Ahsan Mansur and Bazlul Haque Khondker take a look at the country’s macro-economic situation with an eye towards the up-coming budget

The current fiscal year is coming to end on June 30, 2009. Government machineries are busy finalising the budget for the next fiscal year. Hence this is an appropriate time to assess the state of the economy of Bangladesh.

During the last several months, the world economy experienced a sharp downturn manifested through a severe contraction in global output and international trade leading to falling commodity prices, stock and money market collapse, and an unprecedented rise in job losses.

The economy of Bangladesh also starting to experience the adverse impacts of the global recession. In this piece, an attempt has been made to assess the strengths and weaknesses of the macro-economic environment in Bangladesh for the current and the next fiscal year and provide some indicative guidelines for 2009-10 budget

Satisfactory performance

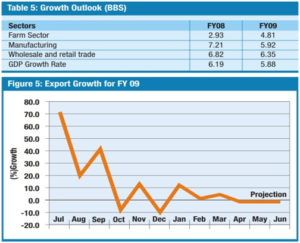

Rates of economic growth and inflation have been the main focus of a large of number of discussions as well as research papers. Real economic growth is estimated by the Bangladesh Bureau of Statistics (BBS) to be 5.88 percent this fiscal year compared with the target growth rate of 6.5 percent.

Although economic growth will be slower than the objective set in the budget, this outlook is much higher than the growth rates estimated by the World Bank (4.5-5.5 percent under alternative scenarios). Bumper harvests of rice crops, a robust performance of the manufacturing sector, and strong domestic demand, supported by continued strong inflow of worker remittances, helped sustain domestic economic activity.

The increase in the general price level or inflation has come down to 5 percent. Factors such as falling commodity prices and bumper rice harvests have contributed to the falling rate of inflation. The underlying inflation rate (i.e. non-food inflation), which is closely associated with monetary development however showed a rising trend. A common characteristic of recessions is deflation or a steady decline in the general price level leading to a depressed environment for investment, output and asset creation by the economic the agents. Bangladesh did not experience a decline in the general price level and hence avoided a deflationary situation that many regional economies and industrial countries are currently going through.

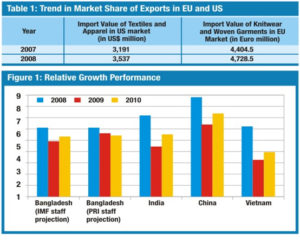

Despite the slowdown in economic activity, Bangladesh’s performance has been one of the best globally. A review of economic growth, export performance, and strength of the balance of payments validates this claim. The slowdown in Bangladesh GDP growth has been quite modest relative to most other comparator countries. In particular, the output shocks have been quite severe in the fast-growing global economies like China, India, and Vietnam (Figure 1).

A relevant question is why Bangladesh’s economic performance has been better than most others? Four factors have been identified for this better performance. These are: (i) resilience and competitiveness of our exports; (ii) strong inflow of remittances; (iii) terms-of-trade gains resulting from the collapse in commodity prices; and (iv) a robust performance of the agriculture sector.

Export Performance: Readymade garment and knitwear account for about 76 percent of Bangladesh exports. The overall export growth thus depends significantly on their performance. The performance of garments and knitwear remained healthy (with growth at around 20 percent for garments and 25 percent for knitwear), gaining market shares in the US and EU markets during this period of economic slowdown (Table 1). Although other major export categories have suffered badly, due to the satisfactory growth of textile exports the overall export growth is expected to be around 12 percent in FY09.

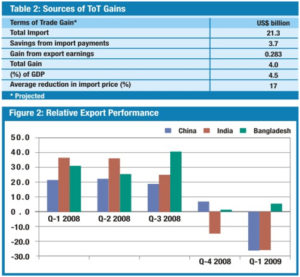

During this period, both China and India posted negative growth in their total exports. It is clear from the figure that during the third and fourth quarters of 2008 and January-February 2009, the export performance of Bangladesh was much better than that of China and India (Figure 2).

Terms-of-Trade Gains: Bangladesh has made significant terms-of-trade (TOT) gains due to falling import prices. On average, import prices have declined by about 17 percent in FY09 over the preceding year. The sharp drop in commodity prices has reduced the import bill by $3.7 billion or 4.0 percent of GDP (Table 2). All segments of the Bangladesh economy, the government, manufacturers, and consumers have benefited significantly from this TOT gain.

Government budget is also a significant beneficiary of the TOT gain (Table 3). Potentialbudgetary savings from this TOT gain is estimated to be $1.1 billion (1.2 percent of GDP). Much of this budgetary saving originates from lower prices of petroleum products, fertiliser, and wheat. Despite a large revenue shortfall, this large saving has contributed to a lower fiscal deficit of 3.9 percent of GDP in FY09, well below the budget target (5 percent of GDP).

