Bangladesh aspires to become a middle income country by 2021.

That hope is predicated on raising its current 6.0-6.5 per cent annual growth rate of gross domestic product (GDP) to 8.0 per cent or more on a sustainable basis for the next decade. There is no doubt that the nature of trade policy during this period will play a supportive or restraining role in achieving the targeted rate of growth. Historical evidence around the globe point to the fact that high performing economies (those growing at annual rates of 7.0-8.0 per cent for long periods) also have the most open trade regimes, particularly during the periods of high performance. This relationship was validated in a seminal cross-country research paper by David Dollar and Art Kraay (2001), which also concluded that growth was good for the poor.

In the late 1990s, Bangladesh was listed by analysts among the “most globalised” developing economies on the basis of its trade openness and progressive integration with the world economy. The expectation was that, in two decades or so, Bangladesh would be ranked among the most open economies of the developing world. That did not happen, as progress in trade liberalisation stalled after a decade of tariff rationalisation and removal of trade-related quantitative restrictions. Is the current trade policy stance consistent with Bangladesh’s long-term growth and poverty reduction goals?

Annual budgets in Bangladesh have a major role in carving out the trade policy stance following some measure of consultations with business chambers and other stakeholders. Fiscal Year (FY)2013 budget is no different as the tariff and para-tariff adjustments proposed provide the direction and contours of trade policy which will have an impact on the incentive regime that will affect decisions of investors, producers, exporters, importers, and consumers. Employment, growth, and poverty reduction are the eventual outcome of these decisions. That makes a critical review of budgetary proposals on trade taxes important for policy.

Launch of DTIS and impending trade policy review: The year 2012 is critical for trade policy. After a spectacular year in export performance, the sharp slowdown this year has raised concerns about the sustainability of export growth. The Government, in cooperation with the World Bank, has launched the preparation of a Diagnostic Trade Integration Study (DTIS), a study that seeks to identify hindrances to greater integration of Bangladesh into the multilateral trading system. The DTIS will reflect the above concerns on sustainability of export growth, and will build on existing work and fill knowledge gaps where necessary.

Later this year, the periodic Trade Policy Review on Bangladesh is also expected to take place at the World Trade Organisation (WTO). Thus, given the fact that Bangladesh aspires to become a middle income country by 2021, which would definitely require a trade policy orientation that is supportive of high export performance and rapid GDP growth, it has become a national imperative to review the state of play in trade policy and mould it in the right direction. The Budget for FY2013 has been launched but no changes in trade policy directions are evident from the tariff proposals.

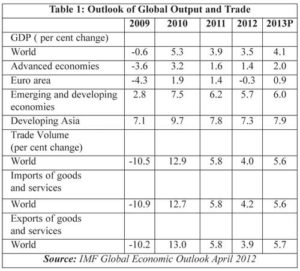

Global economic environment and outlook for 2013: Because of progressive integration of the Bangladesh economy with global trade and finance, it cannot be immune to external developments. The global economy has been slowly trying to recover from the lasting effects of the global financial crisis of 2008. A modest uptick was noticeable in the US economy as consumption and inventory investment picked up along with the credit and labor markets. But recent events- especially those in the Euro area — has imposed fresh uncertainties on the global economic outlook for 2012 (Table 1). The latest Global Economic Outlook of the International Monetary Fund (IMF) projects world output and trade to slow in 2012 with a modest pick up in 2013. The future of the European Economic and Monetary Union has become increasingly uncertain with mounting sovereign debt causing significant increases in sovereign bond rates and unwillingness of a large fraction of the population of affected European Union (EU) countries to accept austerity measures to ensure fiscal consolidation. The impact of the Euro zone crisis is being felt by the developing Asian nations through the export and financial channels leading to a softening of growth in developing and emerging Asian region.

From the global trade perspective, 2012 is expected to see a decline in trade volume growth but a modest bounce back is expected in 2013. Given lower deficit in deficit economies like the United States and lower surpluses in surplus economies like Japan, the global trade-related imbalances are not expected to worsen. Besides this, the decline in consumption during the crisis in the U.S and Europe has not been met by increased domestic demand growth in surplus economies like China, consequently leading to a slowdown in global demand for global imports. Again, the decline in demand in the U.S and Europe has affected China and Developing Asia through export channels, which constitutes a huge portion of their income and GDP.

The same is true for Bangladesh, whose current state of integration with the global economy, make its growth and export prospects over the short- to medium-term rather subdued in view of the sluggishness of global output and trade in the near-term.

