JUNE must be a month of astrologers.

By this I only mean that the range of economic predictions and projections penned down and scrutinised in this month can only come close to what we witness in astrology. Yet, unlike astrology — where often saintly men or women draw predictions from some logic I still can’t master — economic science provides a set of tools to economists and policymakers that can allow them to make prudent but pragmatic projection about the state of the economy in the near future. Moreover, with these tools in hand, policymakers in our own economic and political domain have calmly envisioned a state, which we now call Vision 2021. This vision, in short, has two broad objectives that we cannot fail to attain. These are:

Per capita annual income is projected to rise to about $2,000 (at constant 2013 dollars) by 2021, thus crossing the middle-income threshold.

Substantially eradicate poverty by bringing down the number of people living below the poverty line to 15 per cent of the estimated population.

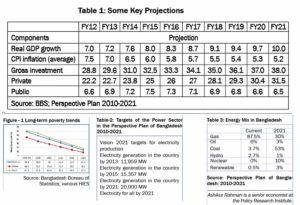

Furthermore, this vision is of imperative interest to us as it marks the completion of 50 years of independence. In some sense, it maps our journey out of the crude Kissinger prediction of being the ‘bottom less basket’. It is also the least we can do to honour those who have embraced martyrdom for the sovereignty of a land they have loved piously. To materialise this vision, certain projections must be attained, which are noted in Table-1 and Figure-1. As shown, the economic and social prosperity that ‘Vision 2021’ embodies is largely dependent on facilitating economic growth of GDP per capita to 8 per cent by FY2015 (and 10% by FY2021) and reducing headcount poverty ratio to 15 per cent. This goal, in turn, is dependent on how we facilitate growth in private and public investment.

Hence, the ‘national budgets’ we draw and implement between FY2013 and FY2021 are instrumental tools in addressing these specific parameters. This is because budgets are effectively a mechanism to determine how we allocate our resources to the most deserving sectors. If we can mobilise resources in an optimum manner, and allocate them to growth-enhancing sectors effectively, then the groundwork for obtaining the desired growth momentum is partially done. I say ‘partially’ since in economic literature, what exact combination of circumstances enhances growth is still not thoroughly understood. What we do know, however, is growth in private investment is essential to maintain economic boom, and this is dependent on the ‘credit pool’, ‘infrastructure’ and ‘policy environment’ available to private actors. So, our national budget must address these three issues with sufficient care to enhance private investment share of the GDP to 31 per cent by 2021. Even so, the realities in ‘ground zero’ that we witness are somewhat different. To mention a few, the national budget FY2012 projected economic growth to be 7 per cent. This was based on the projection that private investment would be 22.2 per cent of the GDP. Nonetheless, recent estimates suggest that, in FY2012, economic growth was 6.3 per cent and private investment-GDP ratio 19.1 per cent. This not only means that we missed our desired growth target but also there is prima facie evidence in support of the view that the relative stagnation in private investment has jeopardised our growth outlook.

Additionally, two important factors have contributed to this observed stagnation in private investment. First, in FY2012, the government undertook bank borrowing amounting to Tk 19,568 crore. This crowded out the ‘credit pool’ available to the private sector. Consequently, the private sector failed to generate the projected growth in private investment. In the current fiscal year, the national budget has pointed out that the government intends to borrow Tk 23,000 crore. Likewise, with a budget deficit of Tk 52,000 crore in FY2013, it is probable that the government will exceed their expected bank borrowing target for the current fiscal year. Thus, the question that needs attention is the following: with an increment in public sector bank borrowing, can we obtain the projected growth of private investment in the current fiscal year? The pragmatic answer here is: no.

Second, the prevailing energy infrastructure has also acted as a key constraint to growth in private investment. Here, it must be noted that when the incumbent government assumed office, actual energy generation ranged between 3,600 and 4,300 megawatts. The shortfall on a given day even reached as much as 2,000MW if any major power plant went out of operation. At present, however, average actual production is substantially higher, with a maximum generation of 6,066MW in March 2012. Annual natural gas production has also risen, and there is increased momentum in gas exploration activity in offshore blocks. Nevertheless, what has troubled policymakers is how the increase in energy generation was fuelled. As noted from Table 3, more than 80 per cent of our energy generation is fuelled by natural gas. Yet, in order to obtain 20,000MW of installed capacity by 2021, we need a quantum shift in the use of coal as a source of energy. In fact, the current Perspective Plan of Bangladesh 2010-2021 identifies coal to fuel 53 per cent of all energy generation by 2021. Against this backdrop, the proposed national budget makes no reference to the timeline of when we will formulate our national coal policy. This issue is of fundamental importance since without a coherent national coal policy, the likelihood of adopting an ad hoc coal management mechanism increases exponentially. This, in turn, can severely disrupt our fiscal balance in future (in the very manner the present import of furnace oil for rental power plants has).

To conclude, this article provided a brief scrutiny of national budget FY2013 in light of the two principle objectives of Vision 2021 — facilitating economic growth and reducing poverty levels. As an economist, I feel that these broad agendas will remain unrealised if we fail to facilitate the size and scope of the private sector. This is because the private sector must ultimately evolve as the engine of growth and modernisation, and it is the responsibility of the policymakers to provide the institutional arrangement so that the profit maximising incentive of private actors encourages innovation, creativity and wealth creation. Thus, the ‘government’ must cease to imagine itself as the driver of prosperity. Rather, its goal should be to provide a ‘helping hand’ to the ‘invisible hand’ of the market forces, which will enhance the over efficiency in the economic activities that surrounds us. In this regard, the policymakers must make a genuine effort to implement the present national budget FY2013 in order to address the projections made in the ‘Perspective Plan of Bangladesh 2010-2021’. So far, we can only see that the micro details of the national budget FY2013 are inconsistent with the macro objectives of Vision 2021.