Inflow of remittances: Worker remittances have remained strong and likely to remain steady. Bangladesh is probably the best performer globally in FY09. As long as crude oil price remains at around $50 per barrel or higher, much of the investment programs in the GCC region will continue to be implemented. The Saudi budget was done at $52 per barrel price even when prices were sky-rocketing. Furthermore, these economies have builtup huge petro-dollar savings in recent years allowing the governments to maintain their planned spending despite lower oil revenues. Accordingly, notwithstanding the widespread apprehensions, chances of a massive return of Bangladeshi workers from abroad are slim.

The balance of payments (BOP) position has also strengthened further due to the TOT gains and the resilient exports and remittances. In particular, a large surplus in the current account will also be achieved due mainly to falling price of imports, satisfactory export growth and buoyant remittances. The external current account surplus will reach a record high $1.3 billion (1.4 percent of GDP) in FY09. The level of foreign exchange reserves should also reach new highs, exceeding $7 billion level.

Agriculture sector performance: Performance of the agriculture sector has been robust largely due to previous year’s high prices of agricultural products and policy support of the present government. According to the BBS estimates, the real GDP growth of the farm sector would be 4.8 percent, which is almost double that of the previous year (i.e. 2008).

In particular, production of Aus and Aman varieties were 25 percent and 34 percent higher in FY09, according to the agriculture and food ministries. Global recession has certainly affected Bangladesh through the export sector, which translated into slower manufacturing and services sector activity.

Manufacturinmic slowdown, reflecting growth dropped to 5.9 percent in FY09 from 7.2 percent in FY08. The gain in agricultural growth however has been more than offset by the lower growth of manufacturing and service sectors contributing to the projected slower overall GDP growth in FY09 (Table 5).

Macro-economic outlook for FY10: A bumpy ride in the first half

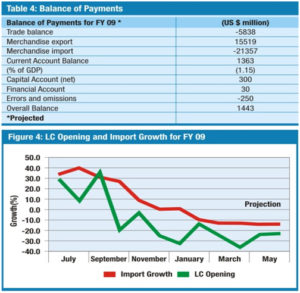

The fiscal year 2009-10 starts with some major concerns in a number of areas. There are definite signs of econo the impact of global economic recession. Opening of letters of credit (LCs) for imports have declined sharply in recent months. Thus, import growth during much of March-June 2009 will be significantly negative over the corresponding period last year.

LC openings have been declining every month over the corresponding period since October 2008. Considering the lag between LC openings and actual arrival of imports, import growth is likely to be negative during the first half of the next fiscal year. Among others, negative import growth implies lower base for import-based tax revenue. As a result of the large revenue shortfall in FY09 and the outlook for negative import growth in the first half of FY10, budgetary target for revenue mobilisation will suffer.

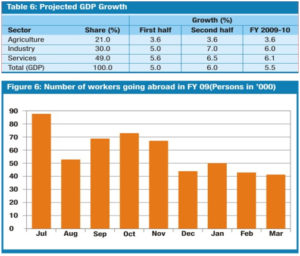

Export growth has slowed down and will remain sluggish. Number of workers going abroad has declined from their record high pace in recent months. Therefore, both external and domestic demand are likely to fall, adversely affecting the growth performance for FY09-10.

Economic growth will be particularly subdued in the first half of FY10, with a modest pickup in the second half. The weakness and subsequent recovery will come from manufacturing and related activities. Agricultural sector growth will decelerate to its historical average level following a strong performance in FY09. Domestic demand growth will also be moderate due to slower remittance inflows.

Demand for Bangladeshi exports is showing signs of sluggishness due to the global recession. The fall in export demand may be accompanied by a decline in domestic demand for goods and services arising from slow inward remittances.

It is further projected that world economy would continue to struggle to move to a recovery stage during the first half of FY10. At this stage, inflow of foreign remittance and demand for exports are expected to remain low, limiting real economic growth at 5 percent.

The world economy is expected to enter into a recovery stage in the second of FY10. The sustained gains in stock markets globally over the last eight weeks tend to support this outlook.

The second half of FY10 may thus be accompanied by a relatively stronger demand for Bangladeshi exports and a resumption of more buoyant inflow of foreign remittances. As a result of the expected rise in overall demand in the second half, the average real economic growth should be around 5.5 percent in FY10 (Table 6)

Important considerations for FY10 budget

Against this macro-economic backdrop, the central issues for the next budget should be:

-Formulation of a realistic budget taking into account the sluggish revenue growth and intensifying power problem

– Making efforts to fulfil the government’s electoral commitments, particularly with respect to poverty alleviation and supporting the farm sector.

– Start addressing the long-standing structural fiscal issues to maintain fiscal sustainability, and improve resource allocation and public sector service delivery over the medium term.

