The current Awami League (AL) government, at more than half way through

its current five-year term, is facing an increasingly harsh macroeconomic environment. As such, the government deserves credit for positive achievements and at the same time, needs to defend its own track record on many other areas. The adverse macroeconomic environment that we are facing today has not happened unexpectedly, but in part is the result of cumulative disregard to a number of core economic principles.

While it has become fashionable to find economic arguments to justify short-term policy interventions on social, political and economic grounds, the cumulative result and financial burden of such actions may undermine the medium- and long-run economic growth prospects of the country.

Specifically, the issue that I would like to cover in this write-up is about the allocation of precious and extremely limited public resources. Efficiency and productivity gains resulting from use of public resources, are directly tied to the optimal use of those resources for productive purposes. The supply-side response originating from properly utilized resources has a definite tendency to mitigate demand pressures originating from increased government spending. However, a positive supply response can only be generated from productive allocation of resources, either directly (such as investments through Annual Development Programme or ADP) or through effective social sector spending (such as health and education), which also contributes to productivity gains through the development of human capital.

On the other hand, an improper allocation will not only create inadequate supply response and may only serve to further exacerbate domestic demand and balance of payments (BOP) pressures and an already difficult to handle inflation rate. I have the apprehension that more and more of our public sector resources are ending up in activities with little or no positive supply side effect but certainly undermining Bangladesh’s macroeconomic stability. I will only focus on a few of these important areas to make the point.

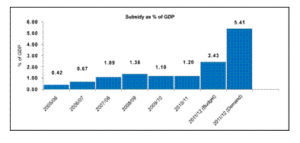

First, let’s look at the degree of proliferation of subsidies in recent years. Subsidy in various forms used to range between 0.5 – 1.0 per cent of gross domestic product (GDP) in a typical year, with some increases recorded due to exceptional external shocks or natural calamities (flood and cyclones). However, because of not paying due attention to the financial consequences of public sector interventions in different forms the subsidy bills are estimated to have reached a record high level in fiscal year (FY) 12.

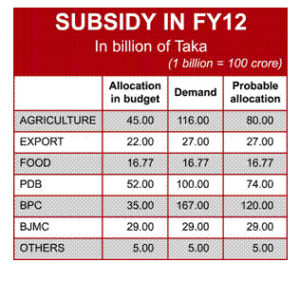

Ministries and agencies of the government are now demanding Tk 460 billion (equivalent to $6.0 billion and 5.5% of GDP) compared with the record high Tk 205 billion allocated in the FY12 budget. Particularly noteworthy are the subsidies claimed by ministries and agencies on account of petroleum products (Tk. 167 billion), agriculture (Tk 116 billion) and Power Development Board (Tk. 100 billion), and Bangladesh Jute Mills Corporation (Tk. 29 billion).

At one-fifth of total government spending in the budget, allocation of subsidies amounts to 3.0% of the GDP, which is already a matter of concern. There also exists the real threat of the subsidy bill rising to 5.0% or more of GDP in the absence of significant further price adjustments. If that happens that would be about a third of the total budgetary spending and equal to the total fiscal deficit, leading one to question the manner of use of resources that led to the above situation.

What we have discussed above and shown in the chart only relate to explicit budgetary subsides and do not capture various other forms of (economic and hidden) subsidies incurred through other quasi fiscal activities. Case-in-point is the subsidy through lower gas and CNG pricing. At Tk 400 or so per household per month, gas pricing for households in Bangladesh is a joke. The pricing policy is also most inequitable both vertically (because poorer urban and rural households do not have access to gas) and horizontally (because a vast number of new urban household have to depend on LPG for cooking due to lack of gas connection).

Cheaper fuel, particularly in the form of CNG, is the worst form of resource allocation. Economically and commercially speaking, there should not be much difference between petroleum and CNG prices, in terms of energy equivalence. But the much cheaper CNG price in Bangladesh has contributed to: massive conversion of cars, trucks and buses to CNG, using imported conversion kits; reduced engine life for vehicles; frequent visits to CNG stations leading to long lines and congestion of roads; and cheaper fuel meant more cars on the streets leading to more congestion. Economic losses for the people are enormous.

