The government should depoliticise energy price setting by letting it be market determined and regulated by BERC without political interference

It was heartening to read the honorable Prime Minister’s explanation to the press on the need for an increase in diesel prices. It was a politically difficult decision but the right one from the economic management point. The growing fiscal tightness owing to low tax compliance, as rightly noted by the PM, makes it fiscally unsustainable to carry on the huge and growing burden of energy subsidy. Importantly also, continued large subsidy on fossil fuel including diesel is inconsistent with Bangladesh’s commitment to reduce its own contribution to greenhouse gas emission. Even though Bangladesh is a small polluter when compared with the USA, China and other large polluters, in the spirit of being a team player all countries must also put their houses in order.

The need for diesel price adjustment emerged from rising international prices. More generally, all commodity prices are on the upswing globally. The combination of massive fiscal stimulus to fight the Covid-19 induced economic downswing and the emerging supply constraints in specific areas due to structural problems have created an unprecedented global dilemma of rising inflationary pressures amidst inadequate economic recovery. Bangladesh is facing a similar problem of rising inflationary pressures and the need to boost GDP growth. The situation calls for deft economic management and political courage to tackle some of the bottlenecks created by the perception that these are political sacred cows.

Energy price is one such sacred cow and it is a credit to the PM for tackling it head on. But the government needs to go further. The Perspective Plan 2041 (PP2041) and the 8th Five Year Plan have emphasized the importance of adopting green growth strategy as the instrument for achieving Upper Middle-Income Status (UMIC) by 2031 and High-Income Country (HIC) Status by 2041. In this green growth strategy, there is no place for any fossil fuel subsidy. Indeed, the incentive policies and public investments must all be geared to support the supply and use of clean energy and green technology in agriculture, manufacturing, power, transport and construction. By taking this first important and bold step to increase diesel price, the government has given a signal that it means business. It should now move forward with the next step to depoliticise energy price setting by letting it be market determined and regulated by the Bangladesh Energy Regulatory Commission (BERC) without political interference.

Subsidies not a viable policy option

One of the main concerns of the critics is the impact on inflation. Even before the diesel price hike Bangladesh has been facing growing inflationary pressures from global commodity price increases. As an importing country, Bangladesh has very little control on rising commodity prices including fuel oil. It can lower the many high custom, supplementary and regulatory duties to partially compensate for rising commodity prices. More importantly, it will need to

manage its monetary and fiscal policies to avoid excess demand pressures. One would hope that as in the past the rising commodity prices in most cases are a temporary phenomenon and will pass away. In some cases, they might also induce a domestic supply response. But trying to shield the economy from these price increases by price controls and subsidies is not a viable policy option.

Redistributive fiscal policy needed

It is well known that inflation tends to hurt the poor more than the rich. The argument against diesel price increase is partly grounded on this. This brings into focus the government’s poverty reduction strategy and more broadly the government’s inclusive growth strategy. A review of Bangladesh development experience shows that along with many positive outcomes, a major negative result is the growing income inequality. Furthermore, various survey results show that Covid-19 has substantively hurt the poor and low-income group. In this environment, rising inflation induced by global commodity prices is a worrisome development.

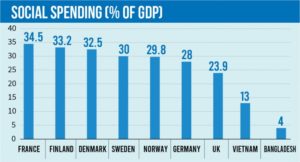

What are the policy options? Western European countries have tackled income inequality and the protection of the living standards of the poor by the extensive use of redistributive fiscal policy whereby high taxation of the rich is used to finance programs for the low income and the poor people. Typical programs that benefit the low income and the poor include free universal education upto grade 12, free/heavily subsidised healthcare, and a comprehensive social protection program based on income transfers to the poor and vulnerable. The percentage of GDP allocated to these programs is huge, ranging from 35% in France to 24% in the UK . Even in Vietnam, a lower middle-income country like Bangladesh, these spending amount to 13% of GDP. In Bangladesh by comparison, the spending is a mere 4% of GDP (2% in education, 0.7% in health and 1.3% in social protection excluding civil service pensions). The policy gap is huge.

Many reforms are necessary to introduce a comprehensive and well-functioning redistributive fiscal policy. The most fundamental reform is the need for a comprehensive overhaul of the tax system. The tax to GDP ratio hovers between 8-9% of GDP, which is one of the lowest in the world. Vietnam, for example, raises 18% of GDP as tax revenues. There is a huge literature on why taxes are so low in Bangladesh. Resolution of the tax revenue constraint requires the tackling of another, and perhaps the most fundamental, sacred cow that involves adequate taxation of the rich. With few exceptions, the rich don’t pay their fair share of taxes. The core elements of the required tax reform are well known and are listed in the 8th Five Year Plan. Implementation requires strong political will.

Many reforms are necessary to introduce a comprehensive and well-functioning redistributive fiscal policy. The most fundamental reform is the need for a comprehensive overhaul of the tax system. The tax to GDP ratio hovers between 8-9% of GDP, which is one of the lowest in the world. Vietnam, for example, raises 18% of GDP as tax revenues. There is a huge literature on why taxes are so low in Bangladesh. Resolution of the tax revenue constraint requires the tackling of another, and perhaps the most fundamental, sacred cow that involves adequate taxation of the rich. With few exceptions, the rich don’t pay their fair share of taxes. The core elements of the required tax reform are well known and are listed in the 8th Five Year Plan. Implementation requires strong political will.

Sadiq Ahmed is Vice Chairman of the Policy Research Institute of Bangladesh.

https://www.tbsnews.net/analysis/politics-reforms-332398