Amid the ongoing episodes of political and social unease in Bangladesh,

a piece of good economic news is the improvement in the balance of payments. The memory of the sharp decline in reserves and a substantial depreciation of the taka during January 2011 to February 2012 is still fresh in the minds of investors and citizens. So the improvement in the balance of payments, reflected in rising reserves and appreciation of the taka, must be welcome news. What explains this positive outturn? How sustainable is this development? What are the implications for policy management? These questions have emerged in several conversations with business, researchers and journalists. Given this interest, I am providing my views for the broader audience.

a piece of good economic news is the improvement in the balance of payments. The memory of the sharp decline in reserves and a substantial depreciation of the taka during January 2011 to February 2012 is still fresh in the minds of investors and citizens. So the improvement in the balance of payments, reflected in rising reserves and appreciation of the taka, must be welcome news. What explains this positive outturn? How sustainable is this development? What are the implications for policy management? These questions have emerged in several conversations with business, researchers and journalists. Given this interest, I am providing my views for the broader audience.

I will first explain what factors have caused this positive development in the balance of payments.

First, a major policy improvement that has supported this result is the much-needed correction in the monetary policy. We are all acutely aware of the negative effects of loose monetary policy of FY10 and FY11 in terms of fuelling inflation, contributing to an asset price bubble, and creating excess demand pressure on the balance of payments during FY11-FY12. The monetary policy correction since the second half of FY12 has contributed to lowering inflation, reducing the pressure on asset prices and eliminating the excess demand pressure on the balance of payments in the first half of FY13. This is a testimony to the fact that proper conduct of monetary policy is essential for inflation control, exchange rate management and stabilising asset prices.

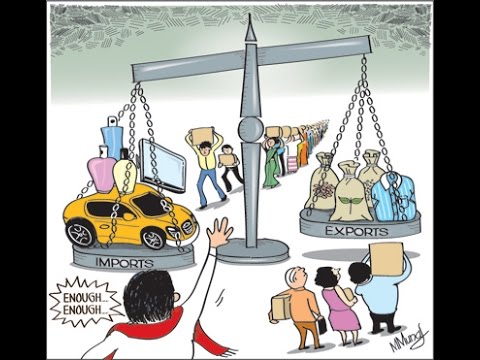

A second factor is the modest recovery of exports, growing by an average of 7 percent during July-December in 2012 over the same period in 2011. This is somewhat higher than the growth in exports in the full FY12 (6 percent). The recovery in exports is led by garments and jute goods, but there is a downturn in food products, tea, raw jute, leather and chemicals.

A third factor is the remarkable performance of remittances. If present trends continue, Bangladesh will register a record increase in remittances in FY13 exceeding $14 billion.

A fourth factor, and perhaps most significant, is the slump in imports. Total imports in the first half of FY13 are lower by 8.2 percent in nominal dollars as compared with an expansion of 17 percent in the first half of FY12. The decline in imports is broad based, although consumer goods are down relatively more. This import outcome provides a mixed signal. In particular, the fall in intermediate and capital imports might be symptomatic of a sluggish investment climate and an associated slowdown in GDP growth.

A fifth factor is the surprisingly sharp improvement in net capital inflows. Both public and private net inflows gained momentum in the first half of FY13. While a fuller analysis of this development is necessary before making any conclusive statements, a priori a part of the explanation might lie in the slowdown of private capital outflows as happened in FY11 and FY12. The correction of monetary policy and the associated reduction in the demand for dollars is likely to have played an important role. Another supporting factor is the more liberal stance of the Bangladesh Bank on foreign private borrowing. On the whole, the substantial improvement in the capital account is a major positive development which, if sustained, will have a beneficial effect on investment and growth in Bangladesh.

