What explains this sharp decline in export performance since FY2011? There are several factors including the effect of the low base year (FY1990) values that magnify the growth rates of the earlier years.

Infographics: TBS

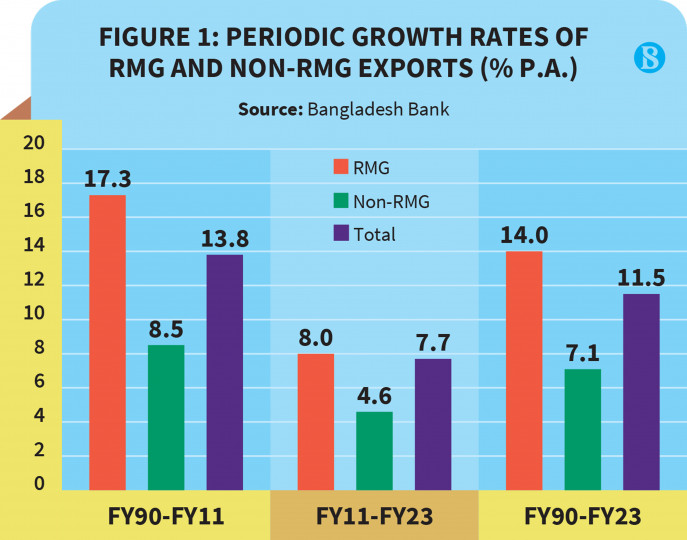

The enormous success of Bangladesh in boosting the exports of readymade garments (RMG) is well celebrated. Remarkably, Bangladesh pushed RMG exports from a mere $624 million in FY1990 to an impressive $47 billion in FY2023, recording an average annual growth rate of 14% over a 33-year period. In contrast, non-RMG exports grew modestly from $900 million to $8.5 billion, which is an annual average growth rate of 7.1%. As a result, the share of non-RMG exports in total exports has shrunk from 61% in FY1990 to a mere 10%.

Overall export performance has slowed in recent years, down from 13.8% between FY1990 and FY2011 to 7.7% between FY2011 to FY2023. The growth of both RMG and non-RMG exports slowed considerably. But the slide in the growth of non-RMG exports was particularly acute, falling to less than 5% per year. While RMG exports maintained a stronger growth trend, the average growth rate declined dramatically from 17.3% between FY1990 to FY2011 to 8% between FY2011 and FY2023 (Figure 1).

What explains this sharp decline in export performance since FY2011? There are several factors including the effect of the low base year (FY1990) values that magnifies the growth rates of the earlier years. At the policy level, a major contributor is inappropriate exchange rate management. A core determinant of the overall solid long-term (33-year) export performance is macroeconomic stability combined with flexible exchange rate management. But exchange rate management went off track after FY2011, when a sustained appreciation of the real exchange rate derailed export incentives.

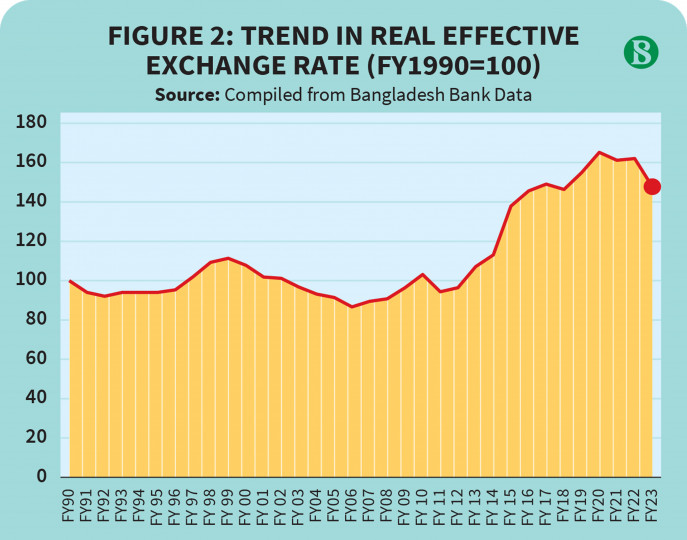

The long-term trend in the real effective exchange rate (REER) is illustrated in Figure 2. The chart tells a clear story of how the exchange rate policy went off track after FY2011. Between FY1990 and FY2011 the REER maintained a downward trend and in FY2011 the REER was still 5% lower than the rate in FY1990. This suggests that the exchange rate policy was supportive of export growth and was one major contributor to the double-digit export growth between FY1990 and FY2011.

