If Bangladesh Bank’s latest Monetary Policy Statement (MPS) — No.11 in the series since 2006 — is any guide, taming inflation seems to be assuming primacy over other goals of the central bank.

And rightly so. Perhaps for the first time in a long time, the stance of monetary policy has been proposed to be “restraining” — a pseudonym for restrictive monetary policy for the next six months. This will not win the central bank many admirers in the business community who have long been accustomed to pressing for, and receiving, what could be termed as, accommodating or “loose” monetary policy, one that keeps credit flowing seamlessly in the direction of business and industry.

Why is this turnaround, if one could call it that? Clearly, the central bank’s task is not an easy one as it finds itself once again between the rock and a hard place. Having tried for two years to put the inflation geni back in the bottle and failed to do so, it is left with no choice but to put a hard brake on credit growth in the hope that that will ease demand pressure and restore sanity to the price level.

In doing so however it runs the risk of putting the damper on a booming manufacturing sector that is effectively seizing export opportunities from a global recovery. So there is a policy dilemma that needs to be acknowledged. How do you tame inflation without taking the wind out of the sails of an expanding economy?

In all fairness, Bangladesh Bank (BB) faces a tough balancing act. The simple truth is that the task is not made easy particularly when inflation (point-to-point) has crossed double digits and food inflation is over 12%. The situation calls for applying every weapon in BB’s armory to tame inflation before it spins out of control — and there are ominous signs that could happen.

Someone has to ask the question: why is inflation running so high? To put the blame on global price trends would be easy. Food grain prices have been on an uptick globally and Bangladesh had to import nearly US$2.0 billion worth of rice and wheat in the past year thus contributing to the high food price inflation. However, that trend is not supported by petroleum or other commodity prices enough to give credence to putting all the blame on imported inflation.

A closer look at BB’s past monetary management might yield better insights into the latest phenomenon. Sound and non-inflationary monetary management requires money supply growth to approximate output growth plus say two percentage points to accommodate expanding monetization of the economy.

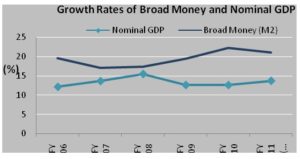

Yet for the past five years in a row, growth of broad money (M2), which best reflects growth of money supply for transactions in the economy, was running well ahead of the growth of nominal gross domestic product or GDP (goods and services produced during the year valued at current prices) by 7.0-10% (Fig.1) thus depicting a clear case of too much money chasing too few goods for too long.

It is high time to come to terms with this simple arithmetic of monetary management. If money supply growth outpaces output growth for too long, there is no escaping the hard truth that at the end of the day “inflation is a monetary phenomenon”. Perhaps this realization is what makes BB to set targets of broad money growth closer to nominal GDP growth.

The only problem we see is that year after year that target rate of broad money growth gets exceeded by a huge margin with predictable results on inflation (Table 1).

| Table 1: Monetary Policy Statements: Target Vs Actual | |||||

| (Annual Growth Rates) | |||||

| FY 10 | FY 11 | FY 12 | |||

| Target | Actual | Target | Actual* | Target | |

| Domestic Credit | 18.7 | 17.91 | 17.9 | 27.8 | 20 |

| Credit to public sector | 25.3 | -1.65 | 25.3 | 38.0 | 28.1 |

| Credit to private sector | 16.7 | 24.24 | 16.0 | 25.5 | 18.0 |

| Broad money | 15.5 | 22.44 | 15.2 | 21.0 | 18.5 |

| Inflation (12 Month Moving Avg.) | 6.5 | 7.31 | 6.5 | 8.8 | 7.5 |

Source: Bangladesh Bank

Talking of targets the apparent divergence between key targets and outcomes seems to occur with unfailing regularity raising the issue of credibility and realism in target setting. Surprisingly, as far as inflation is concerned, BB is unwilling to take the responsibility of setting a target, acceding that privilege to the budget authority claiming it has operational independence, not goal independence.

Since inflation hurts the poor more than the rich, there is inherent inequity in setting inflation targets at 6.5% and above and even then in not being able to keep inflation at or below that target. An argument has been made in the MPS with attendant empirical evidence that moderate levels of inflation are actually supportive of growth in developing countries like Bangladesh. An inflexion point is reached, claims that research, when inflation exceeds 8.0%. Hence, the inflation target for the coming year has been set at 7.5% as realistic without any mention of the adverse impacts of such high inflation on the poor who make up one-third of our population. At least this part of monetary policy cannot be termed as pro-poor.

In its policy approach, the MPS appears more focused on restraining credit growth than money supply as the principal instrument to rein in inflation although in setting targets, both these indicators have been scaled down. As far as the private sector is concerned, with interest rate flexibility on the cards, I imagine reining in credit growth in a climate of rapid trade expansion would be a tough task. Even more challenging would be the pre-announced strategy of curbing lending to unproductive uses — like real estate and equity markets — through increased monitoring will surely stretch capacities to the limit.

As for credit to public sector, past experience has shown how little control BB has on this credit component which is determined by fiscal developments and other exigencies of government. It is only recent memory that credit to public sector rose 38% in the past fiscal year largely due to a spate of heavy government borrowing from the BB, something the latter was unable to avert.

The past year has shown how fragile our balance of payments situation could become as a consequence of external developments or misplaced monetary management. In theory, a freely flexible exchange rate regime allows monetary policy to be effective in managing output or inflation. But in a managed floating regime of the kind we have, monetary policy goals could be undermined by exchange rate developments.

For nearly five years since fiscal year (FY) 2006, the exchange rate was kept at around Taka 69 to the dollar. It was not difficult to prevent dollar appreciation (with a slight depreciation bias) by the BB through intermittent purchase of dollars while exports and remittance came in strong and the current account surplus hovered around 3.0 per cent of GDP. All that changed in the last fiscal year with superior export performance that fueled import growth of 43 per cent. Except for the $1.9 billion of food grain imports, much of the import growth could be attributed to higher imports of intermediate and capital goods.

Yet the trade deficit grew by $2.5 billion and the current account surplus dwindled to 0.5% of GDP. The concomitant pressure on the exchange rate was moderated by sale of nearly one billion US dollar sales by BB to keep the exchange rate from depreciating further and fueling inflation.

Finally, monetary management appears least challenged in addressing growth objectives. As long as the global recovery remains on track (assuming the US resolves its impending debt crisis), strong manufacturing growth is expected to continue with 7.0% GDP growth target for FY12 well within notwithstanding the restraints proposed in the monetary stance.

(Dr. Sattar is Chairman, Policy Research Institute of Bangladesh. zaidisattar@gmail.com)