Tentative Global Outlook: It is still too early for world leaders to claim victory over The Great Recession of 2008-09. The global economic recovery is anything but robust. Fears of a double dip recession still loom on the horizon.

Near 10% unemployment rates afflict the USA and most countries of Europe. And global economic diplomacy has taken a turn for the worse. Gone is the fuzzy rhetoric about G20 co-operation to boost global growth. China has not wilted under western pressure to revalue the Yuan. A potential currency war signaling competitive devaluations could destabilize the global economy. The US Federal reserve recently chose to loosen monetary policy releasing cash to buy $600 billion of bonds – a kind of monetary easing to further induce dollar depreciation. Bulging deficits and mounting public debt threaten several erstwhile model economies of Europe. In stark contrast, emerging market economies of Asia (India and China, in particular) are showing signs of an earlier and more sustained turnaround.

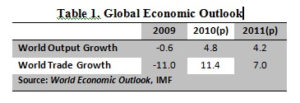

The much-watched global indicators from IMF, World Economic Outlook, recently presented a picture of a slowly recovering world economy (Table 1). IMF projections point to a subdued rather than robust recovery. A peep into the IMF projections reveal that Asian recovery is stronger than either Europe or North America. Nevertheless, a CNN ticker on 02 December, 2010 screamed “global manufacturing powers ahead” suggesting an upbeat assessment of the global economy.

Bangladesh economy on a rebound

It seems the Bangladesh economy is taking the cue from emerging Asia rather than the developed economies which are not out of the woods yet. If the first five months of the current fiscal year is any guide, Bangladesh economy is on a rebound from the sluggish growth of the past year. By all indications, Bangladesh weathered the global crisis largely unscathed, albeit subdued, and is ready for a robust expansion of output and investmentprovided global demand is sustained and domestic political environment remains stable. By and large, international outlook appears to get more favorable. Quite apart from being dubbed in 2005 as the Next 11, after BRICs (Brazil, Russia, India, China), promising investment destination by USinvestment bank, Goldman Sachs, Bangladesh has also been listed in 2007 by J.P. Morgan as the Frontier Five countries (along with Nigeria, Vietnam, Kazakhstan, Kenya) to make the group of Emerging market Economies with promising potential for investment and growth. In the post-crisis period, Goldman Sachs was quick to point out that Bangladesh came out of the global crisis “broadly in line with expectations” and was the only N-11 country whose macroeconomic stability improved despite the crisis. The economy’s resilience in the backdrop of a global economic crisis can now be made best use of through the massive infrastructure investment program that is badly needed for an economy targeting 8%+ GDP growth in the near term.

2011 growth outlook strongly positive

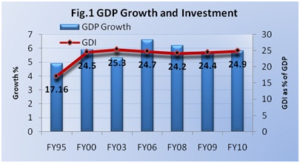

The Great Recession of 2008-09 that throttled international demand for Bangladesh exports resulted in subdued growth performance for two years in a row: fiscal years 2009 and 2010. In effect, PRI estimates the global crisis robbed the economy of some 1-1.5% of GDP growth. That shortfall could be a thing of the past if opportunities presented during the current fiscal year – global and domestic — are fully exploited to inch closer to the proverbial 7% GDP growth in FY2011. All indications are that this year the jinx of below six percent growth will be over, thanks to very robust export performance in the first quarter and the outlook for some easing of the energy situation in the near term. Figure 1 shows growth trends with the revised GDP growth numbers from BBS with estimates of 5.7% and 5.8% growth for FY09 and FY10, respectively.

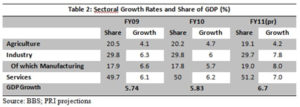

After two stagnant years of modest growth in manufacturing and services, in FY11 we expect robust growth in both these sub-sectors while agriculture should sustain growth rates of 4%+ subject to favorable weather conditions and sound management in the supply of agricultural inputs. The high growth expectation for manufacturing stems from the strong uptrend since April in overall exports covering RMG and non-RMG manufactures. The fact is that RMG, whose exports grew 35%+ during July-Nov 2010, makes up almost 70% of manufacturing. In aggregate, we expect GDP growth for FY2011 (Table 2) to be around 6.7%, approaching the targeted 8% growth by FY2015, the final year of the Sixth Five year Plan.

