The national budget for fiscal year (FY) 2010/11 is going to be announced on June 10. Finance Minister’s budget speech will review the Bangladesh’s overall economic performance, including the execution of the FY10 budget. One bright spot on that front is the impressive performance of the National Board Revenue (NBR) in realizing the ambitious target set for it in the FY10 budget.

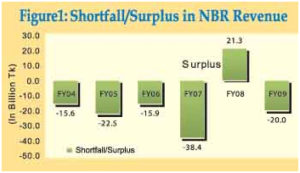

NBR generally has a track record of missing the revenue targets set in the budget. In recent years revenue targets were missed almost every year and by sizable margins, except in FY08 during the care-taker government because of a number of special factors (Figure 1).

The revenue shortfall in FY09 was sizable (TK 20 billion) because of import slowdown associated with the global economic crisis. Against this background, at the time of budget announcement, the NBR target entailing a 16.2% revenue growth appeared ambitious given the economic outlook clouded by the global economic crisis and the fall in import payments. However, NBR revenue collection for the nine-month period through March 2010 points to a positive turnaround, contrary to earlier expectations. The analysis below tries to explain why we are optimistic about the revenue outlook in the current year, the factors which may have contributed to this likely outturn, and what are the lessons for the next budget.

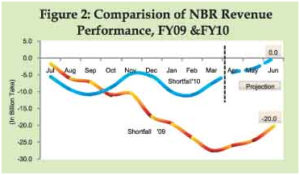

Why we believe that the NBR revenue target is going to be realized in the outgoing fiscal year (FY10)? As originally expected, NBR revenue growth was markedly slower than the target in the first quarter of FY10 (July-September), with the revenue shortfall at Tk. 10.7 billion, worse than the shortfall of the preceding year (Figure 2). However, revenue growth accelerated since October and has remained strong through March. During the six-month period through March, NBR revenue increased by 22.7% over the corresponding period of the preceding year and the buoyant revenue performance almost erased the shortfall of the first quarter. The cumulative increase in revenue through March 2010 was 18.3%, in line with the growth target set in the budget. If the buoyancy in NBR tax revenue continues through the final quarter of FY10, there is a possibility that the revenue target may even be exceeded.

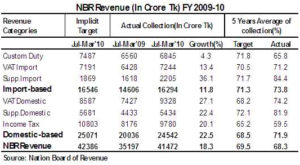

What are the sources of this strong tax performance? A review of the major components of tax revenue indicates that much of the revenue growth has been from domestic based taxes like the domestic value added tax (VAT) and income tax. During the second and third quarters of FY10, domestic VAT increased by 36.2 percent and income tax by 17.1 per cent (Table 1).

Other components of NBR tax revenue, primarily import-based taxes, have been growing moderately, in part due to a decline in import payments resulting from lower import prices due to the decline in commodity and product prices associated with the global economic crisis. The modest growth in import-based taxes was also helped by the 5.0% regulatory duty imposed on many imports in FY10 budget.

What economic factors may be contributing to this surge in domestic-based taxes? It is now fairly well established that economic growth in FY10 was largely domestic demand driven. Export growth declined in dollar terms for the first time in many years due to the impact of global economic recession and the power crisis at home. Domestic household demand growth however has remained strong due to salary increases at the public and private sector levels, the continued inflow of workers’ remittances (16 % growth through March), and the impact of the wealth effect arising from ballooning asset prices. Stock market capitalization increased by 151.9 per cent or $17.0 billion since June 2009 to $28.3 billion as of end-May 2010 (Figure 3)

The wealth effect associated with inflating land and real estate prices is difficult to estimate, but would certainly amount to several times more than the gains in the stock market capitalization given the much larger size of this nonfinancial asset class. Impact of wealth effect on national economy has not got much attention in Bangladesh until now, but with the ongoing surge in asset price inflation the impact of wealth effect on domestic demand and economic management may not be ignored anymore.

The sharp increase in domestic VAT clearly points to a surge in domestic sales of taxable goods and services. As the formal service sector in the economy is growing due to domestic demand (think about the expansion in demand in telecommunications sector alone) and an increasing number of service providers are coming under the tax net (look around and find how many restaurants and fast food outlets are opening up in your neighborhood), certainly this component of domestic VAT accounting for about 40% of VAT revenue has been and should remain buoyant in the coming months. Manufacturing sector growth in FY10 has been slower than usual, but that is primarily because of the disappointing performance of the export oriented garments and textiles sector (accounting for 40% of the manufacturing base). Excluding the export oriented sectors, the performance of domestic manufacturing sector would be quite buoyant. Since export sector is not part of the tax base and do not contribute to the domestic tax revenue, it is the performance of the non-export manufacturing base that matters for domestic VAT.

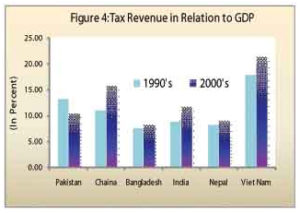

Domestic resource mobilization strategy for the next budget. The positive revenue performance is a welcome development. We all are aware about the extremely low level of domestic revenue that NBR mobilizes in relation to GDP, compared with other developing countries in the world (Figure 4).

Raising tax-to-GDP ratio from the current dismal level of 9.0-10% to 13-14% to GDP under the Sixth Five Year Plan (SFYP) will be a monumental task. Without realizing such an ambitious revenue target it would not be possible for the government to increase investment spending and improve quality of public service delivery needed for Bangladesh to come out of the current medium-growth steady state (5.0-6.0% GDP growth rate) to a high growth trajectory of 8% or more.

Fundamental reforms in the administration and designing of the VAT and income tax systems will be keys in achieving the medium-term revenue objective. We certainly hope that, the next budget will start implementing such an ambitious effort in modernizing the VAT administration and policy. Consistent with the strategy outlined by the Finance Minister to the business community, the modernization plan should entail: (i) account-based VAT administration and moving away from the old-fashioned excise-type controls on production and clearance; (ii) allowing the input credit chain to continue through the final stage of sale by abandoning the practice of truncated base for taxes; (iii) computerization of VAT return processing, building up a central database for all VAT registered persons and identifying tax evaders through intra-industry comparisons and other checks; and (iv) hiring at least several hundred auditors to launch a comprehensive audit program. NBR currently audits less than 3.0% of taxpayers per year compared with about 30-35% that should optimally be audited per year. Why would firms maintain accounts properly and comply with the VAT law if the likelihood for it to be audited is only once in 40 years? The NBR should be also plan for modernization of the income tax administration and reform of the income tax law in the next fiscal year.

The policies to be announced in the budget should be seen as the beginning of a long implementation process. Only through forceful implementation of the measures announced in the budget the NBR will realize its future targets. (The writer is Executive Director, Policy Research Institute of Bangladesh. He can be reached at e-mail: ahsanmansur@gmail.com)