Bangladesh economy is currently passing through an interesting episode on the macroeconomic front. On the one hand, the soft patch that the economy is experiencing is largely due to the slower export demand and lower private sector investment resulting from the ongoing global economic crisis. On the other hand, the balance of payments (BOP) position of Bangladesh has never been so strong in its history with record high current account surplus and foreign exchange reserves. Slower domestic demand calls for an easy monetary policy. But the large BOP surplus is causing a rapid expansion of domestic liquidity, calling for a tightening of the monetary policy stance. This paper describes the sources of slower domestic demand and their impacts, the factors contributing to the monetary expansion and the extent of the problem, the authorities’ policy response so far and what would be the appropriate policy mix under the current circumstances.

Weakness in Key Components of Domestic Demand

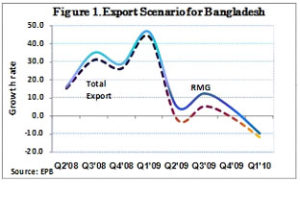

While domestic consumption (comprising household and government consumption) is the largest component of domestic demand, in recent years much of the growth in demand in the domestic economy originated from fast growing exports and private sector investment in manufacturing activity. In part, the fast growing export demand, coupled with remittance fueled domestic demand, contributed to higher investment and a corresponding expansion in domestic manufacturing activity. However recent data point to a significant weakening of both export and investment in manufacturing activity in recent months (Figure 1).

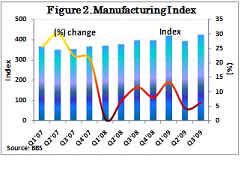

The index of manufacturing activity, after growing at a very fast pace in FY07 slowed down markedly. In particular, manufacturing growth slowed down further in the second quarter of FY09 due to the global recession and slowdown or decline in exports.

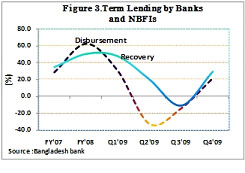

Private sector investment in capital machineries, as measured by disbursement of term loans for the banking system, also appears to have declined significantly (Figure 3).

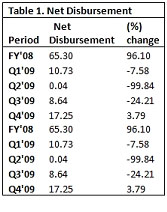

Following a very strong growth in net disbursement of term loan in FY08 net disbursement collapsed in FY09 (Table1).

There has been a moderate recovery in term lending in the final quarter of FY’09, although doubts remain about its sustainability. This softening of investment started with the deterioration of external economic environment and is not likely to change until the global economic outlook improves significantly.

External Sector Developments and Monetary Impact

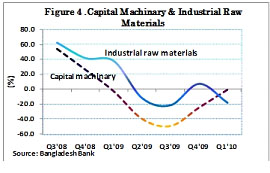

In a normal situation, the weakness in various indicators of domestic demand would call for an easing of the monetary policy stance, in particular to boost domestic private sector investment. However, the combined effect of a collapse in domestic import payments (Figure 4) and continued strong inflows of workers’ remittances has contributed to a record high current account surplus.

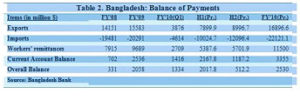

The resulting surge in the net foreign assets (NFA) of the banking system has contributed to record high excess liquidity and a collapse of interbank interest rates. In the first half of 2009/10, fiscal year through December 2009, the external current account surplus is projected to be more than $2 billion and foreign exchange reserves already crossed $10 billion mark at a record pace (Table 2).

For every dollar increase in the NFA, domestic money supply increases by almost Tk 70, fueling liquidity expansion at a very fast pace.

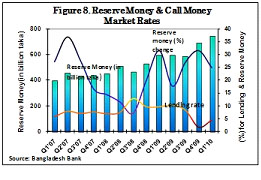

In the absence of strong credit demand, the increase in NFA contributed to a corresponding expansion in reserve money. The resulting excess liquidity in the banking system caused a collapse of the interbank interest rates. Reserve money expanded by more than

31% in FY09 from an average of 20% in FY08. In the absence of active liquidity management, call money rates collapsed in this fourth quarter of FY09 to less than 1 percent. Clearly, such an outcome was not desirable from monetary management perspective.

Threats Posed by the Excess Liquidity in the Economy

Excess liquidity and the resulting collapse in interbank interest rates may appear harmless on the surface. It may even be tempting to view the low interbank rates as a welcoming development in support of higher domestic demand and thus it is not surprising that Bangladesh Bank initially adopted a policy of benign neglect. In reality, however, if such excess liquidity is not sterilized through central bank monetary interventions, the excess liquidity may tend to create inflationary pressures in both commodity and asset markets with much undesirable effects on the economy and the society.

Excess liquidity is like pouring water in a sink. If the faucets are open and the drains are clogged or blocked, very soon water will spill over the sink and run through the floor and carpets, destroying or messing up many things in the house. The excess liquidity in the financial system, with very low returns through interbank rates, will eventually spill over into the real economy with inflationary pressures in the good and asset markets.