It is important to note that GDP growth, for the most part, continues to be determined by factor accumulation (labor and capital) rather than rise in their productivity. Under these circumstances, sustained higher growth can only be had from an increase in Gross Domestic Investment (GDI), which, as a percentage of GDP, has been stagnant for too long (Fig.1). A breakthrough ininvestment is long overdue. Without that happening, even a 7% growth rate would not be sustainable, let alone 8% growth which requires 30%+investment rate. As can be observed, the break from a decadal average of 4.8% growth in the 1990s, to 5.8% average growth in the current decade was prompted by a rise in the investment rate from 17% in FY95 to 24% in FY2000.

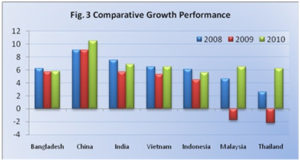

Bangladesh’s recent growth performance – crisis and post-crisis – appears reasonable when compared with other economies in the region (Fig. 3). The global recession hurt much harder emerging market economies of India and China, whose buoyant growth rates took a major hit despite large economic stimulus packages. According to most analysts, China succeeded in large measure substituting export demand with stimulus backed domestic demand and ended up with a GDP growth of 9% in 2009 which is expected to be sustained or improved through 2010 as the world recovers from the global financial crisis and as demand for China’s exports is restored. Indian economy has also bounced back with 2010 estimates of growth running close to 9%. Vietnam, which had fared better than Bangladesh throughout the past decade, took a big hit on its export performance during the crisis owing to stymied international demand for its goods. Now on an upswing, its prospects for over 6% growth in 2010 look better than Bangladesh. Even Malaysia and Thailand are out of their negative growth scenario of the past year and are expected to post 6-7% growth in 2010.

Macroeconomic management on track

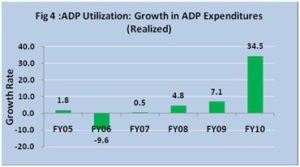

The year 2010 presented twin surprises in macroeconomic management. First, ADP spending was at an all-time high of about Tk. 260 billion at the close of FY10, thanks to a concerted effort by the ministries concerned to overcome the stigma of bureaucratic inertia that was being blamed for the recurrent under-utilization of ADP. Realized ADP spending was a record 34.5% above actual spending of FY09 (Fig. 4). It also tells us that past under-performance in ADP utilization has to be attributed to a lack of political will rather than anything else. However, nagging questions remain in the public mind about the quality and effectiveness of public spending.

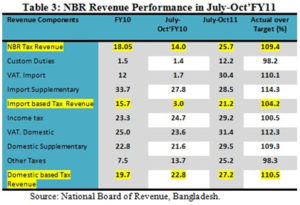

Second, while revenue targets were met for FY10 despite weaknesses in the external and domestic sector activities, the first quarter of FY11 recorded a strong showing on the back of rising trade volumes (import and export) and similar pick up in domestic production activity. Almost all revenue components were running ahead of targets by significant margins (Table 3).

Searching for reasons for this stellar revenue performance, one does find a few tax reform initiatives that seems to have paid good dividends: NBR initiatives in VAT included withdrawal of truncated system at retailer level; income tax reforms included reduction in tax holidays and interest exemptions in savings certificates and bonds, some reduction in business incentives, and reconstruction of different income tax slabs. More relevant was the recovery of the world economy from the doldrums of 2008 and 2009 which fueled export demand, which in turn stimulated imports of all categories – capital machineries, industrial inputs and consumer goods. LC opening for the first quarter of FY11 was running at a record pace of 45% growth supported also by a pick up in import prices.

However, much more effort in revenue reform will be needed to break out of the low tax-GDP mould that Bangladesh is mired in. Even with this upbeat assessment of revenue performance, tax-GDP ratio in FY11 is expected to improve modestly to 9.7%, as against 9.3% in FY10 and 9% in FY09. Needless to mention that the tax administration is in need of fundamental reforms – in scope and depth – to achieve annual increments of 0.5-1% of GDP in the tax-GDP ratio. Only then can Bangladesh match the revenue effort even of its South Asian comparators who are well ahead in the game.

