Economy poised for take off

At the close of 2009, the Bangladesh economy is poised for Take-Off, a sluggish global economic recovery

notwithstanding. The enormous traffic jams in the capital city of Dhaka is a stark reminder of this stage of

growth, though this has not figured in any growth theory. Events of the past two decades will show

that Bangladesh has evolved out of the “traditional society” and has met the “preconditions for take-off” in the

Rostovian formulation (W.W. Rostow 1960, Stages of Economic Growth). The structural transformation has

been taking place as the size of agriculture shrank to 20% of GDP with industry rising to 30%. As we know, the

leading sector driving this secular growth process is readymade garments, which has also created a generation of

entrepreneurs to take on the industrial diversification momentum for the economy to achieve middle income

status over the next five years or so. As we also know, the economy faces a road bump of a major kind – a

binding constraint of power supply. The sooner we are able to face off this challenge, the better it is forthe

economy to transition into the actual take-off. The recent transition to democracy could also be an economic

opportunity for higher growth, provided politics is constructive.

Resilience against heavy odds

In 2008-2009, Bangladesh economy suffered three external shocks, in sequence: the global commodity price

shock was followed by the financial meltdown which gave way to the deepest recession since the Great

Depression – now being described as the Great Recession. It is fair to say that the economy survived the shocks

and is now in reasonable shape to ride out the global recovery that is gaining strength. To be resilient against

such odds was no mean feat. US investment bank, Goldman Sachs, which dubbed Bangladesh among the Next

11 (after BRIC countries Brazil, Russia, India and China, N-11 includes Bangladesh, Egypt, Indonesia, Iran,

Mexico, Nigeria, Pakistan, the Philippines, S. Korea, Turkey and Vietnam) countries with promising potential

forinvestment and growth, recently concluded that Bangladesh has come out of the global crisis “broadly in line

with expectations” and was the only N-11 country whose macroeconomic stability improved despite the crisis.

Looking a bit deeper, it is hard to miss the good news-bad news story. The good news of course is that the

financial sector came out virtually unscathed in the face of a global meltdown. The commodity price spiral of

early 2008 which imposed a heavy terms-of-trade shock tothe economy was soon compensated by commodity

price decline that yielded terms-of-trade gains to the economy. The Great Recession of 2008-09, however, left

its mark, albeit modest by international standards, on the real side of the economy – through trade. Export

performance suffered but the impact was more pronounced on the non-RMG exports which tumbled 6% in

FY09 though overall exports still registered double digit growth of 10.3%, thanks to the so-called Walmart

effect that sustained demand for low-end garments (Bangladesh’s specialty) in US-EU markets. Even the global

forecasts of a collapse of remittance inflows could not keep remittance from flowing into Bangladesh in record

volumes.

The bad news is that it all points to the lack of global integration of the Bangladesh economy – in terms of

financial integration, capital mobility, and trade. Capital account transactions are barely 2% of GDP while tradeGDP ratio is at 43% now. What proved to be a saving grace this time around could be a drag in the future as the

global financial system recovers from its current predicament and resumes its onward march under a reformed

regulatory framework with innovative financial products. Higher growth of 8-10% requiresthe economy to take

advantage of financial innovation and myriad financial products offered by the global financial system. That

will be needed to finance the $50 billion infrastructure and other capital investments over the next five years.

While capital account convertibility can wait, capital account transactions have to be opened up to facilitate

inflow and outflow of capital transactions that support private-public investments in modern industry and

infrastructure.