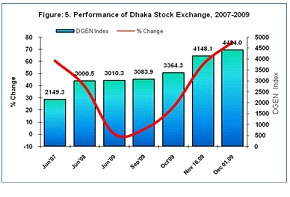

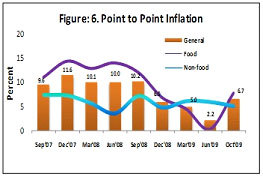

Some of the signs of such pressures are already visible. Banks and investors of financial assets are generally tempted to direct the excess liquidity to the stock market. Therefore, it is not surprising that Dhaka stock exchange general index has crossed 4400-mark for the first time in its history (Figure 5). It is well established that excess liquidity in the financial system has contributed to numerous bubble episodes in the stock markets in many countries, and what we are observing inBangladesh today may be a precursor to that. Domestic inflationary situation in Bangladesh has remained subdued in recent months due to the recent commodity price collapse in the global market (Figure 6).

However, this changes rapidly if excess liquidity in the economy persists and if food prices rebound due to global environment. The recent surge in food inflation in India to (19%) due to a very dry monsoon is also a matter of concern for Bangladesh. The spike in inflation in the middle of October may also be seen as a manifestation of this excess liquidity problem.

The Authorities’ Policy Response and its Adequacy

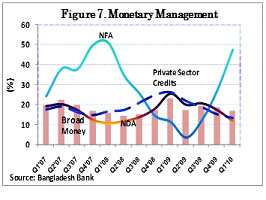

It took some time for the Bangladesh Bank to realize the extent and duration of the surge in the NFA due to growing balance of payments surpluses. The Monetary Policy Statement of Bangladesh Bank announced in July 2009, misjudged the direction and size of capital inflows entirely and essentially projected that the NFA of the banking system would decline by 4.1 percent in FY10. The monetary policy stance accordingly, did not contain any active or special intervention program for sterilizing the surging liquidity expansion. In reality, during the first three months of the fiscal year, the NFA of the banking system increased by 47.7percent, and the growth of reserve money remained high at 24.8% in the first quarter of FY10, following a 31% increase in FY09 (Figure 7).

In an environment of slower credit demand by the private sector, the resulting excess liquidity contributed to a collapse of the interbank interest rate.

After some initial hesitation, Bangladesh Bank started to become more engaged in monetary management through activation of its reverse repo operations and through that pushed the overnight interbank interest rates somewhat upward. This activation of the reverse repo operation has helped contain the expansion of reserve money at 24.8 percent level and helped push up the overnight money market rates to [3.5%- 4%] range. The inverse relationship between the growth rate of reserve money and the call money rate is clear from figure-8.

However, the current high growth rate of reserve money at about 25% range is still a matter of concern.

Some Concluding Thoughts

It is perhaps for the first time that Bangladesh is facing this policy dilemma. In the past, inflow of external resources (including workers’ remittances) used to be matched with increased demand for imports essentially serving as an automatic monetary sterilizer. This time around, however, with import payments declining, the BOP surpluses are growing every month. How long this situation will last is difficult to predict. The outcome will depend on the duration and strength of remittance inflows and how soon import demand picks up. A rebound in global commodity prices with strengthening of global economic recovery may also reduce the external BOP surplus to a more manageable level.

There is also the possibility that the strength of the remittance inflows are not necessarily attributable to workers’ income but with repatriation of some of their assets held abroad due to higher rate of return in Bangladesh. In that case, the surplus in the BOP may be a more lasting phenomenon and the policy response would need to be different.

On the likely scenario that the special circumstances contributing to this monetary expansion is a temporary phenomenon with import demand picking up and remittances slowing down in the second half of FY10, the task is somewhat easy and manageable. Under this scenario, Bangladesh Bank should prevent a significant appreciation of the Taka by maintaining its de facto exchange rate peg but it should engage in more proactive monetary management to fend of inflationary pressures in the good and asset markets in the coming months. We hope that the next Monetary Policy Statement of the Bangladesh Bank (scheduled to be announced in January 2010) will be cognizant of these considerations and realistic in setting its targets for monetary aggregates.

The stated targets would also need to be backed by proactive and forceful monetary management. There will be a sizable sterilization cost associated with this policy, entailing a reduction of profits of Bangladesh Bank. This stance of monetary policy would indirectly reduce the transfer of Bangladesh Bank profits to the Ministry of Finance (as non-tax revenue) and the government should absorb this within the budget. A sharp reduction of profits should not prevent the Bangladesh Bank authorities from engaging in large scale sterilization operations. Under any circumstance, it would not be advisable that the cost of sterilization operation lead to a reduction of the capital base of Bangladesh Bank and cause a deterioration of the quality of its balance sheet.

It would certainly be helpful if monetary policy is supported by an expansionary fiscal stance to boost domestic demand. The slow pace of Annual Development Plan (ADP) implementation and the delays in implementing the procedures for Public-Private Partnership (PPP) framework do not bode well for an acceleration of investment in the much needed infrastructure sector. This is the time when public investment needs to be boosted along the lines envisaged in the budget. It is regrettable that TK 25 billion allocated in the budget for catalyzing much higher PPP investment has remained untouched and not likely to be utilized at all in this fiscal year. Under these circumstances, the government may reallocate during the mid-year budget assessment a large part of the PPP allocation (say Tk 20 billion) to a special infrastructure fund for spending on roads and bridges. A special task force may be established to utilize the funds to the identified projects with special procurements policy for speedy implementation.

Dr. Ahsan Mansur is executive director of the Policy Research Institute