Though the last fiscal year ended without upsetting the macroeconomic cart, spending pressures are building in the current fiscal year as plans for massive public spending on infrastructure take concrete shape. Public policy has rightly placed the topmost priority on solving the power problem at the earliest. The economic benefits of an early solution to this problem can readily outweigh whatever financial costs that might be incurred in the short run. Power shortages have become a binding constraint on higher growth. All would agree that this must be overcome at the earliest. However, not to be overlooked is the significant budgetary burden stemming from the subsidies to PDB needed to cover the high cost of diesel/furnace oil based power projects and rental power plants.

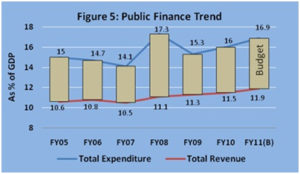

Bangladesh public finance trend (Fig. 5) reveals the twin perpetual challenges of revenue mobilization and adequate spending to cover public investment in infrastructure, building human capital, and paying for social services. The share of public investment in Gross Domestic Investment had fallen to an all-time low of 4.7% of GDP in FY10, from 8% in FY01. This trend needs to be reversed in order to meet the pent up demand for massive infrastructure investments that would have to be made in the public sector, including projects through PPP arrangements. Some headway could be made if the FY11 budget estimates of extra public spending to the tune of one percent of GDP can be materialized.

Highlight of the year — Export performance

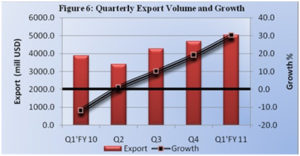

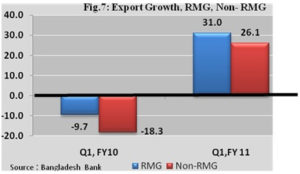

Exports have been picking up pace since the 3rd quarter of FY10. Negative export growth in the first quarter of FY10 has now given way to 30%+ growth in Q1 of FY11 (Fig. 6). Till November, export volume is running at 16% in excess of the EPB target.

An export boom has clearly set in if we look at the growth figures for July-Nov 2010 – 36% growth for both RMG and non-RMG exports (Fig. 7). Although a similar euphoria was seen in the first quarter of FY10, which soon evaporated to close the year with 4% growth, this year the outlook is much brighter. If the current trend is sustained, total exports could hit another milestone of $20 billion by the close of this fiscal year, well ahead of the cautious EPB target of $18.5 billion (Fig. 8).

The promising story of this boom is that it covers a broad range of manufactured goods – RMG and non-RMG, traditional and non-traditional. A modest step towards export diversification is also notable. Leather products, often described as the next RMG, clocked 173% growth in Jul-Nov 2010, continuing a trend of high growth.

Two positive forces must be at work reinforcing each other: the global recovery, though sluggish, is bringing enough export demand to our doorstep, and the “China opportunity” emerging from eroding Chinese competitiveness in readymade garments is diverting substantial demand to our shores. Our garment entrepreneurs never fail to surprise us with their ingenuity! They have built up enormous excess capacities in order to be able to seize opportunities presented by such positive export shocks. Even the power outages could not dampen their indomitable spirit. All this is good news for jobs in the country.

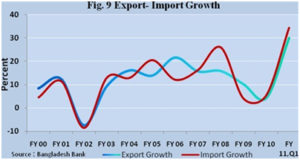

If exports are booming, imports cannot be far behind. During May-Aug 2010, LC opening has recorded 53% growth, with capital machinery imports growing 80%. Throughout the decade, import growth has pretty much followed the pattern of export growth substantiating the strong import-export linkage in production (Fig.9). Which is why it is important to argue that a seamless import regime is a sine qua non for superior export performance. China, the number one exporter of the world is also second only to the USA as an importer of commodities. In Bangladesh, it is important to note that the export success of the garment sector owes much to the planting of a duty-free import regime and a virtual free trade channel for inputs within a high-tariff import economy. By the same token, it can be argued that diversifying exports into other products requires a similar regime that permits seamless and duty-free import of inputs and raw materials for production of exports (e.g. footwear and ship-building required and were given this facility). Without that sort of trade policy framework in place, export diversification will not have legs to stand on.

