correction in Bangladesh is posing a systemic risk to the rest of the financial system or the real economy. If anything, the excess liquidity circulating in the economy may pose a greater risk for inflation and foreign exchange market stability. Loose monetary policy, which was the root cause of the bubble, coupled with further liquidity injections through market interventions, may very well lead to other major problems including macroeconomic instability. Moreover, if further market support operations prove to be temporary then retail investors may feel a greater sense of being given false ground for optimism. Unwarranted market intervention is not just a market of moral hazard but runs potential political risks as well.

Ifty Islam is the managing partner of AT Capital and can be reached at ifty.islam@at-capital.com, and Ahsan Mansur is the executive director of Policy Research Institute of Bangladesh.