Subdued growth performance in 2008-09

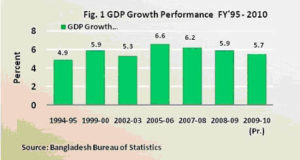

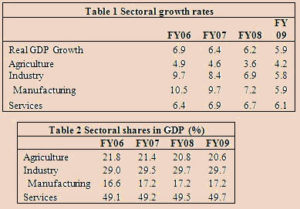

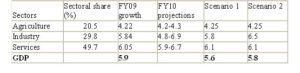

In the end, the Great Recession of 2008-09 did leave its mark on Bangladesh’s growth performance, albeit rather modest by international standards. We ended the fiscal year 2009 with a 5.9% GDP growth (Fig. 1), with agriculture growing a robust 4.2%, industry at 5.8%, and services at 6.1%. If quarterly GDP were estimated, despite the global economic downturn that began around September 2008, GDP growth for the first half of the year would have worked out close to 7%, thanks to booming exports which registered a surge of 42% in the first quarter. Around December, the real sector of trade and output began spiraling downward, ending the year with export decline of -0.7% in the final quarter.

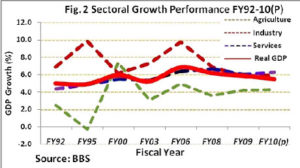

Manufacturing was the hardest hit sector in GDP. Having peaked at 10.5% in FY06, its decline was sharp throughout FY07-09, falling to 5.9% in FY09, which was largely the result of poor export performance stemming from the collapse in non-RMG exports. If manufacturing growth was stymied by collapsing global demand, decline in services growth was inevitable. So it did, falling from 6.9% growth in FY07 to 6.1% in FY09 (Fig. 2).

Even prior to the onset of the Great Recession, manufacturing output became anemic during 2007 and 2008, as

a fallout of the anti-corruption drive which led to a collapse of new investments. This is evident from the sharp

decline in machinery imports which fell 26% between FY07 and close of FY09. Theinvestment freeze

combined with export shocks for the non-RMG sector resulted in slowdown of manufacturing value added.

In terms of sectoral share in GDP (Table 2), there has been no change in the structure of GDP over the past two

years. Industrial growth is what has been driving structural change over the years. There was little movement in

this component over the past year, as manufacturing remained stagnant at 17.2% of GDP for three years

running. What is noticeable is the gradual rise in the share of services from 49.1% in FY06 to 49.7% in FY09,

largely reflecting expansion of telecommunications and financial services.

The global recession which intensified during the second and third quarter of FY09 sparked enormous

speculation about the outcome of Bangladesh GDP with a generous mix of optimism and pessimism. The

notable element of FY09 growth performance was its buoyancy despite all contraindications coming from the

likes of IMF and World Bank whose analysis yielded less than 5% GDP growth for the year. When the official

growth figures computed by BBS were made public with the FY10 budget at 5.9%, it basically validated the

projections of government agencies such as Bangladesh Bank and Planning Commission. Actually, the global

shock had robbed about 1% of GDP growth which could have been 7% under normal times.

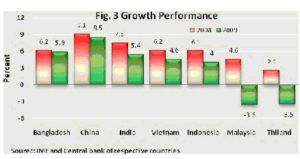

The global recession hurt much harder the emerging market economies of India and China, whose buoyant

growth rates took a major hit despite large economic stimulus packages (Fig. 3). According to most analysts,

China succeeded in large measure substituting export demand with stimulus backed domestic demand to still

come out with an expected growth rate of 8.5% in 2009, compared to India’s which was estimated at only 5.4%;

but recent reports from India suggest a better performance than that. Vietnam, which has been ahead

of Bangladesh in growth performance for the past decade could eke out a rate of 6.2% in 2008 and is expected

to achieve no better than 4.6% in 2009. These comparisons put Bangladeshperformance in a decent range,

particularly when other Asian economies like Malaysia, Thailand and Indonesia did much worse.

Finally, there is wide agreement that Bangladesh economy’s inherent potential is to grow at 7-8 percent per

annum on a sustainable basis, for the medium-term. Sadly, the first decade of the 21st century is coming to a

close withoutthe economy having achieved that milestone, which will have to be left for the next decade. Given

past year’s difficulties and economic forecasts for the coming year, highly optimistic growth projections for

FY2010 will not put it past 6 percent (Table 3). The most likely outcome is perhaps around 5.6-5.8%, (i.e.

pessimistic=5.6%, optimistic=5.8%) provided the global economy does not experience a double-dip recession

which some analysts are predicting.