Small steps in trade policy

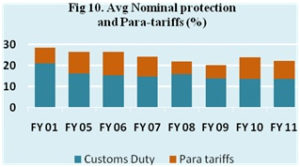

Progressive trade openness has been the cornerstone of trade policy by successive governments in Bangladesh. Whereas tariffs and quantitative restrictions (QR) together determined the extent of openness or restrictiveness of trade policy in the 1990s and before, the QR slate has been wiped pretty much clean since FY2000, leaving tariffs as the main instrument of trade policy and protection. In FY11, average tariffs (nominal protection rate or NPR) declined modestly from 24% to 22%, but para-tariffs, which made up 39% of average NPR, still remains a problem (Fig. 10) and should be addressed in the next phase of liberalization.

The fact is that despite the tariff reduction, Bangladesh still leads in terms of average tariffs in South Asia and elsewhere. So what is the problem if the tariff regime helps to protect domestic

industries? The truth is that import tariffs hurt exports, first, by distorting incentives between export and import substitute production; second, it raises the cost of exports making them uncompetitive in the world market. Our tariff regime continues to be a major barrier to exports despite the existence of a duty-drawback system which is no match for duty-free inputs. In particular, emergence of new and potential exports – the basis for export diversification – is constrained by this cumbersome tariff regime in addition to an unfriendly customs regime that is still geared to collect the bulk of tax revenues (36% in FY10).

Lastly, it is time to strike a balance between the interests of producers and consumers in the articulation of trade policy. While a strong rationale exists for time bound protection of potentially competitive industries or activities, prolonged protection serves neither the interests of the protected industry or the economy, besides coming at the cost of the consumer. In the recent past, input tariffs have been lowered but output tariffs have remained high, such that the advances made in trade policy stance have favored producers at the cost of consumers who ultimately bear the burden of the protection tax. Change is due in this corner of trade policy.

What matters is Real Effective Exchange Rate (REER)

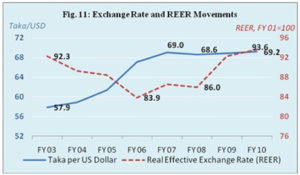

Except for the curious eyes of trade economists, all eyes are typically focused on the nominal exchange rate – Taka per US dollar, a rate the Bangladesh Bank has held steady at Tk. 69/US$ for much of the past four years. This is characteristic of a “managed float” regime since this rate has been maintained through intermittent interventions in the exchange market. The strategy, ostensibly, was to maintain competitiveness of exports as three indicators, namely, remittance growth, steady exports, and current account surplus, all put upward pressure on the exchange rate to appreciate. However, it is the real effective exchange rate (REER) rather than the nominal rate that relates to competitiveness. In that regard, BB’s REER index shows an upward trend (appreciation) since FY08 just when the nominal exchange rate has been held steady (Fig. 11), thus eroding much of the depreciation bias in the exchange rate that might have been targeted.

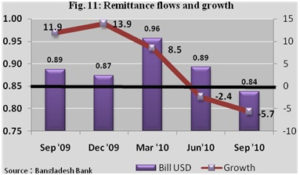

Remittance flows level off

Remittance flows appear to have tapered off since the end of the third quarter of FY10. But cumulative figures for FY10 closed at $11 billion which is likely to decline modestly in FY11. Its rate of growth, after peaking in December 2009, has been on a decline ever since, posting negative growth of 5.7% in Q1 of FY11. The decline appears fairly broad-based, though this pattern mirrors the falling remittances from the entire Middle East, which makes up 60% of all worker remittances. Data on migrant workers (from Bureau of Manpower, Employment and Training – BMET) shows that departures to Saudi Arabia – the country which traditionally received the highest number of migrant workers — has plummeted, while migration to other Middle Eastern countries and East Asia have also fallen significantly. After two consecutive years of record migration in 2007-08 (0.8-0.9 million), 2009-10 saw a sharp fall to only about 0.5 million, thus casting a long shadow on remittance prospects beyond 2011, unless there is a turnaround in demand for Bangladeshi workers in the destination countries.