Evolution of trade policy in Bangladesh: Nevertheless, it is a good time to take stock of the situation as far as trade policy is concerned. At independence, Bangladesh inherited a highly restrictive, inward-looking, import-substituting trade regime, with little debate about its relevance to the new economy whose lifeline was actually an export sector – jute and jute goods. The inherent anti-export bias of an ISI regime went unnoticed as Bangladesh chose a path of import substituting industrialization with minimal impact on industrial development. By the 1980s, the shortcomings of ISI policies became all too evident globally, and the strategic importance of export-oriented policies began to be realised, particularly in developing economies trying to enter markets for labor-intensive manufactures. Though Bangladesh began seriously dismantling its ISI orientation in the early 1990s, to this day, the last vestiges of ISI continue to haunt policymakers and many economists alike, with strong backing from the emerging entrepreneurial class in Bangladesh.

A combination of economic and political crisis in the late 1980s created the atmosphere for embracing critical reforms. Moreover, deregulation, privatization, and trade openness, dominated economic thinking and shaped donor policies for developing economies. Thus, in the early 1990s, Bangladesh launched the deepest and widest set of economic reforms in its external trade and regulatory framework governing domestic production and investment. In this scheme of economic reforms was the onset of trade liberalisation which included tariff reduction and rationalisation, removal of quantitative restriction on imports, exchange rate flexibility, and current account convertibility.

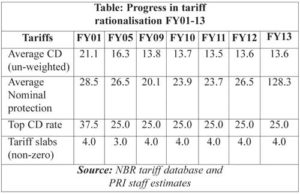

Tariff rationalisation and reduction: Dur-ing the 1990s, Bangladesh significantly reduced its tariff rates and rationalised the structure, progressively moving towards the goal of simplicity and transparency of the customs tariff. The top custom duty (CD) rate came down from 160 per cent in 1990 to 25 per cent today. The average (un-weighted) customs duty declined to 13.6 per cent in FY12 as compared with 70.6 per cent in FY92, and 100 per cent in 1985. Considerable rationalisation of the tariff structure occurred and progress was made towards achieving a degree of uniformity and removing some tariff anomalies that existed due to higher tariffs on intermediates than final products. Two features stand out in the evolution of protective tariffs: (a) the sharp reductions which began in FY92 halted around FY96, and (b) the emergence of para-tariffs, additional levies such as supplementary duties, regulatory duties, and infrastructure development surcharge. Trade liberalisation slowed down by the mid-1990s, and was even somewhat reversed during the last few years of the decade, on the popular notion that earlier reforms had been “too much too fast”. Resistance to liberalisation from business and industry became strong enough at this time to forestall further reduction in protection. One reason could be that productivity improvements and efficiency adjustments were not fast enough for those industries that had gotten used to high protection. At the end, these groups exerted enough pressure to undermine political will to carry forward the liberalisation agenda.

At the turn of the century, it was all too evident that trade liberalisation had slowed down, while some new external developments, particularly in the trade arena, had to be reckoned with. China and Vietnam joined the WTO and were subject to the rules of the multilateral trading system, most significant of which was the requirement to bring down their tariff rates, as a condition of membership. India, having been determined as having the most restrictive trade regime in South Asia, launched a major liberalisation program, unilaterally, and under South Asian Free Trade Agreement (SAFTA), for the South Asian region. Within a few years, India brought its top manufacturing tariff rate down to 10 per cent, and average nominal tariff to around 12 per cent by 2008. Under a multi-year arrangement for budget support from the World Bank, Bangladesh also agreed to a regime of gradual reduction and rationalisation of tariffs during the early years of the decade. Under the same arrangement, all trade-related quantitative restrictions were phased out with only WTO-compliant non-tariff measures (NTMs) remaining.

Accordingly, the following notable trends could be observed. The average tariffs showed a modest but gradual decline until FY09. However, this decline was led by reduction in input duties rather than duties on final goods. The top rate which declined to 25 per cent in FY05, remained stuck at that level since then. More notable was the emergence of para-tariffs like regulatory duties (RD) and supplementary duties (SD). An infrastructure development surcharge (IDSC) of 4.0 per cent was abolished in FY07.

The overall outcome over two decades of liberalisation is as follows: while Bangladesh reduced tariffs, — rapidly at first, and gradually later — other countries in the South Asia region and across the globe generally moved faster. Consequently, despite two decades of liberalisation, judged by the level of average protective tariffs, Bangladesh continues to be listed among countries with relatively restrictive trade regimes. Bangladesh ranks 86th among 110 countries in World Bank’s Overall Trade Restjrictiveness Index (2009); Hong Kong, China being number 1.

Dr. Zaidi Sattar is chairman, Policy Research Institute of Bangladesh. email: pribangladesh@gmail.com