Macroeconomic management remains a strong point

The economy withstood multiple internal and external shocks in the past couple of years and yet came out with

strong internal and external balances. Fiscal deficit and public debt were within sustainable range while the

balance of payments have never looked stronger with the current account in surplus for the past three years

running leading to accumulation of foreign exchange reserves which hit an Continued from page 3

all-time record of $10 billion in November 2009, equivalent to 4.5 months of prospective imports. These

positive external developments brought new challenges to Bangladesh’s monetary management as inflation,

which was well contained by mid-year 2009, showed signs of resurgence as the year came to a close.

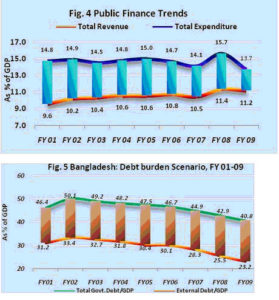

Bangladesh public finance trends (Fig. 4) reveals the twin perpetual challenges of revenue mobilization and adequate spending to cover public investment in infrastructure and building human capital, among others. The tax-GDP ratio remains among the lowest in the world and shows no signs of improving. A spurt in revenue mobilization, albeit unsustainable, was observed in FY08 when revenue-GDP ratio increased by 0.9% of GDP (10.5% to 11.4%), due largely to the fear factor created by the anti-corruption drive which in turn led to increased tax compliance. Predictably, that trend was not sustained the following year. Any upward movement in tax mobilization is unthinkable without fundamental reforms in tax administration.

Revenue constraints set limits to public spending which has been mired in controversy lately, primarily due to the failure of bureaucratic machinery to implement the ADP. While current expenditures have grown by 2 percentage of GDP between FY06-09, development expenditures have not kept pace. The poor record of ADP implementation (Fig. 6) has raised concerns about what the realistic size of ADP should be. Evidence suggests there is a strong case for downsizing planned ADP. Overall, public expenditures have been stuck at 14-15% of GDP for much of the decade when one would have hoped to see a secular rise in this ratio to reflect the demand pressure on publicly financed infrastructure. The jump in public expenditure in FY08 is explained by the inclusion of off-budget subsidies to SOEs into the fold of the budget.

Thus our prudent fiscal deficits – which is a good thing – are the consequence of low revenue and low expenditure profiles – a bad thing. Nevertheless, except for a few years when external or domestic shocks contributed to fiscal vulnerability, external financing appeared to be adequate along with prudent levels of non-inflationary domestic financing of the deficit which remained within modest levels of 3-4% of GDP for much of the decade. With GDP growth on an uptrend, the economy should be able to sustain a higher ratio of public spending and fiscal deficits, and even a moderately higher rate of public debt (Fig.5).

Another vital aspect of macroeconomic management – inflation – is discussed in a subsequent section on monetary management.

Trade performance takes moderate hit

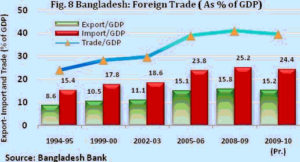

Greater trade openness and progressive integration with the world economy through trade has been an important aspect ofBangladesh’s economic transformation. The global economic shock of 2007-08 was transmitted into the Bangladesheconomy primarily through trade. First, the commodity price shock – negative and positive – resulted in terms-of-trade gains and losses which eventually evened out by the close of fiscal 2008-09. More lingering was the shock from the global recession which moderated external demand for Bangladesh’s principal export of RMG, but led to precipitous declines in non-RMG exports. Yet, when compared to the performance of its peers, Bangladesh comes out almost swinging. RMG exports clocked 15% growth in FY09 – thanks to the Walmart effect – though non-RMG exports declined about 6%, still leaving an overall double digit export growth of 10% (Fig.7).