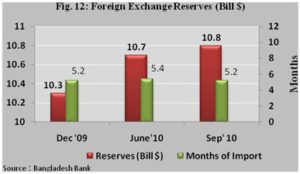

FE Reserves – gaining in comfort level

The foreign exchange build-up that occurred in the past year appears to have stabilized just short of US$ 11 billion (Fig.12). With a strong showing of exports and steady flow of remittance, the import coverage continues at the comfortable level of five months or more. This is much better than the four months import cover of reserves for the past decade.

Inflation casts a long shadow

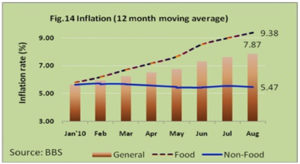

The ghost of the 2007 global commodity price is casting a long shadow once again as foodgrain, commodity and petroleum prices show a rising trend. When international prices feed domestic inflation, there are few options available to us. To say the least, inflation trends are worrisome. In FY 10 point to point inflation crossed the 8% mark in December 09 and remained there for rest of the fiscal year (Fig.13).

Both point to point and average annual inflation (Fig.14) indicate that it is food inflation that needs to be tamed. Non-food inflation is showing signs of moderating though much depends on monetary management to keep it under the lid. The higher inflation rate was mainly due to high food price inflation which was more than 10% throughout the second half of the fiscal year.

International food price hike (FAO food price index grew by 20% in December 09), and India’s double digit inflation throughout FY 10, are major contributors of the food price hike in the domestic market. There was no significant improvement of inflation situation in the first two months of FY 11 as international food price continued creeping upward. Monetary management with M2 growth of 22% has not helped either. Under the circumstances, the budgetary target of 6.5% annual inflation in FY 11 appears to be tough to achieve. Inflation hurts the poor more than businesses or the affluent section of society. Food inflation hurts them even more. Containing the rising trend in prices is therefore an immediate challenge for policymakers. It has to be addressed through monetary management and removing supply constraints (imports, production, etc.).

Monetary management takes anti-inflation stance— finally

Addressing the twin challenge of maintaining price stability while accommodating higher growth is the ostensible goal of monetary management of the Bangladesh Bank. It is often a tough task to achieve a combination of the two goals as can be perceived from the current situation. The accommodative monetary stance of BB for the past several years with fairly lose money and credit policies have given rise to inflationary momentum that can only be reined in by monetary contraction. Broad money (M2) growth (22.4% in FY10) has consistently outstripped nominal growth of GDP (about 14% in FY10) for all of the past five years, and continues to be on that course (Fig.15). Given this situation, containing inflation will be a challenging task in FY 11. In its monetary policy statement in July, 2010, BB has set its target of 15.2% for M2 in FY 11 with commensurate growth targets for its components, net foreign assets (NFA) at 4.2% and for net domestic assets (NDA) at 17.6%. From 40% growth of NFA in FY 10 to 4.2 % in FY 11 appears to be dramatic despite the modest decline in current account surplus (by 18%) and in first quarter remittance (declined by 2%). Even if BB’s growth target of NFA and NDA were achieved our estimates suggest M2 will grow at a rate of 18.6%.

There seems to be no option for BB but to change course towards a more restrictive stance if the inflation menace is to be controlled. That is exactly what seems to be in the cards in view of the latest announcement of BB to raise the cash reserve (CRR) and statutory liquidity requirement (SLR). It seems BB has finally come to the realization about the clear connection between CPI inflation and M2 growth (Fig.16).

