The value of the Bangladesh Taka is legally considered to be determined freely in the interbank market. In the event, however, that the exchange rate has been virtually unchanged at about Tk. 68/69 per US dollar for the last several years. The unusual level of stability vis-a-vis the U.S. dollar in the face of major economic shocks, including the global economic crisis, points to the fact that Bangladesh Bank is following a policy of a virtual peg against the U.S. dollar.

Certainly this unusual stability cannot be explained by market forces, and can be attributable to a conscious policy of Bangladesh Bank to keep the value of the taka de facto pegged against the dollar. The business community likes this, since most of Bangladesh’s foreign trade is denominated in dollars, and business people enjoy the predictability and stability of the exchange rate. The stability against the U.S. dollar also enhances market confidence in the value of the taka, and is generally considered to be conducive for macroeconomic management. Exporters also strongly favour continuation of this virtual peg against the dollar.

The outcome of this virtual peg, however, did not certainly happen on its own. In recent months Bangladesh Bank has been actively buying in the interbank foreign exchange market to ensure that the taka exchange rateremains pegged against the dollar. By intervening in the exchange market in this manner to keep the value of the taka unchanged against the dollar, Bangladesh Bank has essentially kept the value of taka at a depreciated level. This leads us to ask: What would the value of the taka be if it were allowed to be determined freely by market forces?

The argument for this de facto pegged regime is to support Bangladeshi exports, which could suffer if the taka was allowed to appreciate. But the real question should be: Has Bangladesh Bank really been successful in achieving this objective? The remainder of this analysis is focused on this issue.

For competitiveness of Bangladeshi exports, what really matters is the real effective exchange rate (REER), not the nominal exchange rate. While Bangladesh Bank’s stance on the exchange rate gives the impression that it is aimed at enhancing or maintaining competitiveness of Bangladeshi exports, if we look at the development of the REER in recent years and its continued appreciation in real effective terms, the evidence is not supportive of Bangladesh Bank’s stance on the exchange rate. As seen in the chart, REER has appreciated by 11.6 per cent since FY 06, entailing a corresponding erosion of competitiveness, despite the Bangladesh Bank’s policy of a fixed exchange rate regime. The question naturally comes, why did this happen? It happened because Bangladesh has a much higher inflation rate compared to its trading partners.

Macroeconomic theory is generally very clear about the reasons. First, the policy of de facto fixed exchange rate regime contributes to higher inflation in two ways. An appreciated currency would have helped reduce domestic inflation rate by making imports cheaper, which could not happen due to the de facto peg. Second, the interventions that Bangladesh Bank made in the foreign exchange market to keep the value of the taka stable or unchanged essentially amounted to the purchases of huge quantities of foreign exchange by the Bangladesh Bank. By buying the foreign exchange, Bangladesh Bank injected equivalent amount of taka into the economy contributing to a massive increase in the money supply, thereby fueling the inflationary pressure.

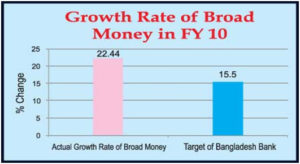

The Bangladesh Bank has de facto lost control on money supply or liquidity expansion in the economy. Liquidity expansion, as measured by broad money [M2] grew by more than 22 per cent in FY10. The expansion in broad money was well beyond the target of 15.5 per cent envisaged in the Monetary Policy Statement of Bangladesh Bank announced in June 2009. While achieving exchange rate stability, Bangladesh Bank lost control on its money supply, and in the process, its control over inflation. This is the real dilemma that the Bangladesh Bank is facing today. It needs to choose between its exchangerate or inflation objectives. It will not be possible to achieve both with one single instrument called monetary policy.

Another uncomfortable development is also happening in the exchange market in recent months. If we observe the differential between the interbank exchange rate and the curb market exchange rate, we notice that the spread, which used to be less than Tk. 1 per dollar, has now widened by five to six-fold. Currently $US 1 dollar is selling for Tk. 74 to 75 in the curb market, while in the interbank market the rate is less than taka 69 per dollar. The visible stability in the interbank market exchange rate is nowhere to be found in the curb market. This widening trend is not desirable and will inevitably lead to many distortions in the economy. People will be tempted to make transactions through the curb market instead of going through the formal interbank channel. Many of the gains achieved in recent years to attract inflow of workers remittances into the formal interbank market may be eroded if this spread remains as large as it is now, or if it widens further.

Measures must be taken to narrow the spread between interbank and the curb market. Injection of dollar liquidity into the curb market will be the bestcourse of action. Such intervention will be financially beneficial for Bangladesh Bank’s balance sheet because it will be selling dollars for a much higher amount of taka in the curb market, while buying it in the interbank market at a much lower cost (in taka terms).

Since Bangladesh Banks current foreign exchange reserve level is very comfortable (at more than $US 11billion) and the outlook for further growth in reserve is quite positive, there is no reason for delays in intervening in the curb market. All that Bangladesh Bank will need is cash dollar notes in hand for the purpose of intervention. We understand that Bangladesh Bank has already placed an order for the importation of such dollar bills. If the purpose for this import is to intervene in the curb market, the process should be expedited and Bangladesh Bank should be ready to import large amounts of foreign exchange bills for this purpose.

As described above, despite the apparent stability in the nominal exchangerate vis-a-vis the U.S. dollar, the Bangladesh Bank has not succeeded in preventing the appreciation of the real value of taka. On this front, there is nothing much that Bangladesh Bank can possibly do, because in the end, the real exchange rate of a currency is determined by the fundamentals of the economy, and the strengthening of the value of the taka in real terms is a reflection of the underlying improvements in the fundamentals of Bangladesh economy.

Central banks can target the nominal exchange rate and successfully defend that under certain circumstances, but they cannot do anything about the real exchange rate in the medium- and long-run, which is driven by economic fundamentals. Nevertheless, Bangladesh Bank needs to be clear about its objective: it has to choose between inflation and exchange rate objectives. It cannot target both objectives. On the second issue of widening spread, however, Bangladesh Bank can do a lot to reduce the spread, and it should do that expeditiously. (The writer is Executive Director, Policy Research Institute of Bangladesh. E-mail: amansur@pri-bd.org)