In 2008 or 2009, double digit export growth anywhere has been a rarity. In terms of numbers, Bangladesh could make the grade because of the robust headstart in the first quarter; that enabled a 19.3% export growth for the first half of the fiscal year (July-Dec). On the whole, the second half (January-June) saw exports pretty much stagnant, growing only by 2%, something that should not be lost sight of in figuring out where our weakness or strength lie. Reflecting on the past year’s export results gives one a sense of relief as well as some food for thought. Certainly, there is no room for complacency. The strengths and vulnerabilities of our export basket must be kept squarely in view in facing the challenge of the coming year — as the recession unwinds, albeit gradually – as well as for the longer term. Export concentration – a source of our vulnerability – only intensified with RMG making up nearly 80% of exports in FY2009. Export diversification suffered another blow as non-RMG exports lost ground partly due to the global recession but as much due to the cumbersome import and tariff regime that stifles emergence of new export ventures.

That said, putting this performance in global perspective gives cause for some relief. Few, if any, non-oil exporting developing countries could show such resilience in the face of the current global meltdown. China, the export and manufacturing powerhouse of the world for decades, saw its exports tumble 22% during the first half of this year, resulting in widespread plant closures and massive job losses. India saw its exports slump 29% for the first half of 2009. Export declines were also experienced by Malaysia (-23%), Thailand (-22%), Vietnam (-24%), and Pakistan (-21%), until June 2009. Germany and Japan, the two leading export surplus developed countries, saw their exports squeezed by falling consumer demand for automobiles and electronic goods in the developed markets. IMF’s World Economic Outlook projects export decline of 9% for 2009 against output decline of about 3%.

The outlook for the coming year looks bleak for Bangladesh though much rides on the back of the global economic recovery. A sharp and sustained global recovery could fuel resurgence of exports. A gradual move out of recession will leave exports flat. PRI projections for FY2010 indicate export performance of 8-9%, keeping in context the first quarter export decline of 11.7%. Imports, which typically precede industrial and export performance, have been just as sluggish in the past year with sharp declines in the imports of capital machinery. The economy witnessed import growth of merely 4% in FY09, due to a sluggish manufacturing sector, resulting in a modest decline in trade-GDP ratio for the first time in two decades (Fig.8)

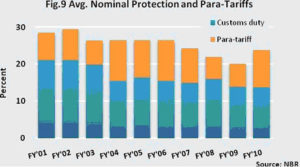

Trade policy in 2009 did not turn a corner. Trade openness, which was making gradual progress over the past two decades faced a setback as average protection rose two percentage points for the first time in many years (Fig.9). For FY2010, a flat regulatory duty (RD) of 5% was imposed across-the-board on all imports subject to the top rate of 25%. That brought the top general rate to 30% in addition to the fact that some 700 of these tariff lines were also subject to supplementary duties (SD) varying from 20% to 100% and above. It was a desperate move on the part of the tax authority to bolster revenues in a slowing economy. Whether or not this will pull up customs revenue depends on the state of the economy and import growth in the current year. What immediately happened was that the ex ante average nominal tariff rose to 23.9%, compared to 20.1% for FY 2008-09. This rise in average nominal protection was a departure from the historical trend of gradual decline since the start of trade liberalization in the early 1990s. Surprisingly, there was no complaint from the business community for the sharp rise in tariffs. That is because this tariff adjustment did more to raise protection to import substitutes than would contribute to revenue.

Thus Bangladesh still leads in terms of average tariffs in South Asia and elsewhere. It might be argued that there is more to trade policy than average tariffs. It turns out that after trade related quantitative restrictions on imports have been eliminated, tariffs and para-tariffs remain the main instrument of trade policy in Bangladesh. So average tariffs pretty much captures the broad direction of trade policy. So what is the problem if the tariff regime helps to protect domestic industries? The truth is that import tariffs hurt exports, first, by distorting incentives between export and import substitute production; second, it raises the cost of exports making them uncompetitive in the world market. Our tariff regime continues to be a major barrier to exports despite the existence of a duty-drawback system which is no match for duty-free inputs. In particular, emergence of new and potential exports – the basis for export diversification – is constrained by this cumbersome tariff regime in addition to an unfriendly customs regime that is still geared to collect the bulk of tax revenues (42%).

