I have written many times in the past about the need to address the governance issues in the state-owned commercial banks (SCBs). This is not because I am a neo-classical economist with unmitigated faith in the market economy, but because of the observed global phenomenon that SCBs anywhere suffer from an inherent governance conflict.

I have written many times in the past about the need to address the governance issues in the state-owned commercial banks (SCBs). This is not because I am a neo-classical economist with unmitigated faith in the market economy, but because of the observed global phenomenon that SCBs anywhere suffer from an inherent governance conflict.

The conflict arises from two characteristics of SCBs. First, since the government owns the banks, the bank managements have no stake in the efficiency or profitability of operations. They keep their jobs and earn their salaries irrespective of performance.

Second, the government of the day is only a transitory owner with little or no real immediate risk. It also has little incentive to manage these banks on a commercial footing because either the losses can be passed over to the citizens through treasury financing based on tax revenues or as continued accumulation of bad loans (also called non-performing loans or NPL).

Instead, there is a strong incentive to use these banks as instruments to finance politically-motivated projects or to distribute political patronage to clients in return for financial contributions to the political party or other personal favours. Losses can accumulate and create severe headache at some point in time. But that can usually be passed over to a future government.

This governance conflict has come to a full force in Bangladesh. Over the years, the SCBs and public specialised development banks (SDBs) have shown erratic performance with low or negative profitability, low or negative return on government equity, frequent need for treasury capital injection to stay alive, and a growing burden of NPLs in absolute terms and also as a share of total loans.

The sharply deteriorating performance has become a substantial cause for concern and it is time that the finance ministry does something positive to stem the tide of bad management of public banks. Although national elections are in the horizon that should not be a barrier to taking actions since they will not likely hurt the government and can only be seen as a favourable outcome by the electorate.

One redeeming feature of the Bangladesh banking sector is the emergence of the private banking as a major player. This progress started around 2000 and has gathered momentum since then. Today, the banking market is vastly different from what it was in 2000 in terms of asset ownership, quality and quantity of banking services, the value of deposit mobilisation and the liquidity of the banking sector. This has served Bangladesh well, with better services to deposit holders and bank borrowers.

The cost of bank borrowing has also come down. Importantly, the deposit and lending shares of the poorly performing public banks have come down from 60 percent and 63 percent respectively in 2000 to 30 percent and 16 percent respectively as of March 31, 2017.

Accordingly, the adverse implications of the growing share of the infected portfolio in public banks is somewhat softened by their sharply declining loan market share.

Nevertheless, the downside risks of the large NPLs of public banks for the overall health of the banking sector are worrisome. Additionally, political interference in private banks has also caused problems for the loan portfolio of some private banks that further weakens the financial health of the banking sector.

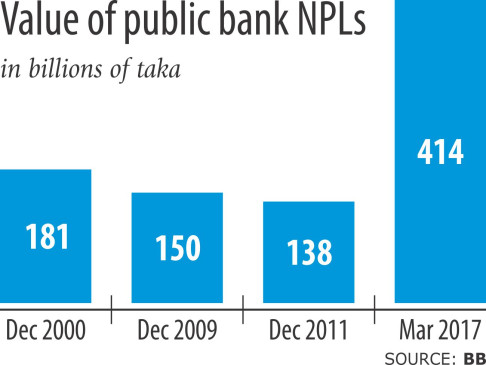

The growing incidence of NPLs in public banks is partly due to bad lending decisions but also owing to outright thefts and scams. Irrespective of the reason for the deterioration in the financial health, the fact remains alarming that as of March 31, 2017 some Tk 414 billion of outstanding loans of public banks (SCBs plus specialised banks) were classified as non-performing in the sense that there is little prospect that these loans will be recovered.

The NPL of public banks in FY2009 was Tk 150 billion; it fell to Tk 138 billion in December 2011. The amount of NPLs soared to Tk 424 billion in March 2017, rising by Tk 276 billion over the past six years. This large NPL prevails despite write-offs of some of the bad loans and a restructuring of considerable amount of doubtful assets.

In terms of percentage of total outstanding loans of public banks, the NPL amounts to 29 percent. In the US dollar terms, NPLs of public banks are equal to $5.2 billion. This value of NPL exceeds by 179 percent the total public spending on health in FY2017 and is equal to 93 percent of the total public spending on education in FY2017. The opportunity cost of NPLs is high. This is indeed a sad state of affairs at a time when Bangladesh needs resources to invest more in health, education and social protection.

On the policy front, the inability of the finance ministry, who owns and supervises these banks, to stem the tide of NPLs is very worrisome. Despite considerable public debate and discussion, the situation continues to deteriorate. On the contrary, the ministry has responded by injecting capital into these public banks to shore up their capital base and keep them in business. An estimated Tk 93.8 billion has been injected so far into these banks between FY2014 and FY2017.

This $1.2 billion diversion of tax payer money to keep the corrupt, inefficient and financially loss-making public banks into business is a most distressful policy decision. It is not only unethical but also unsustainable. Without first fixing the reasons for the deterioration of the portfolio of the public banks, simply providing funding from the treasury to beef up their capital base with a view to keeping them in business is equivalent to putting bandage on a deteriorating cancerous wound.

There are much better policy options than self-defeating capital injections. As I have indicated in my previous write-ups, the first best solution is to privatise the public banks. Private banks cannot afford to run excessive NPLs as they will go out of business. In most cases, the owners will come down hard on management and will likely replace them on account of poor performance. There is no such accountability in public banks.

It is known that in the current political environment, privatisation is not a viable option. So, a second best option is to convert the SCBs into “narrow banks” and either fold out or drastically reform the SDBs. The idea of narrow banks is that SCBs will no longer have a lending function. They can collect deposits and perform treasury functions including funding of budget deficits by holding T-bills. By taking away lending decisions, the SCBs will become safe banks with a zero risk for accumulating additional NPL.

Regarding SDBs, a full diagnostics of their operational problems should be done. The development function that these banks are playing should be properly identified based on a solid review of the market failure that is being addressed by these banks, and a system of subsidy introduced that is financed upfront through the budget. This way the fiscal cost of running the SDBs will be transparent, the SDBs can strive to remain financially solvent within the framework of their mandate, and the management of SDBs can be held accountable for performance.

A third best option is to drastically reform the SCBs in the same spirit as the SDBs. Unlike the SDBs, the case for subsidisation due to market failure does not exist. So, whatever the government’s reasons to own banks, it must let them be run on a commercial basis. This means these SCBs must be managed by professional bankers; be fully supervised by the Bangladesh Bank; should be subject to all penalties of the Bangladesh Bank for any violation of prudential norms as their private bank counterparts are; be required to earn a profit; and be held fully accountable by the owners (government) for performance.

It is only as a part of a business decision to run these SCBs commercially and earn a profit that the government could justifiably provide one-time budgetary resources to re-capitalise the SCBs. In this environment, there will be a new management team who will be subject to performance rewards as well as penalty. The government will not intervene in lending decisions or in the matter of loan rescheduling and recovery. These will be normal business decisions of the new SCB management, who will also have the flexibility to hire and fire staff members and decide on remuneration based on financial profits. In summary, except for government ownership, the SCBs will behave like private commercial banks.