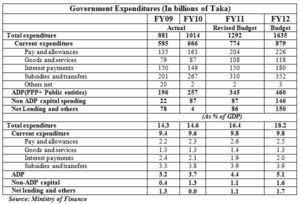

Bangladesh has generally kept a tight lid on current expenditures by containing the size of public salary budget and by keeping interest

expenses under control through low fiscal deficits. This has served Bangladesh well, especially in an environment of low tax revenues. However, there is a tendency for the subsidy bill to grow. Much of this increase is owing to global food and energy price increases.

There is a need to monitor the sustainability of these subsidies, especially if the tax effort does not materialize. In the event, either the fiscal deficit will go up or the ability to increase development spending to support higher growth will falter.

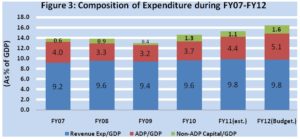

Total development spending as a share of gross domestic product (GDP) has shown an encouraging recovery over the past two years, rising from 3.6% of GDP in FY2009 to 5.5% of GDP in FY2011 (Figure 3).

While the Annual Development Programme (ADP) is the main source of development spending, the development spending from non-ADP sources is also rising. Based on this progress, the fiscal year (FY) 2012 budget targets a further increase of 1.2% of GDP in total development spending. Of this increase some 0.7 % of GDP will be provided from the ADP and 0.5% of GDP from non-ADP sources. The planned development spending of 6.7% of GDP in FY2012 is consistent with the need to achieve the 7.2% GDP growth projected for FY2012 in the budget and the Sixth Five Year Plan. The spending priorities, focused on human development, agriculture, transport and energy, are on the right course. The main issue is quality of implementation.

The Implementation Challenge: There are two main concerns about the implementation of public spending programmes in general and developmentspending in particular. First is the problem of low capacity in the public sector. The second is the question of corruption and leakages in public spending.

Notwithstanding some progress in improving planning and budgeting and public financial management, both implementation issues are perennial problems in Bangladesh. They are at the heart of the governance challenge in Bangladesh and need to be squarely addressed. The solutions are well known and involve a combination of such initiatives as effective public-private partnerships, out-sourcing, decentralization to local governments, e-governance, procurement based on competitive bidding, and results-based monitoring and evaluation. How well the government tackles this implementation challenge will be the main determinant of the ability to implement the required investments in infrastructure and human development that are essential to achieve the higher growth and employment targets of the Sixth Plan.

Consistency of Fiscal and Monetary Policies for Inflation Control and Balance of Payments Management: Two important downside risks that have substantial consequences for the economic impact of the FY2012 budget concern the ability to manage the subsidy bill and the ability to mobilize the planned amount of foreign financing. The soaring global food and fuel prices have complicated budgetary management. Understandably, the government’s immediate response has been to absorb most of the shock in the budget.

While this is politically correct, its sustainability is an issue. When external shocks assume a long-term pattern there is no option other than to take corrective actions. In this regard, the government needs to take further actions to align domestic fuel and electricity prices to adjust to the global reality of long-term higher energy prices. Some partial adjustments have been made, but there is still a way to go.

The budget has made implicit assumptions about further adjustments as suggested by subsidy allocations. If these price adjustments are not made, the subsidy bill will go up. This will either result in higher budget deficit or force a reduction in development spending. Either of these two results will lower the quality of the budget.

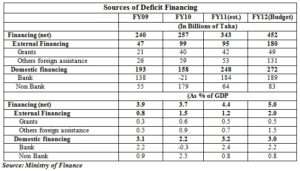

Regarding deficit financing, the budget has made some optimistic assumptions about the availability of foreign financing. The planned level of foreign financing for the FY2012 budget will not likely materialize from the disbursements of the existing project pipeline alone. The implicit assumption here is that the government will seek additional flexible financing for the budget. In the event this financing does not happen, there will be greater need for domestic financing.

Within the context of domestic financing, in FY2011 the budget’s reliance on bank borrowings surged dramatically from a negative of Taka 21 billion in FY2010 to Taka 184 billion. This is planned to go up further to Taka 189 billion in FY2012. With a likely shortfall in foreign financing, the budget’s pressure on bank financing will further increase in FY2012 from its already planned high level. This could create a substantial policy challenge for the consistency of fiscal policy with the objectives of monetary policy as explained below.

The experience of macroeconomic management in the past two years has important implications for the consistency of macroeconomic targets and instruments in FY2012. The FY10 budget was broadly consistent with keeping inflation and balance of pressures under control by both keeping the fiscal deficit low and by avoiding bank borrowings for the budget.

While the estimated fiscal deficit in FY2011 and the planned deficit in FY2012 are contained within prudent limits, there is a substantial expansion in the demand for domestic financing of the budget, up from 2.2% of GDP in FY2010 to 3.2% and 3.0% respectively in FY2011 and FY2012. The composition of domestic financing has also changed drastically in FY2011 and FY2012 budgets as compared with FY2010 budget. In FY2010, bank borrowing for the budget was negative, whereas this surged to 2.4 % of GDP in FY2011 and is projected to remain large at 2.2%. In both FY2010 and FY2011 monetary policy was too accommodating, mainly to the private sector, but pressure from the budget also grew in FY2011. The result was a substantial excess demand in the economy that hurt the balance of payments and inflation.

Thankfully, Bangladesh Bank has taken measures recently to curb the expansion of domestic money supply. But the budget financing story in FY2012 is quite different from that in FY2010. How fiscal policy will seek to reconcile its demand for higher bank financing with lower availability of domestic credit owing to monetary tightening is an important policy question.

Conclusions: The FY2012 Budget makes a bold attempt to break with the past low public revenue and low development spending features of lackluster budgets to a much more ambitious expansionary fiscal policy stance to support the growth acceleration objective of the Sixth Plan. The overall budgetary framework in terms of revenue, expenditure and fiscal deficit targets are broadly consistent with the growth and macroeconomic targets of the Sixth Plan. The broad development expenditure priorities of the budget are also similarly consistent. In this regard, this budget is a major step forward.

The downside of the budget is that it falls short on the policy front in a number of ways that makes the budget susceptible to serious downside risks and could also compromise the Sixth Plan’s objectives to improve the composition and efficiency of private investment. These include: (a) clarity about energy price adjustments that are essential to contain the subsidy bill; (b) policies for strengthening public sector implementation capacity; (c) policies for reducing corruption and leakages; (d) broadening of tax base by introducing a broad-based property tax system; (f) reform of trade taxes, especially the phasing away of supplementary duties; (g) bringing capital gains from real estate and stocks into the income tax net in line with treatment of income from other sources; (h) strategies for mobilizing flexible budget financing from donors; and (i) a comprehensive domestic debt financing strategy that minimizes reliance on bank borrowings to avoid a conflict with monetary policy. (Concluded. The writer is Vice-Chairman of the Policy Research Institute of Bangladesh. He can be reached at e-mail: sahmed1952@live.com)