Soon after emerging from the devastating effects of the Global Economic

Recession, the world economy once again is entering into another unsettling and challenging environment/period due to the rapidly unfolding Euro debt crisis. As Bangladesh is getting integrated with the global economy through trade, a significant deterioration in the external environment, particularly when Eurozone economies is the single largest destination of our exports, EU debt crisis is certainly going to impact Bangladesh economy. The issue is how badly we are going to be impacted and through what channels.

The table below helps us to compare the recent global and EU real growth outlook with the growth performance during the global economic crisis of 2009:

| Actual Data | Projections (April-11) | Projections (Oct-11) | OECD Projections | ||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | 2011 | 2012 | 2011 | 2012 | |

| World Output | 2.8 | -0.7 | 5.1 | 4.4 | 4.5 | 4.0 | 4.0 | ||

| Advanced Economies | 0.2 | -3.7 | 3.1 | 2.4 | 2.6 | 1.6 | 1.9 | ||

| United States | 0.0 | -3.5 | 3.0 | 2.8 | 2.9 | 1.5 | 1.8 | 1.7 | 2.0 |

| Euro Area | 0.5 | -4.3 | 1.8 | 1.6 | 1.8 | 1.6 | 1.1 | 1.6 | 0.2 |

| Emerging and Developing Economies | 6.0 | 2.8 | 7.3 | 6.5 | 6.5 | 6.4 | 6.1 | ||

| Developing Asia | 7.7 | 7.2 | 9.5 | 8.4 | 8.4 | 8.2 | 8.0 | ||

| China | 9.6 | 9.2 | 10.3 | 9.6 | 9.5 | 9.5 | 9.0 | ||

| India | 6.4 | 6.8 | 10.1 | 8.2 | 7.8 | 7.8 | 7.5 | ||

| World Trade Volume (Goods & Services) | 2.9 | -10.7 | 12.8 | 7.4 | 6.9 | 7.5 | 5.8 | 6.7 | 4.8 |

Source: IMF World Economic Outlook April and October, 2011; OECD Preliminary Report,28th November, 2011.

A few comparisons can be made of the two episodes. First, while real GDP in the Euro area declined by 4.3% in 2009, nobody is projecting such a deep recession in the Euro area due to the current debt crisis. Second, current expectation is that the Euro area may enter into a recession or no-growth phase, although for some hard-hit economies the loss of output could be much more severe. Third, the point to note is that the revisions to the growth outlook for the Asian economies are relatively minor. Finally, the comparison of the two epic episodes also indicates that the impact of the EU debt crisis on the global economy is expected to be less than the earlier global economic crisis and its impact on Bangladesh should be examined against this broader international context.

The paper discusses the key channels of transmission through which Bangladesh economy may be impacted by the rapidly unfolding European Union debt crisis. The presentation starts by examining the current macroeconomic setting and the short- and medium-term objectives set by the government in its FY12 budget and Sixth Five Year Plan. The presentation then draws on the experience of Bangladesh during the recent global economic crisis of FY09.

As in the past, the impact of the current EU debt crisis, the slowdown of export demand and economic activity in the EU and a broad range of industrialized countries including the United States, are expected to materialize through the following channels:

- Financial

- International Trade

- Remittances

- Access to external financing

While drawing on the lessons learnt from the FY09 Global Economic Crisis, the presentation also highlights the ways in which the transmission channels and the extent of the impact of the crisis may be different during the current EU debt crisis from what it was in the previous global crisis in FY09. The presentation will also try to focus on some of the macroeconomic tensions which have emerged in recent months in Bangladesh. In particular, the combined effect of the accelerating inflation, balance of payment pressures and depreciation of the Bangladesh taka exchange rate, a run-away subsidy bill and the excessive borrowing by the government from the banking system makes the domestic environment significantly less favorable than the domestic macroeconomic environment at the time of the global economic crisis of FY09. Current domestic macroeconomic imbalances may be exacerbated by the external shocks originating from the EU debt crisis, thereby undermining the short- and medium-term growth and poverty alleviation objectives of the government.

Although Bangladesh financial sector was largely untouched by the global meltdown of 2009, the real economy experienced its adverse impacts primarily through three channels: slower export growth; moderation in the inflow of workers’ remittances; and dampened investment and consumer sentiment. The second round impacts of the crisis were also being felt on the real economy through a general slowdown in overall economic growth, slower revenue growth, declining imports and excess liquidity in the banking system due to slower demand for domestic credit.

Channels of transmission

Financial channel: Bangladesh’s financial sector did not experience any turbulence arising from the meltdown in the global financial sector during FY09 due to its limited connectivity with the international financial system. The banking sector, which dominates the financial sector in Bangladesh, remained healthy as it was not much linked and exposed to the global economy. Profitability of the banking sector improved significantly despite the global financial crisis of 2008-09 and all basic banking sector prudential indicators continued to improve.

| Performance of the Overall Banking System | |||

| Net NPL Ratios | Profitability Ratios | ||

| Year | Return on Assets | Return on Equity | |

| 2003 | 18.80 | 0.50 | 9.80 |

| 2004 | 9.80 | 0.70 | 13.00 |

| 2005 | 7.20 | 0.60 | 12.40 |

| 2006 | 7.10 | 0.80 | 14.10 |

| 2007 | 5.10 | 0.90 | 13.80 |

| 2008 | 2.80 | 1.20 | 15.60 |

| 2009 | 1.70 | 1.40 | 21.70 |

| Jun-10 | 1.67 | 1.58 | 22.94 |

Source: Bangladesh Bank

There was no sign of liquidity shortage in the banking system in FY09– rather there was excess liquidity due to deceleration in credit growth. The deceleration of credit growth in FY09 was primarily attributable to lower commodity prices (depressing value of trade) and a slowdown of exports in value terms.