How sustainable is this improvement in the balance of payments? On the export side, while the recovery of commodity exports is welcome, it mostly came from garments while many export items registered negative growth. As a result, the share of garment exports in total commodity exports grew even further. Although Bangladesh has good prospects for further expansion in garment exports, the inability to meaningfully broaden the export base continues to challenge policy and presents a serious long-term downside risk. Additionally, there are immediate issues relating to labour safety in garment that pose significant risks to the sector and must be managed forcefully. Detailed analysis of the constraints to export diversification suggests that the anti-export bias of the trade policy is a serious concern. This needs to be addressed sooner than later. The poor state of infrastructure is yet another constraint on export diversification.

Regarding services exports, the continued expansion of remittance earnings is welcome. The recovery of investment and growth in the Middle East and strong oil prices suggest that this source of earnings will remain strong in the coming years. The improvement in banking services and the flexible management of the exchange rate are additional supporting factors for the continued growth of remittance earnings.

The developments on the import front send mixed signals. The reduction in the demand for imports from the unsustainable expansion pace of the past three years is a positive development, partly supported by the correction in monetary policy. But the broad-based decline in imports, particularly capital imports and raw materials, is worrisome. Investment data show that the investment rate has been basically flat at the 24-25 percent of GDP for the past 4-5 years. This is not good news for the country because without acceleration in the investment rate the projected growth of the economy and exports in the Sixth Plan will not happen.

It is tempting to blame this sluggish investment performance on the monetary policy correction. A review of the evidence clearly shows that this is misleading. There is no shortage of domestic liquidity for investment. Private credit is expanding at a healthy rate of 18-20 percent. The reason why the investment rate is flat is largely because of the government’s inability to implement its infrastructure development programme in the power and transport sectors. Availability of land is another constraint. The scarcity of skills is a third constraint. Low foreign direct investment that brings new technology, know-how and global market penetration is a fourth factor. These binding constraints on the expansion of the investment rate have nothing to do with monetary policy.

The upshot of all this is that when these binding constraints are addressed import demand will go up significantly. So, the short-term increase in reserves partly based on depressed import levels is no cause for celebration.

Finally, the sustainability of the improvement in capital account needs further review and analysis. Some of the improvements in the capital account emerging from corrective monetary policy and supportive foreign private borrowing policy will likely sustain if these policies are preserved. But Bangladesh does not have a well articulated foreign borrowing strategy. FDI flows remain very low. The investment climate for both domestic and foreign investments remains worrisome. Without noticeable policy improvements in these areas, the sustainability of the improvement in the capital account is doubtful.

The policy implications going forward emerge clearly from the above analysis.

First, the prudent management of the monetary policy since early 2012 must be sustained. This will be a challenge in an election year, especially if fiscal policy is too expansive.

Second, the policies for diversification of exports must begin to be addressed. The finance ministry needs to find other sources of revenue (income tax, value added tax, property tax) rather than rely on trade taxes that distort investment decisions in favour of domestic activities and against exports. In the past, a balanced exchange rate management that avoids an appreciation of the real exchange rate has supported the growth of exports. So, the appreciation of the real exchange rate in recent months needs to be averted to avoid hurting exports.

Third, evidence suggests that infrastructure constraints are a binding constraint on private investment in general and manufacturing investments and exports in particular. So, the easing of the infrastructure constraints will also support export diversification. This will require a carefully developed foreign borrowing strategy; finding pragmatic ways to implement the public-private partnership arrangements for infrastructure; moving to a system of turn-key contracts for large infrastructure projects; developing a social contract by which any government in power commits to ensure corruption-free procurement of at least all large public projects; and strengthening the project implementation capacity of the public sector.

Finally, the government must take some policy actions to improve the investment climate for domestic and foreign investment. In addition to the focus on infrastructure noted above, much more attention needs to be given to land procurement. The export processing zone and industrial park initiatives are good ideas but need to be managed well with participation by stakeholders, primarily FDI investors and concerned business chambers. Lessons of positive experiences from China, Malaysia and Korea might be very helpful. The EPZs and IPs are best done by the private sector with the government playing a supportive enabling role.