The REER started appreciating after FY2011 owing to Bangladesh Bank policy of keeping a relatively nominal exchange rate even as the inflation differential between Bangladesh and trading partners widened, leading to an appreciation of the REER. The REER appreciated from 94.4 in FY2011 to 165.2 in FY2020, which is a whopping 75% appreciation of the Bangladesh Taka (BDT) in real terms. There were some corrections between FY2020 and FY2023. Even so, the REER in FY2023 was 57% more appreciated relative to the level in FY2011.

Infographics: TBS

The adverse impact of this sharp appreciation of the REER on export performance was substantial. Growth rate of total exports almost halved, from 13.8% in FY1990-FY2011 to 7.7% in FY2011-FY2023. The adverse effect on non-RMG was particularly devastating, as the growth rate declined to below 5%.

The imperative for proper management of the exchange rate has increased with the onset of a serious balance of payments crisis since 2022. The government has tried to stabilise the balance of payments primarily through import controls. Between FY2022 and the first half of FY2024, imports have fallen by 27%. GDP growth is on a falling trend and one key factor for this is the sharp fall in imports that has hurt activities in energy, power, and manufacturing.

Clearly, use of import controls as a tool for managing the balance of payments is inconsistent with the Perspective Plan 2041 objective of accelerating growth to secure Upper Middle-Income status by FY2031. The only sustainable way to reconcile the acceleration of GDP growth with stability of the balance of payments is to boost the growth of exports. Among other policies, this will require proper management of the exchange rate.

The best policy would be to pursue a flexible market-based exchange rate policy, where the exchange rate is guided by the market forces of demand and supply. A flexible market-based exchange rate will boost exports and remittances and lower the demand for imports by raising import costs. The government can influence the exchange rate through monetary, fiscal and trade policy instruments. The fear that the exchange rate will overshoot, and fuel inflation can be addressed by reducing trade tariffs and through demand management based on use of monetary and fiscal policies. An increase in the interest rate through monetary tightening backed by a reduction in fiscal deficit through strong and meaningful tax reforms is the best way to fight inflation and reduce the demand for imports.

A second important determinant of export performance is the incentive policy emerging from trade protection. As is well known, high custom duties along with supplementary and regulatory duties provide strong protection to domestic production thereby shifting investor incentives away from export to domestic markets. Research done by the Policy Research Institute (PRI) shows that the magnitude of the resultant anti-export bias of trade policy is substantial.

This anti-export bias affects only the non-RMG exports. The RMG exports face zero anti-export bias because they can import all inputs at world prices without paying trade taxes based on the Bonded Warehouse System. This facility is only available to RMG exporters. Domestic RMG producers do not have this facility. The anti-export bias of trade policy is the main reason for the differential export performance of RMG and non-RMG exports.

Moving forward, the reform of trade policy with a view to lowering trade protection and eliminating the anti-export bias is a core reform for boosting non-RMG exports. Other determinants of exports include reduction in trade logistic costs through simplification of custom clearances and investments in transport infrastructure including sea, air and land ports, improvements in skills through investment in education and training, boosting FDI through reduction in the cost of doing business, participation in global value chain, adoption of better technology, and participation in bilateral and regional free trade agreements.

Sadiq Ahmed is Vice Chairman of the Policy Research Institute of Bangladesh. He can be reached at sadiqahmed1952@gmail.com

https://www.tbsnews.net/economy/imperative-market-based-exchange-rate-844826