Current account surplus and savings-investment paradox

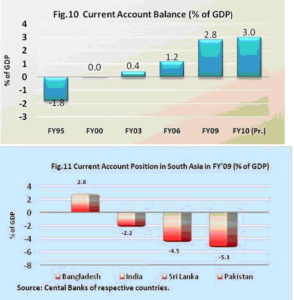

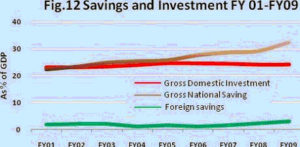

With a reasonable export performance and sluggish imports, the economy posted yet another year of current account surplus, joining the ranks of a few non-oil developing countries running current account surpluses, in contrast to the performance of others in South Asia (Fig.10-11). The picture is likely to be repeated in FY2010 if the global recovery is as indicated earlier. Record remittance inflows, and a combination of sluggish imports and moderate export growth has contributed to the current account surplus, leading to accumulation of foreign exchange reserves which hit $10 billion for the first time in November 2009. For a growing economy like Bangladesh, which is hungry for investment, these current account surpluses signify nothing more than under-spending as is evident from the savings surplus over gross domestic investment (Fig.12).

To be sure, two things were happening in concert. In aggregate terms, the economy was accumulating savings at a faster rate, thanks largely due to a surge in remittance inflow. So, the gross national savings reached a figure of 32 percent of GDP in FY09, from only 18 percent in 2002. At the same time, our gross domestic investment has been stuck at 23-24 percent since 2002. What is striking is the switch in the composition of this investment – a rise in private investment and a fall in the share of public investment, which reached a low of about 5 percent (out of 24 percent) in the latest fiscal year. The savings-investment “surplus” now stands at 8 percent of GDP – resources equivalent to the cost of three Padma Bridges! I know of no other non-oil developing country (except China) that has such a huge savings surplus (Table 4). So much of savings is going waste when the economy is crying for resources to invest in infrastructure, health and education.

First and foremost, it signifies our inability to invest all our available resources. Second, it could be that our financial intermediation is not efficient. Savers and investors are two divergent groups. It is the financial system – banks and non-bank financial institutions – that bring savers and investors together. In a smoothly functioning financial system, such an excess of savings (investible capital) would have reduced interest rates, increased the demand for investment and restored savings-investment equilibrium. That none of this is happening tells us that there is some stickiness or major inefficiency in the financial intermediation process. Third, we have been made aware of the poor performance of ADP implementation in recent years, which has had the effect of reducing the share of public investment in total investment. Problems with power and infrastructure have pulled back potential private investment as well. Lately, the global economic slowdown has compounded the problem. So the overall investment climate has not been conducive to result in an improvement in the investment-GDP ratio, which has remained stagnant for nearly five years and shows no sign of improvement.

Remittance flows challenge monetary management

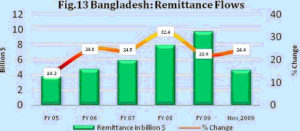

After record growth in remittance inflows in FY08 (speculated to be the result of job termination in the Middle East), remittance flows remained robust in FY09 ($9.7 billion) and until November this year (Fig.13). There is no sign of slowing down of remittances anytime soon. Coupled with significant current account surpluses, these foreign exchange inflows, in the absence of strong sterilization moves by the Bangladesh Bank, boosted bank reserves (+31% reserve money and 19% M2 growth at close of FY09) resulting in a money market that was flush with liquidity. In the backdrop of global recession, term lending from the banking sector to large and medium enterprises dried up creating a widespread phenomenon of “excess liquidity”. A late reaction of Bangladesh Bank to mop up excess liquidity from the banking system through reverse repo operations proved too little too late, as the phenomenon seemed to continue till close of 2009.

In the past year, monetary authorities have faced two challenges stemming from the bulging current account surplus.