Exposure of the capital market to foreign portfolio investment was minimal and it still remains so. During FY 09, when all stock markets across the globe recorded sharp decline in their stock price indices, the general indices in Bangladesh continued to increase. Hence it is expected that external shocks originating from the EU debt crisis will not have any noticeable impact on the financial sector including the capital market this time as well. Bangladesh capital market has its own problems and domestic issues will continue to dominate market performance/developments in the coming months.

International trade channel: Exports had slowed down markedly beginning October 2008. Almost all categories of exports registered a marked slowdown (readymade garments and knitwear) or a sharp decline (almost all exports except textiles). Total shortfall in export proceeds during October-June 2009 was estimated to be about $2.1 billion.

It is noteworthy that, Bangladesh textile sector is the most competitive in the world despite numerous bottlenecks on the domestic front and the sector was able to increase its relative shares in the European Union and US markets during the crisis. Despite the slowdown in textile exports, Bangladesh’s relative performance has been very strong. It has been the best performer among all textile exporting countries to the EU and US markets, allowing it to improve its relative position vis-à-vis its competitors.

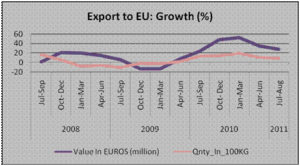

In line with the previous episode (FY08-09), this time also there is sign of decline in global and Bangladesh exports. This situation will be getting worse in the coming months. Despite some slow down from the prior quarters, export to the EU has remained healthy through August 2011. The high growth rate of 30% experienced in Jul-Aug will probably not last and a further deceleration in export growth to the EU is expected.

Despite some expected slowdown in exports to the Euro region, we do not expect exports to that region decline in value and volume terms because of the following reasons:

- As indicated in various global projections, while some EU countries will certainly enter into a recession, for the EU region as a whole the depth of the recession, if any, will be much shallow.

- Bangladesh has received the benefits of the change in the rules of origin beginning in 2001, and the positive impact of that should be felt in the coming months in its textile exports.

- Diversion of textile orders from China is expected to continue and should be an important beneficiary of that process.

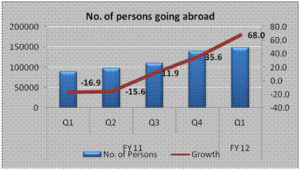

Inflow of worker’s remittances: FY09 experience has showed that number of workers leaving for abroad declined stridently. The decline continued for some time through end – 2010. However, the trend has reversed and a strong pick up in this number since Q1, 2011 has been observed. In Q3, 2011 (or Q1, FY 12) the number of workers going abroad increased by 68% over the corresponding quarter of the previous year.

Inflow of remittances picked up somewhat in the final quarter of FY11 with overall growth limited to [6%] for the year whereas it has slowed down during the previous crisis. The primary reason for the difference in the migration situation and outlook is attributable to the following factors:

- Much of the Bangladeshi workers migrate to the oil exporting Gulf countries, where economic activity and employment opportunities are driven by developments in crude oil prices.

- During the global economic crisis, crude oil price (Dubai Index) declined to only $41/barrel from an all time peak of $131/barrel. In contrast, during the current episode, crude oil prices are still above $104 and are likely to hover around $100/barrel level in the coming months.

- In the midst of he ongoing Arab Spring Revolution, all oil exporting Gulf countries have increased government spending significantly—leading to growing demand for manpower.

- Some new markets are also opening up in the region including Iraq, Lebanon and Libya.

Source: World Bank

Source: World Bank- External financing channel: Traditionally, in an open market economy, a global or regional crisis tends to constrain market based financing. Thus it would be very difficult for Bangladesh Government to access international capital market by issuing sovereign bonds or borrowing from foreign financial institutions.However, Bangladesh traditionally depends on official bilateral and multilateral external financing. During the global economic crisis there was not much of an impact on external financing because of the drying up of official and multilateral financing. The problem of lower foreign aid in recent years was primarily attributable to slower project utilisation rather than adverse external factors. A shortfall in the pipeline of foreign aid is not expected due to the crisis but there are concerns whether the major economies such the EU impacted by growing fiscal and debt problems would be able to fulfill their existing and new commitments under various bilateral and multilateral/global initiatives.

Macroeconomic objectives and tensions of domestic origin: While we do not expect external shocks arising from the EU debt crisis to have any severe effect on our economy, there are a number of areas where serious pressures have emerged which, if unattended, may potentially undermine macroeconomic stability. Some of the important areas are highlighted below.

Price stability will be key to macroeconomic management and growth:Upward inflationary trend is continuing and in September it reached the highest level since 1998 at more than 12%. Inflationary pressures worsened during most of FY11 despite bumper rice and other food (potato, fruits and vegetables) production, as domestic demand increased and international food price continued creeping upward.

Source: World Bank

Source: World Bank