The recent initiative of the United States Federal Reserve to stimulate economic growth by injecting some $600 billion through the purchase of US Treasury bonds, known as the “Quantitative Easing” (QE2), has generated considerable controversy and debate both abroad and in the USA. The concern abroad is that this would cause their currencies to appreciate against the dollar and thereby reduces their export competitiveness. The outside world, which holds a lot of the US Treasury debt instruments, also worries that this policy will inflict capital losses by inflating the US economy and lowering the real value of these dollar debt instruments. The concern in the US is that the fiscal deficit is already very high ($1.3 trillion or 8.9 percent of GDP); this action will further raise the budget deficit and also increase inflationary expectations.

The US government is happy with the action of the Federal Reserve because it is worried about the persistent high unemployment rate and the slow pace of the economic recovery from the 2008 global financial crisis even though it has already injected a substantial amount of fiscal stimulus through tax cuts and additional Federal spending. The expectation is that this move will lower the long-term interest rates and stimulate economic activities. Additionally, the expected depreciation of the US currency will boost exports and create jobs.

The opponents in the USA, led by the Republicans and conservative economists, fear that the monetary stimulus from the latest Federal Reserve initiative will spark inflationary pressures both through excess liquidity and due to the depreciation of the US currency. They are also concerned that continued high fiscal deficits will worsen the already burgeoning federal debt ($13.7 trillion or 93 percent of GDP as of November 19, 2010) that has implications for increases in future tax obligations that could hurt future growth prospects. The Republicans are worried to such an extent that there is even a talk about introducing new legislation that takes away the Federal Reserves’ mandate on economic stimulus and restricts its role to only inflation management.

While this could be a political ploy to put pressure on the Democrat government in power, the issue from an economic perspective is a substantive one. Standard macroeconomic theory has grappled with this challenge of assigning proper roles to various policy instruments in economic management. Based on the path-breaking work of Nobel laureates Jan Tinbergen, James Meade and Robert Mundell, the conventional wisdom is to assign inflation management primarily to monetary policy, economic growth to fiscal policy primarily, and balance of payments management primarily to exchange rate. Given inter-dependence, in a modern economy these three policy instruments obviously need to be coordinated to achieve the policy goals in each of these areas. From a long-term perspective, however, the primacy issue is substantive and deserves serious attention by policymakers.

Led by the pioneering work of another Nobel Prize winning economist Milton Friedman, it is now well accepted that over the long-term inflation is mostly a monetary phenomenon. So the ability to attain and sustain an inflation target over the longer term will depend upon whether monetary growth and inflation targets are properly aligned. While it is understood that short-term deviation is possible, continued large deviation of monetary growth from the inflation target is not likely to be a sustainable inflation control policy over the longer term. It is because of this long-term relationship, the central bank that is responsible for the conduct of monetary policy is also primarily accountable for keeping inflation under control. When a central bank becomes active in stimulating economic activity in an environment of rising prices, the suspicion of trade-off between growth and inflation and the fear that the monetary authority is deviating from its primary task of inflation control become real concerns.

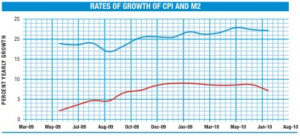

A similar debate as in the USA about the proper role of the central bank and the conduct of monetary policy seems to have emerged in Bangladesh recently. Inflation has been rising steadily over the past 15 months while growth of broad money supply (M2) has also been rising steadily, mostly fuelled by the rapid growth of remittances but also due to Bangladesh Bank’s policy to keep interest rates low in order to stimulate economic activity. More generally, with average GDP growth in the 6 percent range and growth of M2 at 22 percent as presently, there is bound to be inflationary pressure in the economy. Average global inflation rate for 2010 is 3.7 percent, while it is 1.5 percent in high income economies and 1.2 percent in the USA. Clearly, the average inflation rate of 7-9 percent prevailing in Bangladesh is not a welcome development and cannot be blamed on exogenous factors only.

Critics of this expansionary monetary policy argue that the policy stance of the Bangladesh Bank is not benefitting economic growth but fuelling price hikes in stock markets and in real estate while at the same time fuelling general inflation. Bangladesh Bank believes that inflation is fed by increases in global and domestic food and commodity prices and that low interest rates are benefiting business and economic activity. Since there is very little empirical research to prove one or the other hypotheses, it is difficult to be conclusive. Yet, the observed correlation between rising inflation and the high average M2 growth rate (that is much in excess of GDP growth and the inflation target), the galloping real estate and stock prices, and much slower global inflation rate — all would seem to suggest that the worry of the critics about excess monetary growth fuelling inflation is well founded and cannot be easily dismissed.

Without being dogmatic about the role of the central bank, I think it is a fair principle that this must be the institution that is accountable for managing inflation in the country. In the US, the inflation rate presently is very low (below 2 percent per year) and the unemployment rate is very high. So it is understandable why the Federal Reserve is less worried about inflation at the present time. In Bangladesh where the inflation rate is rising substantially faster than the global inflation, it is hard to justify an expansionary monetary policy irrespective of whether or not low interest rate benefits growth. Bangladesh is growing at a healthy 6 percent and the constraints to higher growth are not the interest rate but factors such as infrastructure, labour productivity, trade protection and cost of doing business. A tighter monetary policy aimed at bringing down inflation to around the global level would seem to be a much more desirable policy of the Bangladesh Bank at the present time than an expansionary monetary policy.

The writer is vice chairman of the Policy Research Institute of Bangladesh.