PRI Policy Briefs

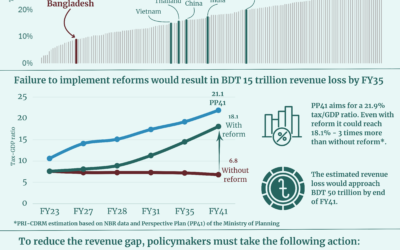

PRI Briefing Note: Bangladesh’s Domestic Resource Mobilisation: Imperatives and a Roadmap

Presentation: Bangladesh Domestic Resource Mobilisation: Imperatives and a Roadmap

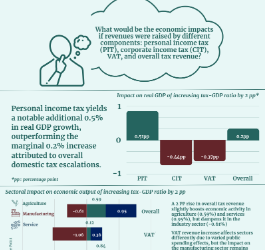

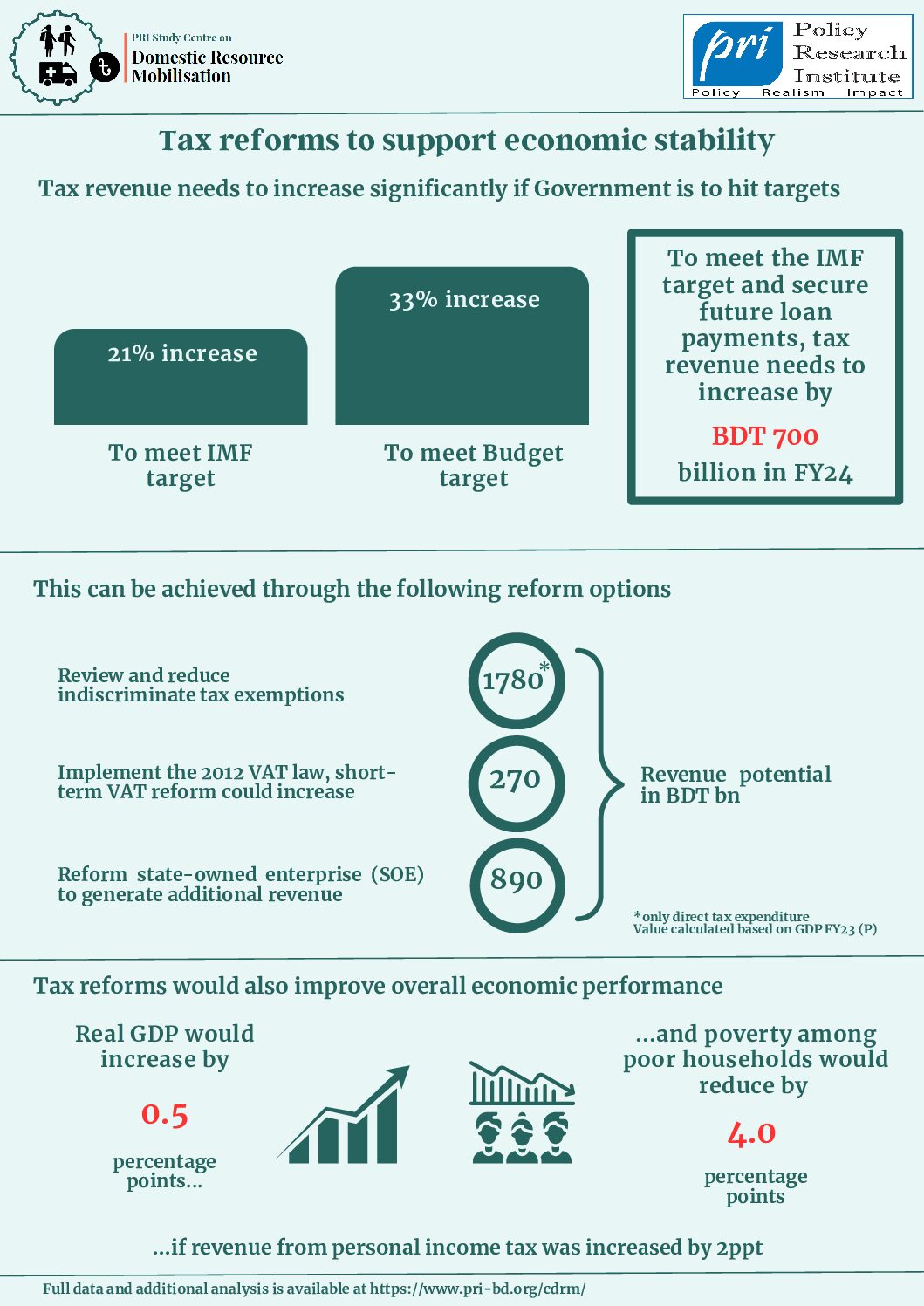

Infographic: Connecting Fiscal Policy Changes to Economic Outcome

PRI Briefing note: Connecting Fiscal Policy Changes to Economic Outcome

Presentation: Connecting Fiscal Policy Changes to Economic Outcomes

Increasing Revenue from the Personal Income Tax

The Budget Balancing Act: Social Protection Allocation in the Face of Fiscal Constraints

IS IT TIME TO EXPLORE TAXATION THROUGH THE LOCAL GOVERNMENT INSTITUTIONS IN BANGLADESH?

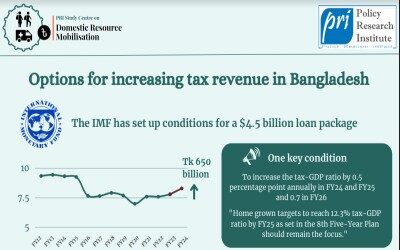

Infographic: IMF and Bangladesh

PRI Policy Brief : IMF and Bangladesh

Presentation: IMF and Bangladesh

Presentation: Bangladesh Resource Mobilisation Through Strengthening the Finances of State-Owned Enterprises

Presentation: PRI-CDRM Post-Budget Discussion

PRI Briefing: Fiscal Tightrope- Juggling Revenue Gaps and Spending Obligations in an Election Year Budget

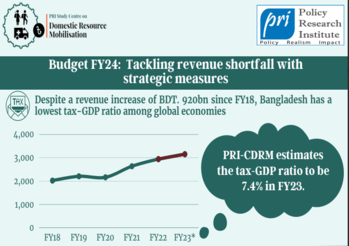