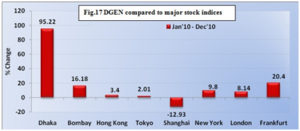

Bull run is not over yet

Major equity markets around the globe typically lead the way to economic recovery. However, the uptick in those markets observed since April 2009 appears to have petered out in 2010 reflecting the sluggish global economic recovery and other uncertainties. As of the writing of this report (05.12.2010), the bull run in the Dhaka Stock Exchange is still on. After performing better than most equity markets in 2008 and 2009, Bangladesh stock indexes once again led the way with a resounding 95% rise in the DGEN index in 2010 (Fig.17). Leading stock indexes of Europe and America were no match to the surge in the Dhaka index that is

being described by some as a potential speculative “bubble. Trading volume in the Dhaka Stock Exchange tripled since January 2010 (from Tk.11 billion to Tk.32 billion) while market capitalization has crossed 50% of GDP by December 2010 from 27%. Such record expansion in

trading volumes and market capitalization (Fig.18-19) is unmatched in the history of the Bangladesh equity market though not unprecedented as far as global experience is concerned. The moot question is whether the buoyancy in share prices properly reflect the flow of future income of companies they represent. If stock prices have gone ahead of the balance sheets of companies (price-earnings ratio at 26 is surely on the high side), a correction is inevitable though none can predict the timing.

Modest increase in FDI inflows in 2010

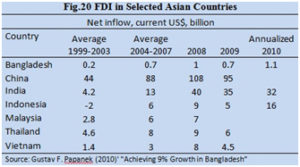

It would be folly to think that foreign investment is all about capital inflow, which is nothing but a quantum indicator. More important for Bangladesh is the job creation, transfer of technology and ideas, management, and international market access that comes with FDI. It remains an enigma to international analysts why Bangladesh should not be attracting substantially more FDI than it gets currently. Total FDI flows were $700 million for the year 2009 compared to a record $1086 million in 2008, a decline of 36 percent that was attributed mainly to the global recession according to the World Investment Report 2010 prepared by the United Nations Conference on Trade and Development (UNCTAD). FDI inflows have picked up during the period January-June (2010) to $570 million. If the trend persists, we can expect another year of FDI in excess of $1 billion. The biggest chunk of FDI came into the Telecommuni-cations sector ($344 million) followed by Gas & Petroleum and Textiles and Clothing. Yet, when compared to FDI inflows in comparator nations (Fig.20), the scope for receiving vastly greater amounts of FDI annually becomes all too apparent. Poor infrastructure (power, etc.), high corruption rate, high import costs due to tariffs and regulations, and “permit Raj” combined with slow decision-making, are being cited by potential foreign investors as the main bottlenecks.

Opportunities and Challenges going forward

Looking beyond 2010, we see enormous opportunities for a quantum jump in economic progress, but daunting challenges remain. Regardless of a growing sentiment of “export pessimism” in hitherto export-oriented economies, Bangladesh has a long way to go before its export potentials run out of steam. The message from global analysts is that Bangladesh can become an export powerhouse provided it can get its act together and seize the opportunities presented. First of all, a big opportunity is unraveling right in our neighborhood. With wages rising, China is fast becoming uncompetitive in most of its labor-intensive exports, such as textiles, shoes, furniture, toys, electrical goods, car parts, plastic products, kitchenware, and a host of consumer goods. Foreign investors in these sectors are searching hard for alternative locations to set up industries. It is not hard to feel the momentum already.

What seems to be a trickle ought to become an avalanche. If Bangladesh could get a piece of the Chinese pie comparable to what Indonesia has captured, it would mean export growth of 25-30% over the next five years and an extra five million jobs. What is Bangladesh’s claim to beating the competition? It has the lowest labor costs amongst its competitors: Vietnam, Cambodia, Indonesia, Philippines, India, and China. This opportunity, said Professor Gustav Papanek, an eminent scholar of Asian economies, will not last if it is not seized within the next 2-3 years. We need to get on the train before it leaves the platform.

On balance, the year 2010 will go down on record as the year in which the economy turned around from a dismal first quarter (Jan-Mar 2010) performance in the wake of the global economic crisis. Since April 2010, the economy has rebounded and the trend continues in terms of exports, domestic production and demand, and, by inference, in jobs and poverty reduction. The outlook for 2011 could not be brighter.

……………………………..

The author, a former civil servant and World Bank economist, is Chairman, Policy Research Institute of Bangladesh. zaidisattar@gmail.com