First, it put pressure on the nominal exchange rate to appreciate. Strong remittance flows could have created a sort of Dutch disease problem by hurting exports. To forestall that problem, Bangladesh Bank went on a dollar buying binge (to keep the Taka from appreciating) that added to bank reserves that was not sterilized. Next, despite raising commercial banks’ open positions (caps on foreign exchange they can hold), ballooning remittances further added to reserves at a time when bank lending was stagnating, leaving the financial system afloat on excess liquidity. There is little doubt that some of this excess liquidity is fueling asset price bubbles, raising risks in real estate and equity markets. The situation remains unchanged till the close of 2009.

Inflation menace returns

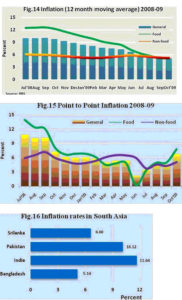

The spectre of inflation poses another challenge to monetary management. After suffering from double digit inflation for a full year, from September 2007 through September 2008, largely fueled by the global commodity price shock, inflation appeared tamed as global prices declined (Fig.14). But monetary policy remained accommodative throughout the period leading to the rise in inflation that we now witness from mid-year 2009 (Fig.15). Food price inflation has led the way as untimely rainfall raised concerns about a bumper Aman harvest. Excess liquidity in the system has created the wherewithal for non-food inflation to pick up steam. The next six months will be crucial for Bangladesh Bank to use all the tricks in its armor to contain the monster of inflation. And accommodative monetary policy might not be the answer. That Bangladeshhas managed inflation far better than its peers in South Asia (Fig.16) ought to be no ground for complacency.

2010 harbinger of good times

Analysts are cautiously optimistic about the world economy in 2010. Both trade and output growth are expected to be in positive territory after a year in which world output and trade shrank for the first time since 1944. Output was down 3% while trade plummeted 9% in 2009. It is a matter of relief that Bangladesh economy came out of this catastrophe with export growth of 10% and GDP growth of 5.9% with macroeconomic stability in tact to make use of opportunities that will come its way in 2010 as the world economy emerges from the ashes of the Great Recession. The good news is that in spite of all the dark forebodings, there was no repeat of events similar to that of the Great Depression, thanks to the timely and coordinated intervention by G20 nations. Of course, the economic stimulus packages were implemented at huge costs – massive public debts that will have to be serviced and reduced in the years to come. There were hard lessons learnt. Balancing of future global demand has now emerged as a critical issue to be negotiated and resolved among the major economic powers. The weakness of leveraged globalization has been recognized. But solutions to resuscitate credit markets are still being worked out. One thing policy makers around the world will hopefully keep a watchful eye on is executive excesses driven by corporate greed which almost brought the global financial system down.

Equity markets typically lead the way to economic recovery. This time has been no different. Major stock markets around the globe have been on an uptick since April 2009 (Fig.17) signaling that the economic recovery is under way. That is indeed good news for Bangladesh which must continue to rely on export markets to trade its way out of poverty, regardless of what China and India – two super-large consumer markets – can do by focusing on domestic demand stimulation. After performing better than most equity markets in 2008, it is no surprise that Bangladesh stock indexes are once again leading the way since the April resurgence of equity prices.

2010 will be critical for the global economy. The goal will be to avert a double-dip recession. Soon enough, we will know for sure if the world’s leading economies fall into a W-type recovery that was experienced during the Great Depression. That would be calamitous. Bangladesh stands to gain most from a V-shaped recovery, which is the forecast of most economists.

Given current trends, two global milestones will have been reached in 2010. China is expected to overtake Japan as the second largest economy of the world. India’s manufacturing output will overtake agriculture. No such notable structural transformation is expected for the Bangladesh economy in 2010 when the principal challenge will be to return the economy on a 7% plus growth trajectory in FY2011. The key to that will lie in removing the binding constraint of power. The rest will fall in place and the take-off Bangladeshis are waiting for will be theirs.

Dr. Zaidi Sattar is Chairman of the Policy Research Institute of Bangladesh. He can be reached at zaidisattar@gmail.com