Infographic on Press Briefing: PRI-CDRM Pre-Budget Discussion

Presentation: PRI-CDRM Pre-Budget Press Briefing and Discussion

Infographic on PRI Briefing: IMF Loan Conditions on Domestic Revenue Mobilisation

PRI Briefing: IMF Loan Conditions on Domestic Revenue Mobilisation

On the Optimality of Tax-GDP ratio

Fiscal Reforms in the 8th Five-Year Plan

Recent Macroeconomic Developments and

Fiscal Implications

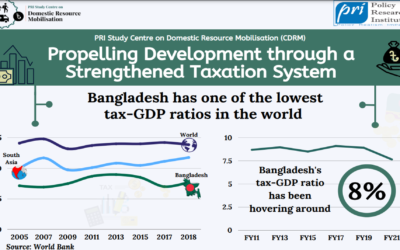

Propelling Development through a

Strengthened Taxation System

Bangladesh’s External Debt and Implications for Domestic Resource Mobilisation

Bangladesh’s Fiscal Space in a Global Context: A Comparative Assessment

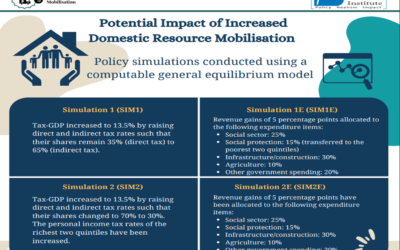

Infographic on “Potential Impact of Increased Domestic Resource Mobilisation”

Addressing the Fiscal Conundrum in Bangladesh

Sadiq Ahmed

Redistributive Fiscal Policies can help reduce income inequality in Bangladesh

Sadiq Ahmed

The imperative for tax reforms

Bangladesh has shown strong resilience and dynamism by rising rapidly from the ruins of a war-devasted economy in 1972 that was characterized by high incidence of poverty (around 80%)

Subscribe today to receive EPC’s Latest newsletters and topic updates.