Revenue: In a year when the government needs the most revenue to cover its ambitious spending plans, the revenue potential will be negatively affected by two factors: (i) a very low tax base due the huge shortfall in the NBR revenue in FY09 and also a low non-tax base after adjusting for the one-time factors like the large transfer from the Bangladesh Telecommunication Regulatory Commission (BTRC); and (ii) growth in NBR taxes from the base would be subdued in FY10 due to lower import prices and the effect of slower economic growth. Domestic demand growth would also be less buoyant because of slower growth in remittance inflows. Accordingly, revenue growth in the budget should not be more than 10-12 percent of the existing base, even with some measures to increase revenue. A higher proportion of revenue should be realized from domestic-based taxes (i.e. income tax and domestic VAT).

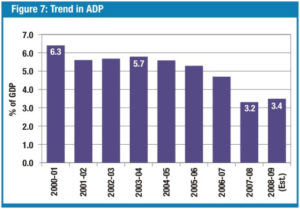

Expenditure: The two major components of expenditures are recurrent outlays and the annual development program (ADP). Although expenditures on the recurrent component is generally close to the budget target, ADP implementation has always been much lower than its targets. Moreover, the size of the ADP has declined by half in relation to GDP over the years. Any further decline in public sector investment is not acceptable, given the state of infrastructure in Bangladesh.

Recognising the failure of traditional ADP-based approach for delivery of power and infrastructure, government should go for pubic-private partnership (PPP)-based investment program. Thus Finance Minister Muhith’s announcement that the next budget would make a bold move to a PPP-based investment program is most welcome. As the PPP-based infrastructure investments gain momentum, the ADP-based investment program should be primarily limited to areas where private sector investment would be difficult to attract (e.g. rural roads, health centers, public schools, etc.).

More specifically, the government may establish a sizeable PPP investment fund of perhaps about $1 billion to create an impact in the investment circle, with the objective to catalysing total investment of $4-5 billion in the infrastructure sector. Effective implementation will require establishment of a dynamic PPP Cell at the Ministry of Finance, with authority to promote private participation in investment projects, evaluate their economic viability, develop relations with potential investors, and adopt policies to encourage establishment of infrastructure funds by domestic and foreign entities.

The Indian experience is particularly noteworthy in this regard. PPP-based investment programs started with Monmahan Singh as the finance Minister and got further impetus after he became the prime minister. PPP programs in India started with a lot of apprehension, but now boasts investments worth $500 billion in the next 5 years. Everybody in India is convinced that this is the vehicle to close the vast infrastructure gap that persists in India today. Bangladesh must learn from the PPP experience of India, China, East Asia, and the Middle East and adopt policies to close its ever-growing infrastructure gap.

The popularly elected government would also need to spend more on social sector programs to meet its political commitments. The government is committed to: achieving 100% net student enrollment at the primary level by 2010; supplying pure drinking water for the entire population by 2011; bringing every house under hygienic sanitation by 2013; and reducing poverty rate to 15% by 2021 from 45% at present. A sizeable allocation has to be made in the budget to initiate the process in this regard.

Although there may not be any need for a large general fiscal stimulus package, the government would need to assist the adversely affected export sectors through financial and fiscal support. As a minimum, the incentives for the affected sectors under the recently announced incentive package should be continued through the first half of FY10.

Since there may be need for fiscal support to other sectors during the year, the government may consider establishing a “Financial Crisis Mitigation Fund.” A sizeable amount set aside under the Mitigation Fund would enable the government to respond promptly in the event needs arise in various sectors of the economy.

The overall budget deficit in FY10 would not be less than 5% of GDP, if the government wants to address these pressing issues. This level of deficit, although high, would be appropriate and sustainable. However, the government would need to mobilise a higher level of financing from foreign sources in order to avoid crowding out of the domestic private sector. The additional foreign financing should be for quick disbursing budget support, enabling the government to overcome the difficult economic situation.

Given the significant uncertainties and downside risks, the budget should also have a contingency plan. The contingency plan should only be activated in the unlikely event that the global economic recession turns worse and/or continues for a much longer time than envisage under the current baseline macro scenario discussed earlier. Such a contingency plan should entail:

-A generalised fiscal stimulus package (of 2 percent of GDP) to boost domestic demand, which could be implemented on a short notice.

-Mobilisation of support from the donors community under the various new facilities established at the World Bank, IMF, ADB, and IFC.

-The objective would be to reach preliminary understandings with bilateral and multi-lateral donors so that an additional $1.5-2 billion can be mobilised within a short time.

-The budget deficit would have to be increased (approximately 2 percent of GDP or so).

Such an expansionary fiscal stance for one year would not be a problem from fiscal sustainability, but external financing will be key to preventing crowding out of private credit and avoiding emergence of balance of payments pressures.

Ahsan H. Mansur is Executive Director, Policy Research Institute. Bazlul Haque Khondker is Professor, Department of Economics, Dhaka University.