Based on reported expert estimates, every year 8.15 million work hours and 3.2 million business hours are lost on the roads of Dhaka city alone. In monetary terms, the losses are estimated to be Tk 200 billion ($2.5 billion) per annum due to congestions in Dhaka city alone. Speaking of opportunity cost, there are important projects in Dhaka alone such as the Elevated Expressway (valued at $ 1.2 billion) and the Dhaka Monorail ($ 1.5 billion) which can be accommodated with room to spare, if resource that are currently tied to petroleum and CNG subsidies were to be redirected.

The government of Bangladesh (GoB) has been pumping a large sum of resources to keep the loss-making jute mills under the Bangladesh Jute Mills Corporation (BJMC) afloat. In FY12 budget the amount in the form of explicit subsidy is Tk 25 billion (more than $300 million). In addition, public entities will most likely be borrowing much more than Tk 43 billion ($550 million) borrowed from the banking system last fiscal year.

Nobody is questioning why the GoA is running the permanently sick industries for the last 40 years? Nobody is also questioning why the government is reopening the already closed sick/dead industries? Nobody is questioning why consumers would pay an extra Tk2000-8,000 per ton on imported sugar (as supplementary/excise duty) just to keep our inefficient and sick sugar mills running?

Misallocation of public resources are visible almost everywhere. Over the years we have had a proliferation of ministries without assessing/reviewing the needs for existence of many old ministries/agencies. Do we really need 40 ministries and 55 plus divisions/agencies to run the government? To make the point, why do we need separate ministries for jute, textiles and industries? All activities of these three ministries can be handled (perhaps more efficiently) by the Ministry of Industries. Today jute is not as important for Bangladesh as it used to be in the past. Export of footwear, vegetables, and home textiles each would soon cross the level of export proceeds from jute and jute products. On the same criteria should we now open separate ministries for these and other emerging export products?

Large lending programmes are also being operated by Bangladesh Bank through its subsidized windows. While the list of such programmes will be large, some of these quasi-fiscal activities include: subsidized lending for the small and medium enterprises (SMEs), fish and shrimp culture, cultivation of specific spices, credit for sharecroppers and women entrepreneurs, etc.

Total size and amount of subsidy through numerous special credit programmes are not publicly available and there is no systematic and regular monitoring and evaluation of these special discount facilities. In short, we do not really know the effectiveness of these types of quasi-fiscal activities and the total economic cost of running such operations.

While there is no comprehensive assessment of the total amount of subsidy borne by the Bangladesh economy, based on the points made above, the total subsidy including the hidden ones may reach about 8.0-9.0 per cent of GDP, including the 5.0-6.0 per cent potential claims on the budget. In addition to these direct (fiscal, quasi-fiscal and economic) costs, there are also indirect costs to the private sector as noted above in the case of Dhaka city transportation. The real question is can Bangladesh afford to bear such a heavy burden and still sustain its growth momentum and macroeconomic stability? On the surface, every subsidy has its noble objectives and moral justifications. The real issue is: did we ever undertake a comprehensive monitoring and evaluation of the vast range of subsidy and transfer programmes to determine whether the subsidies and transfers reach the target groups and achieve their intended objectives?

Resource mobilization is a difficult task and with tax revenue at 10% of GDP Bangladesh is seriously behind relative to our regional and global comparators. To broaden and improve public service delivery, Bangladesh needs to use its mobilized resources much more efficiently. Publicly provided resources must be priced appropriately to ensure efficient utilisation of resources — be it gas, petroleum, fertilizer or subsidized credit or maintaining unnecessary administrative network and inefficient public sector enterprises.

This is high time that the government takes a step back and takes an inventory of its activities in a comprehensive manner. Bangladesh has demonstrated on several occasions its capacity to address many serious problems, but the first necessary step for that to happen is to “acknowledge seriousness of the problem”. Only after that acknowledgement, the government would be able to make efficient resource allocation its real policy priority. I am sure significant progress can be made in this direction if a determined and definite shift is made in the context of the next budget.

(The writer is Executive Director, Policy Research Institute (PRI), Bangladesh. He can be reached at e-mail: ahsanmansur@gmail.com)